One of the most prolific ways to build a profitable business is to key into the policy direction of the Government of the day. Sadly, the same Government can be a catalyst in the destruction of your business if you find yourself on the opposite end of their policy direction, knowingly or unknowingly.

Most times, honey flows and profits follow when you are on the same page with the Government, but if you are on the wrong page with them, profits easily evaporate and losses follow.

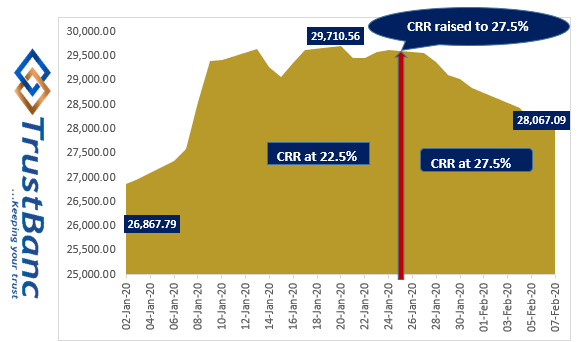

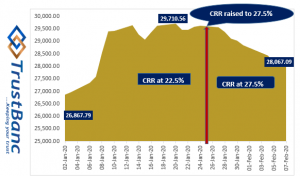

The ban of ‘Okada and Keke’ in Lagos effective 1st February 2020 left c.$400 million (N122-145 billion) capital sitting on gunpowder. In a similar vein, the increase in Cash Reserve Ratio (CRR) for banks from 22.5% to 27.5% by the Central Bank of Nigeria (CBN) killed the rally in the equities market; in a matter of days billions of gains recorded in previous weeks evaporated into the air.

Equities Market Update

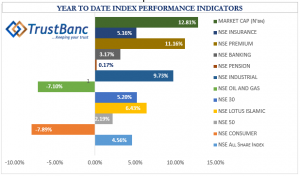

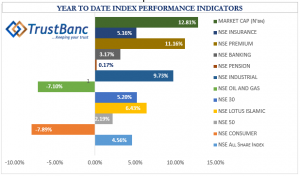

We have had just 27 trading days in the year but it’s feeling like 270 days already, Investors have seen very good times and experienced sustained turbulence too. The first 17 days felt like the Market was on steroids recording stellar performances that ranked Nigeria’s equities market as the best performing globally, all these happened before 24th January 2020.

Then came CRR, you would recall that we gave several updates on Tekedia on the liquidity surge in the system, too many billions stranded as a result of declining treasury bill rates and interest rates generally.

On 24th January 2020, the CBN turned up to arrest those stranded funds, they increased CRR from 22.5% to 27.5% and that withdrew approximately N800 billion from the system. The withdrawal stifled the flow of cheap funds into the equities market, no matter how sweet a company’s fundamentals are, if there are no funds to purchase the stock, it won’t gain.

Cash Reserve Ratio (CRR) refers to a certain percentage of total deposits commercial banks are required to maintain in the form of cash reserve with the central bank. It is a monetary policy tool used to influence the country’s borrowing and interest rates by changing the amount of funds available for banks to make loans with.

The market opened low with an All Share Index (ASI) of 26,842.07 but closed in the green on the first trading day of the year at 26,867.79. The gain was sustained for 8 straight trading days to rank as the best performing ASI in the world; it peaked at 29,710.56 on 20th January. Recall, ASI is the daily ‘GPA or Jamb Score’ of the equities market, a higher ASI is an indication of gain or positive performance.

The ten trading days since the CRR changed has seen the equities market lose nine times, this is the power of Government directives or policies, it can change everything in a very short time. There is a lesson here for diversification, always position your investments to gain from low and high times, from positive and negative policies.

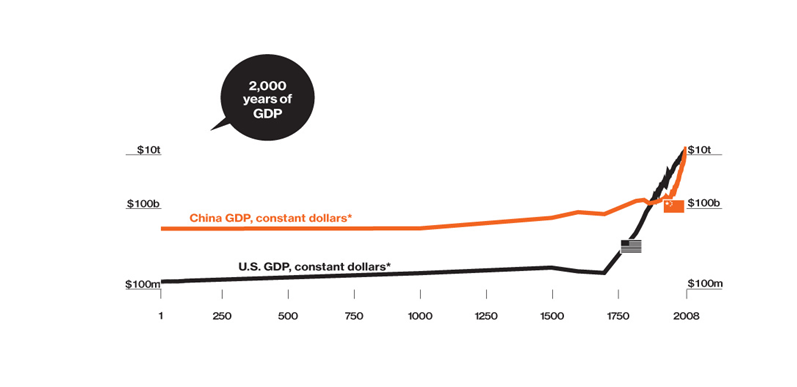

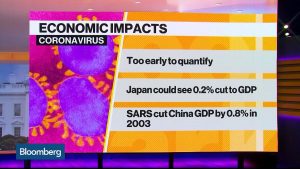

Economic Consequences of the Coronavirus

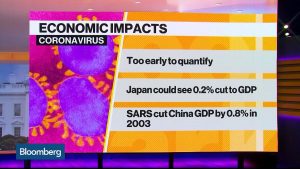

“SARS sickened 8,098 people and killed 774 before it was contained. The new coronavirus, which originated in the central Chinese city of Wuhan, has already killed more than 700 people and infected over 34,400 across 25 countries and territories. Chinese officials have locked down Wuhan and several other cities, but the virus continues to spread” CNN

The outbreak of the coronavirus is a textbook example of an exogenous shock. It forces a rethink of the scenario for growth for the next months by looking at the demand and the supply-side effects.

Exogenous shock results from when something really bad occurs – outbreak of disease, earthquake, which has a significant, enduring negative effect on prices. An event that’s outside the realm of everyday competition among companies, the cyclical rhythms of a nation’s business cycle or the interaction among countries.

On the demand side:

Household consumption is impacted because people have to stay at home, suffer from an income loss, feel uncertain and hence postpone big-ticket purchases. Foreign travel declines as well as purchases of foreign goods, so imports declines. Public spending will tend to increase, either to build health care facilities, or, possibly, to support growth (this could also happen via tax cuts or spending incentives).

Corporate investment will decline because of reduced demand but in particular, increased uncertainty. Companies will probably hold off investing until they have enough confidence that the epidemic will not spread further. The decline of imports and tourism represents a direct spillover effect to the rest of the world. Exports can also suffer because of what happens on the supply side. William DE VIJLDER

On the supply side:

Production declines because of a drop in demand and a shutdown of factories, shops and offices. Global value chains cause international repercussions, all the more so because substitution effects will be small in the short run, because customers prefer to wait rather than switching to another brand, or simply because it’s impossible to reorganise the value chain at short notice. In addition, for a temporary shock, this would make little economic sense. Another consequence is massive destocking. William DE VIJLDER

How this one take concern Nigeria?

If you export or import from China, your operations can’t be the same again. Prices of most supplies from China will surely go up if they have not gone up already. Expect the prices of some goods in the market to skyrocket in the coming weeks.

Please take action now because inaction may cost your company a lot this year.

“Car plants across China have been ordered to remain closed following the Lunar New Year holiday, preventing global automakers Volkswagen, Toyota, Daimler, General Motors, Renault, Honda and Hyundai from resuming operations in the world’s largest car market” CNN, and similar factories, this will definitely affect spare parts market in Nigeria.

Introducing TrustBanc Group

I have left Capital Bancorp to join TrustBanc Group as Group CFO – responsible for the group’s finance, investment banking and strategy.

Capital Bancorp was amazing but TrustBanc presents an opportunity to learn from a visionary leader, one that is irresistible. Abu Jimoh is the Founder of TrustBanc, the transformation legacy he left at Coronation Merchant Bank will remain a legend in merchant banking for a long time.

- Reach out if you have a digital product that speaks directly to our market, our structure is youthful and we keep a disruptive mindset.

- Reach out if you need a seasoned private equity partner.

- Reach out for your investments – equities, money market or commodities, our products are well packaged and balanced to appropriately diversify your investments and preserve your capital.

- Reach out for credits and loans, our rates are not destructive, they are friendly and competitive.

There are probably a hundred other ways we can touch you and your associates, watch this space closely.

Like this:

Like Loading...