The World Bank has approved $2.2 billion for the execution of six major projects in Nigeria. The projects are part of the 2020 efforts of the World Bank to help countries with serious infrastructural deficiencies and overwhelming poverty issues.

The World Bank said on Wednesday that the projects would support human capital and economic development in a bid alleviate millions of Nigerians from poverty. Nigeria is the home of the largest number of poor people in the world, and its government is doing little to quell the escalating pandemic. The Bretton Woods Institution has therefore added the country to its campaign against extreme poverty.

The campaign is being executed through many projects ranging from immunization to facilitation of business friendly environment and expansion of the digital economy. It also seeks to improve public and private sector capacity on governance.

“Nigeria is central to the World Bank Group’s mission of tackling extreme poverty. The World Bank is carefully targeting its support on high impact projects as the country works to tackle corruption and lift 100 million of its people out of poverty,” said David Malpass, World Bank Group President.

The campaign also covers some aspects of children welfare. World Bank’s country director for Nigeria, Shubham Chaudhuri said the project will provide social amenities that many in the country need.

“Ensuring that children are immunized and sleep under mosquito nets, building better roads especially in rural areas, and providing Nigeria’s poorest citizens with a unique identification that will make social safety nets and services more effective,” he said.

The funding will be provided by the International Development Association (IDA), the French Development Agency, the European Investment Bank and the Federal Government of Nigeria. The breakdown of the projects is as follows:

$650 million IDA credit is to be used to fund immunization and the fight against malaria in some selected states. The projects will be financed through concessions.

The upgrade of rural roads and access to farms and other agribusinesses across 13 states, currently being handled by the Nigerian Rural Access and Agricultural Marketing Project, will get $280 million funding from an IDA credit, $230 million from the French Development Agency, and $65 million from the Nigerian Government.

IDA credit of $115 million, $100 million from the French Development Agency and $215 million from the European Investment Bank will be used to support the Nigeria Digital Identification for Development Project, and the National Identity Management Commission, in their quest to up the number of enrollees into the national identification system to about 150 million in the next three years.

Other projects to be financed by the $2.2 billion includes the Ogun State Economic Transformation Project that is designed to facilitate private investment in the state by providing infrastructural amenities for businesses and fostering good relationship between farmers, suppliers of farm products and other service providers. Part of its goal is also to provide training and apprenticeships for women and farmers. The project is to be funded through a $250 million IDA credit.

Apart from poverty alleviation, Nigeria’s identity crisis is another integral issue that is importantly going to be addressed through the World Bank fund. In December, the United States Government added Nigeria to the list of countries it has placed on visa ban. The excuse was that Nigeria has failed to live up to expectation in digital security, mainly data gathering, sharing of intelligence and reporting cases of lost passports, etc.

The Trump administration promised to lift the ban as soon as Nigeria stands up to the challenge. The National Identity Management Commission (NIMC) has pointed at lack of funds as a reason for failures in implementing identity management that will place the majority of people in Nigeria in a database.

The $330 million mapped out for digital economy and identity management will help to speed up the process of enrollment and printing of IDs that have been in slow pace for long.

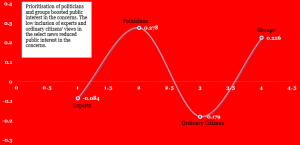

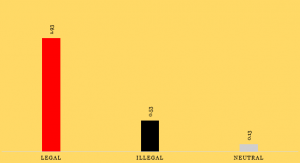

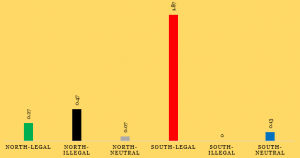

However, many are concerned about the judicious use of the fund. In a country notorious for corruption, words on the streets are that it may end up in private pockets if the projects are not thoroughly monitored.