It is usually assumed that there are no templates when it comes to entering and managing communities. This is usually so assumed because communities are different in many respect: history, economy, culture, previous experience with multi-national companies (MNCs), etc. However, with years of experience working with communities and managing community entry agendas of MNCs and other related endeavours, there are surely host communities management strategies that are sustainable and for which consensus exits.

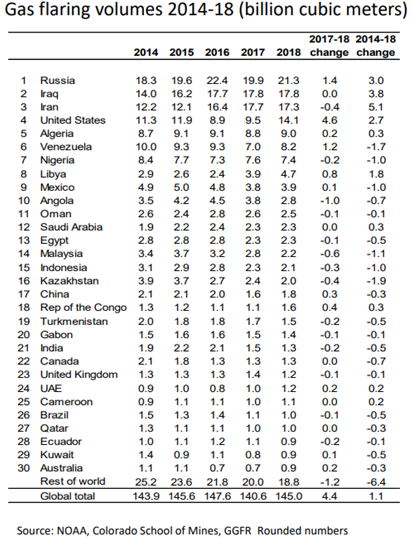

At the discovery of oil in Olibiri in 1956 and the subsequent granting of the first oil exploration licences to Multinational Oil Companies (MOC) in 1961, communities had a positive disposition towards MOCs1. The first impression of communities was that the MOCs were an opportunity to address long-overdue developmental issues. Many of these hopes may have been dashed, due to poor management strategies not necessarily a lack of resources to address the development issues, a major part of which is environmental degradation (where gas flaring has been a major contributor). Though gas flaring was legally prohibited in 1984 in Nigeria, MOCS has continued to flare gas for reasons beyond technical exigencies. As a consequence, communities in the Niger Delta had in 2005 sued2 NNPC, Shell, Exxon, Chevron, Total and Agip joint venture companies for failure to stop gas flaring. This and other similar ligations3 have not brought succour to the people of Niger Delta. Gas flaring has remained at over a million cubic feet annually. This has led to child respiratory diseases, asthma, cancer, and premature deaths are increasingly becoming the lot of a vast majority of Niger Delta residents, due to the massive gas flaring. Relations between MOCs and their respective host communities have strained, and conflict has escalated at the same time.

Permit Holders (PH)4, under the Nigerian Gas Flare Commercialization Programme (NGFCP) stand a great chance of helping communities realize their development aspirations if they get their community relations and development strategies right. The NGFCP requires that PHs, in collaboration with Producers5 acquire or build Gas Connection Assets6, which span communities, it is necessary to define the different stakeholders and their roles in this sector.

Permit Holder (PHs): A company that has, pursuant to the Regulations, been granted a Permit to Access Flare Gas by the Minister of Petroleum

Producer: A holder of Oil Mining Lease or allottee of a Marginal Field or a contractor under a Production Sharing Contract

Gas Connection Assets: Assets that include:

a) Buyer Gas Connection Assets: the natural gas pipeline used to transport Flare Gas from the Delivery Point at the perimeter of the Flare Site to the Project Facility and any other equipment, machinery or other property of any that are hosts for flare gas sites in the gas-rich parts of Nigeria. In pursuing these projects, regulations of the Nigerian Gas Flare Commercialization Programme expressly states that the PH “shall be responsible for managing a fair and balanced community relationship in its operations”.

This leaves the entire ramification of host community management and corporate social responsibility for the area of operation to the PH without a mention of the Producer.

b) Producer Gas Connection Assets: the pipeline, equipment, machinery, and other assets or facilities including the Measuring Station designed, funded and built by the Permit Holder and used to transport Flare Gas from the Flare Gas Connection Point to the Delivery Point under the Connection Agreement. Title, care and custody of these assets are transferred by the Permit Holder to the Producer on the Commercial Operations Date.

It is important that PHs commence their operations with a proper strategy such that they are investing resources in dimensions of host communities management or relations that are Value Drivers. In what follows, we describe a number of points that need to be considered for a mutually beneficial operator-host community relationship.

Community Entry and Relations Strategies

Initial Entry

This needs to be gotten right. Any flaws from this stage might leave the PH with months or years of stalled operations. A first step will be to pay courtesy visits to the traditional leaders of the community to send the signal to the community about the PH’s intention to respect local authorities and a readiness to work in partnership with the community on installing and operating the gas processing plant and gas connection assets. The next move will be to pay a similar visit to other leaders in the community including town union leadership, youth & women leaders, and religious leaders. As the norms and established traditions expect, each of these community stakeholders needs to be visited with cash gifts at hand and handed to the leaders of the groups as the group’s structure demands. In the event that a community is facing a leadership crisis with say two parallel running executives (exco) for a group, the PH should accord both executives exactly the same rights when visiting them. For all the visits, the PH’s team need to make it resoundingly

clear that they believe their planned gas processing operations won’t succeed with the cooperation of various leaders of the community. The PH’s team should also express their

intentions to work with any other relevant groups which they are yet to visit while making clear that they also have plans to ensure that the community positively reaps the benefits of hosting their gas processing operations.

While the series of visits are ongoing the PH should avoid any attempts at designating anyone as “middleman” or “go in-between”, unless in the case that such person is assigned by the traditional ruler of the community. In such cases, the designated middleman is then most likely a member of the council of chiefs. Similarly, the PH should avoid any opportunities for seeing community leaders without the entire exco/leadership. Whenever it is not possible to see the entire exco such visits should be postponed to such a time when the entire exco is available.

Concretizing Relations

After all the visits have taken place, its time to get down to the business of concretizing the promised made to various groups in the community. The various community groups will be informed of the intention of the PH to go into a Global Memorandum of Understanding (GMoU) with the community for mutual cooperation and community development. The GMoU gives kind that is owned or leased by the Flare Gas Buyer to take delivery of FlareGas under the Connection Agreement communities the privilege to define their own development priorities with the assurance that the MOC will provide the funding.

Governing Community Relations

In many host communities, committees (i.e Community Development Boards (CDBs) specially dedicated to defining and managing the implementation of these development priorities already exist. An example is the Itsekiri Rural Development Council (IRDC) which represents the cluster of communities within the area of operations of Chevron in relating with Chevron in accordance with the company’s GMoU. The CDB usually serves as the interface between the communities and the MOCs, the government & contractors. From the outset, it is important to ensure that the governance of the GMoU is such that transparency, accountability and sustainability is guaranteed. A way to guarantee this may be to include a committee that monitors the activities of the CDBs. The monitoring scheme could such that members are made up of representatives of various groups in the community with a tenure of just one year for each person so as to reduce tendencies for connivance with executing companies of priority projects. The main duty of the monitoring scheme is to ensure regular contacts are maintained with the communities, monitor the productivity of the CDB and ensure the even distribution of benefits.

Social Impact

Once the GMoU is put in place, the next activity will be to commence implementation of the social impact initiatives. As way of ensuring that PHs don’t get cut in the web of internal community crises between or within communities, or between and within community groups, the GMou needs to define priority projects, timing for execution, financing requirements, responsibilities of communities to ensure and availability of land, mode of engagement of executing entities (private companies or individuals), minimum engagement level for communities in the execution of community development projects, etc. To ensure PHs can maintain focus on their core operations, it may be important to employ the services of credible Non-Governmental Organizations (NGOs) very vast and knowledgeable in the affairs managing communities oil-producing Niger-Delta Communities.

Community Oriented Sustainable Supply Chains Strategies

While the GMoU may not include involvement in the value-chain of the operations of the PH, it is important to make effort at incorporating local small-to-medium enterprises (SMEs) and community economic clusters into the supply chains of the PH. To realize this, it is important that the PH categories its future demand opportunities using tools like the four Krajic Categories7 with specific strategies. Then with a basic understanding of local capacities & suppliers rank each opportunity according to priority8. The next will be to determine what are the potential ‘community content’ component of each priority opportunity, relying on a more rigorous supply-side analysis. Then develop a plan to achieve the desired community content by choosing appropriate procurement methods and supplier development strategies. Major criteria for this assessment need to be value-driven agenda for the PH.

Environmental Responsibility

No matter the level of success of the GMoU or the efforts at driving up social impact and supply chain integration, any neglect of the environment will negate the entire efforts. A degraded environment is the most sustainable route to impoverishment and conflict. PH needs to avoid this pitfall as communities already contend with a massive array of environmental concerns, and additional gas flare mishaps won’t be taken lightly.

References

1 Amodu, Lanre Olaolu. “Community relations strategies and conflict resolution in the Niger Delta: A study of three major oil companies.” PhD diss., Covenant University, 2012.

2 “Communities sue oil companies to stop Nigerian gas flaring”. Friends of the Earth International. June 20 2005. Online: https://www.foei.org/press_releases/communities-sue-oil-companies-to-sto… . Accessed on October 30 2019.

3 “Nigeria: Delta youth group sues Chevron, Exxon, Nigeria Agip, NNPC, Shell, Total over gas flaring”. April 3 2008. Business and Human Rights Resource Centre. Online: https://www.business-humanrights.org/en/nigeria-delta-youth-group-sues-c… Accessed on October 30 2019

4. Kraljic, P 1983. Purchasing must become supply management. Harvard Business Review, 61(5), 109–117.

5 Ana Maria Esteves & Mary-Anne Barclay (2011) Enhancing the benefits of local content: integrating social and economic impact assessment into procurement strategies, Impact Assessment and Project Appraisal, 29:3, 205- 215, DOI:10.3152/146155111X12959673796128

This article was prepared in association with Kiakiagas.com

Like this:

Like Loading...