I read comments on the reintroduction of toll gates article with many people recommending for Nigeria to reduce expenses to avert fees and taxes. Simply, many Nigerians do think that the Nigerian government is spending a lot of money, and could be cut into shape.

People, nothing like that. This is one area our successive governments have failed Nigerians: no one has told us that we are relatively “severely” poor, and exceedingly underperforming as a nation. Nigeria does not have excess spending problem – the fact remains that Nigeria does not even have enough to spend (note that I am not arguing on the efficiency of the “little” spending).

Nigeria’s national budget is $24 billion for 2019. South Africa budgeted $122 billion. South Africa spends 50% of our national budget on healthcare alone! Yet, Nigeria’s population is more than 3 times South Africa’s. I do not share this without the consciousness that I carry the Nigerian passport.

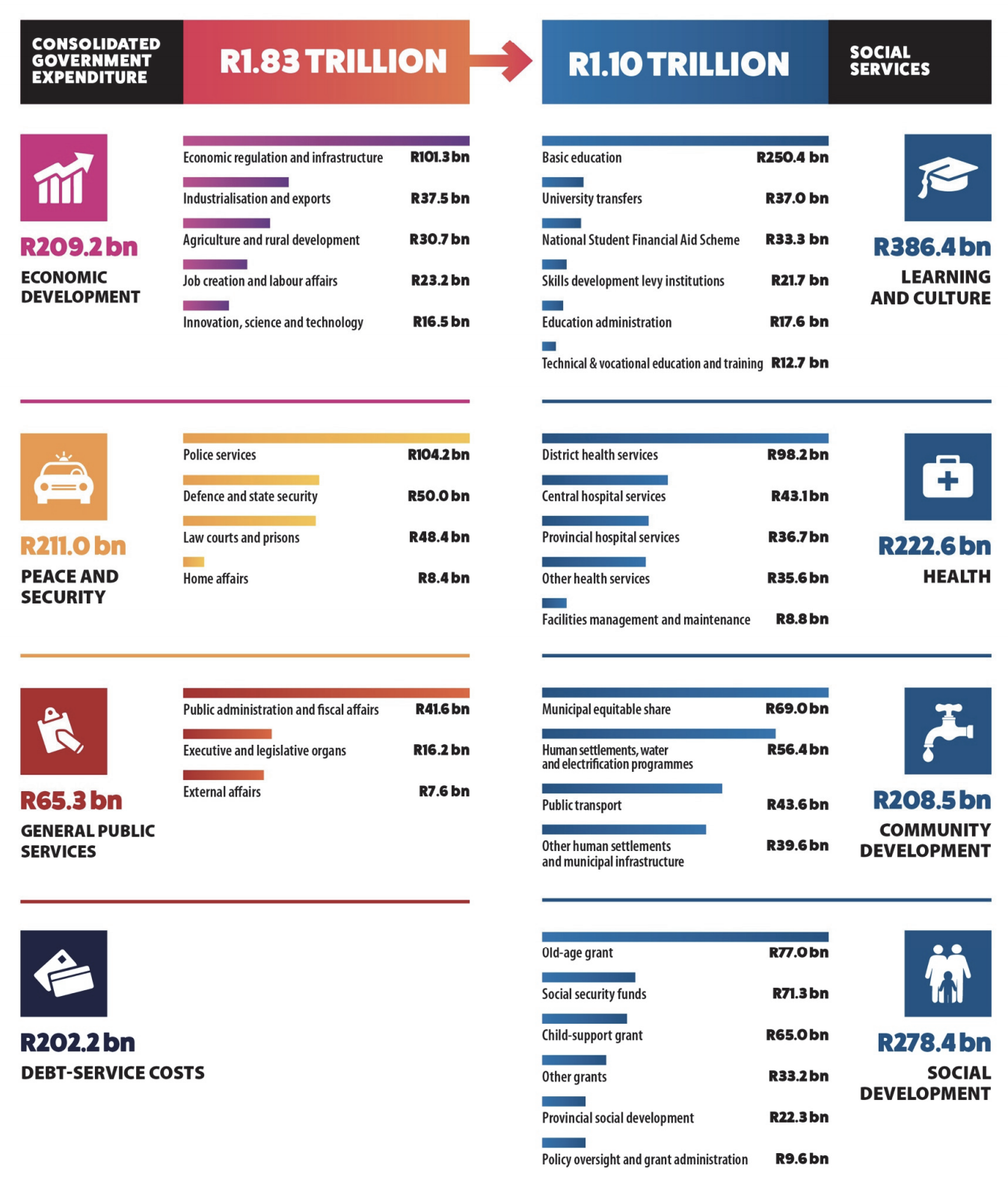

Expenditure in 2019 is expected at R1.83 trillion, with the bulk (R1.1 trillion) going to social services.

State wages and compensation remains the largest category of spending, accounting for 34.4% of consolidated expenditure – a level which the finance minister described as “unsustainable”. Measures are in place to realise a R27 billion reduction in spending here, he said.

Yes, we need to stop the argument that government has tons of money that can be cut. If you go through 2,000 years of economic history, nations rise when companies evolve and pay taxes so that government will have money to spend and improve institutions. This is the fact: Nigerian public institutions will not advance until the private sector does, because the resources to improve them are in the taxes. Even if you remove corruption and save $24 billion in Nigeria, we are still not there!

As Carnegie pioneered U.S. steel sector, he wrote the ordinances, made money before government came to regulate it to avoid it from destroying itself! As Mellon, JP Morgan and other financial titans shaped U.S. banking, government waited, and then went in later to regulate the sector at scale. As Amazon devoured retail, U.S. waited until it moved with ecommerce regulations by requesting local tax collection.

As Rockefeller changed oil business, he provided the money government used to regulate Standard Oil. He was an oil man, and paid the poison pill. Across markets and domains, the private sector has always funded the public sector. Regulation, taxes and those fees are how governments monetize those moments.

Nigeria does not have a dynamic private sector and Nigeria does not have money – do not think government needs to be cut into shape. The fact is this: the government has no money to spend.