As every country in the world is pulling every resource available to contain the COVID-19 pandemic, some are doing so at the expense of much bigger problems. Before the outbreak of coronavirus, Nigeria was battling Lassa fever, another viral disease of rodent origin that has been baring its deadly fangs on lives across states in the country.

As of January, when coronavirus was still a disease limited to the city of Wuhan, Lassa fever was on rampage in over 20 states in Nigeria. With 14.8% fatality ratio, there was a record of over 300 confirmed cases and over 60 deaths. The alarming figures kept the Nigerian Center for Disease Control (NCDC) on its feet until the COVID-19 showed up on African shores, breaking the concentration of the NCDC and resulted in redirection of focus.

The disease control center had outlined a practical public health response designed to keep the Lassa fever in check while efforts are being made to contain it.

Treating confirmed cases in designated centers across the country, following the World Health Organization (WHO) approved protocols, while effort is being made to quell the spread.

Surveillance activities in the affected states to enable case finding in Local government Areas: The surveillance is augmented with modern equipment to facilitate reliable track-record.

Five laboratories with the capacity to test for Lassa fever infection in serum samples were set up across the country. Healthcare workers were trained to keep an index of suspicion for the virus suspected cases.

Upon these protocols, the battle against Lassa fever was being waged. Not that anything has changed in the procedural directives, but the workforce to implement them has been significantly undermined as states prepare in anticipation of coronavirus. As a result, there has been less attention to Lassa fever from the public also, except for those who live in affected LGAs or those who have someone who is infected.

By February, there were 472 laboratory confirmed cases that resulted in 70 deaths. This result touched 26 out of 36 states of the federation and the Federal Capital Territory. While some states like Edo (167), Ondo (156) and Ebonyi (30) record higher cases, other states have been evenly getting their own shares of the endemic.

In the same month of February, there were 15 confirmed cases and one death among healthcare providers.

So far in March, there have been 443 suspected cases, 85 confirmed cases and 11 deaths recorded from 107 LGAs in 28 states and the FCT, according to the data published by NCDC. One of the cases involved a health worker in Edo State. The number of suspected cases so far in 2020 stood at 3,735 and counting, out of which, over 906 cases were confirmed.

The surge in the number of cases has been attributed to dry season and poor environmental hygiene that enable massive breeding among rodents.

The fatality rate for the current season of Lassa fever is 17.8%, though lower than the 23.3% reported the same period last year it is still higher than the 14.8% rate of coronavirus among those 80 years of age and above.

Between February and March, Nigeria has recorded only one coronavirus-related death so far, in Ekiti State. Within this space of time, Lassa fever has claimed over 70 lives.

The first case of Lassa fever was recorded in Nigeria in 1969, ever since then, it has become an unwanted guest who refused to leave. Compared with flu epidemics that usually come and go, Lassa fever is proving to be a permanent epidemic.

Dr. Anthony Fauci, director of the National institute of Allergy and Infectious Diseases said coronavirus like other flus, is seasonal and will go with time.

“Despite the morbidity and mortality with influenza, there’s a certainty… of seasonal flu. I can tell you all, guaranteed, that as we get into March and April, the flu cases are going to go down. You could predict pretty accurately what the range of the mortality is and the hospitalizations will be. The issue now with COVID-19 is that there’s a lot of unknowns,” Fauci said.

The city of Wuhan which held the highest number of coronavirus infections and deaths, on Thursday recorded no new infections, and the health facilities are being shut down for lack of patients.

Though COVID-19 has a global impact, it appears to be a lesser evil compared with Lassa fever. And the Nigerian governments have been urged to make its eradication a top priority.

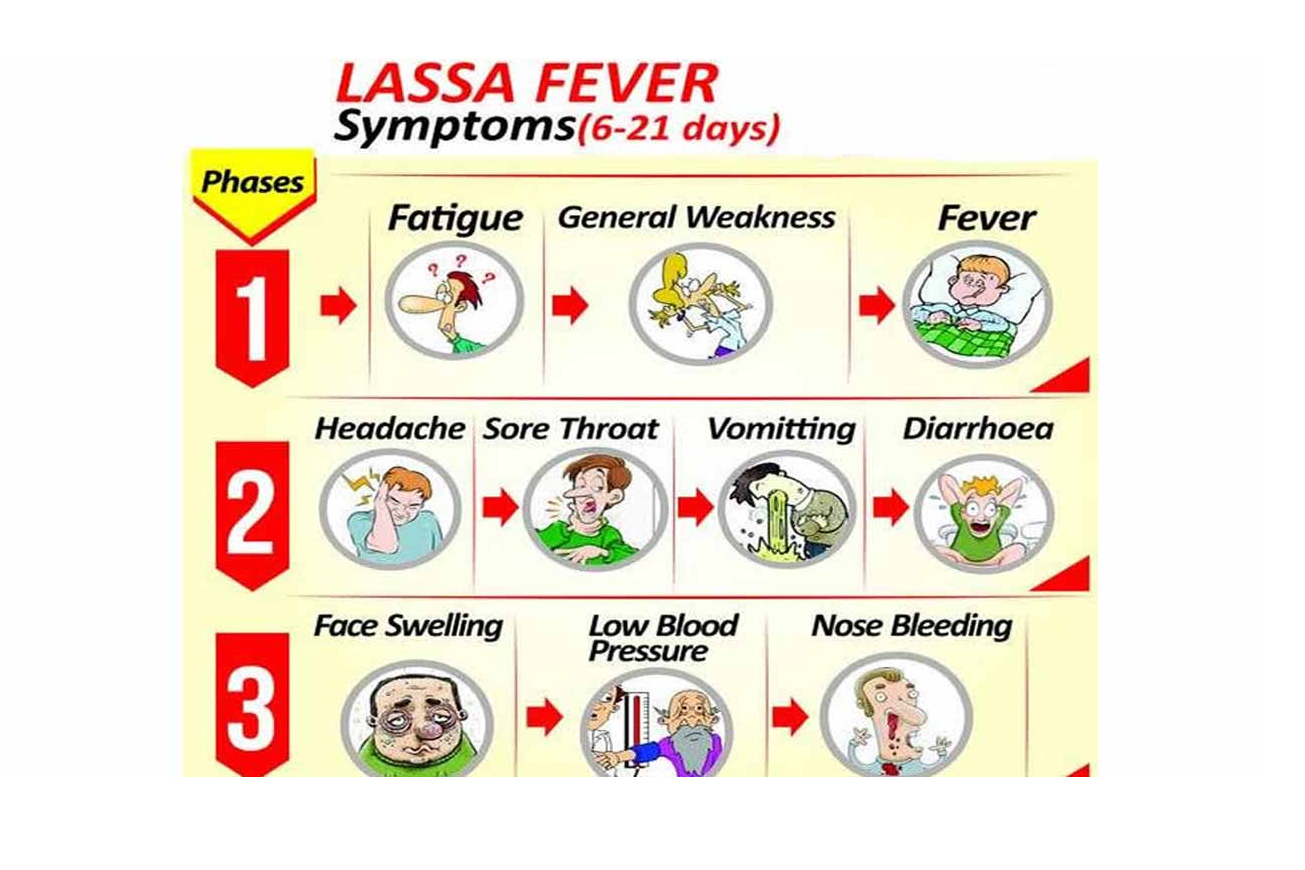

Lassa fever is an acute viral hemorrhagic illness caused by Lassa virus, a member of the arenavirus family of viruses. It is transmitted to humans from contacts with food or household items contaminated with rodent excreta. The disease is endemic in the rodent population in parts of West Africa.