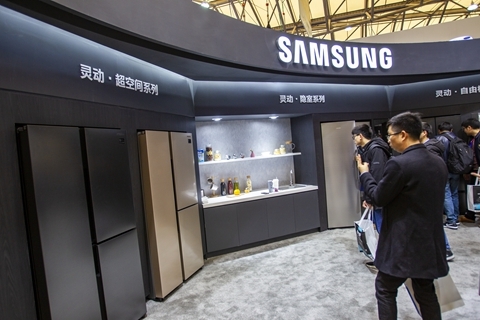

Call it huge competition – Samsung’s market share in China drops from 20% (in 2013) to 1%. The South Korean giant has been priced out by local competitors. Consequently, the company is cutting jobs and production at its last remaining plant in China, moving production to Vietnam and India where it sees more opportunities. Yet, the company will continue to build a multi-billion dollars semiconductor plant in China. The reality is that most of the local smartphone makers rely on Samsung chips – a situation I have called the double play strategy.

Samsung, the world’s largest smartphone producer, is cutting jobs at its last phone manufacturing facility in China, reflecting slowing sales and heating competition in the No.1 smartphone market, Caixin learned.

The layoffs at Samsung’s plant in Huizhou, Guangdong province, are being carried out on a voluntary basis. Employees agreeing to leave with compensation will need to sign up by June 14, according to a company document seen by Caixin. It is unclear how many people will be affected by the job cuts.

Samsung faces rising costs and stiffer competition in China. Meanwhile, the global smartphone market is slowing after years of rapid expansion. In 2018, worldwide shipments of smartphones declined 4.1% to 1.4 billion units, according to market information provider IDC. Shipments by Samsung dropped 8% to 292 million units, although the company remained the largest smartphone vendor in the world.

In Africa, Samsung has lost out to Transsion, the makers of Tecno, Infinix and itel, as the #1 mobile device brand in the continent. But do not weep for Samsung, provided these entities continue to order its memory chips and components, the company will be just fine to a certain level.