In the last two decades, Africa’s transportation problems have continued to be complex due to many factors identified by experts and policymakers. The continent remains one of the continents in the world that has a high population growth percentage. It is a continent where governments spend less on infrastructure, especially public transportation despite its economy which needs modern trade routes. No doubt, transport is a perpetual problem on the continent.

This explains the reason for the influx of motorcycles from countries such as China, India, among others, for easy movement of people and goods. For instance, statistics says the two-wheeler market in Nigeria would surpass $153 million by 2023. Before 2023, global motorbike market is expected to be $9 billion in value by 2021 with Nigeria as one of the three biggest markets.

The major focus of the providers in the last three years is to take prospective riders to their destination, spending less time. This has continued to increase the competitive space with the providers battling for traction and market share in the main cities such as Lagos, Abuja and Port-Harcourt.

In order to get the needed traction and market share, some providers have made a number of strategic moves. Some have improved delivery processes and sourced funds from investors. Recently, Gokada raised $5.3 million. Max.ng is targeting an accumulated total of 2 million rides by the middle of 2020.

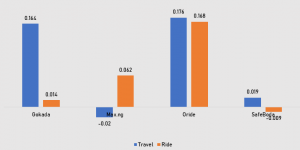

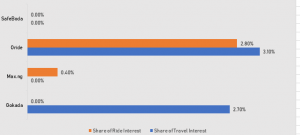

As the strategic moves continues, analysis has shown that the main players would compete more during festivals and holidays. Between September and November, 2019 analysis indicates that Oride and Gokada had a significant share of public interest in travelling and taking ride to various destinations [see exhibit 1 and 2]. This translated to more sales for the two providers, analysis suggests.

Exhibit 1: Link among Public Interest and Motorcycle Ride Providers

Exhibit 2: Share of Ride and Travel Interest

During the period, public interest in travelling and taking rides resonated with Gokada by 8.7%, Oride by 27.8% and SafeBoda by 1.7%. It was a reduction for Max.ng. We discovered a 9.8% reduction in the provider when the public interest in travelling and taking rides was at 1%.

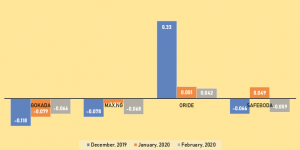

Going forward, Oride is expected to dominate public minds in December, 2019, January and February, 2020, analysis reveals. Passengers are expected to develop an interest in using the provider in December, 2019 more than other providers. However, the interest would dip in January and February, 2020. In January 2020, SafeBoda would be the only provider that would compete with Oride [see exhibit 3]. Others need to aggressive digital marketing in addition to other demand driving strategies.

Exhibit 3: Projected Interest in the Providers