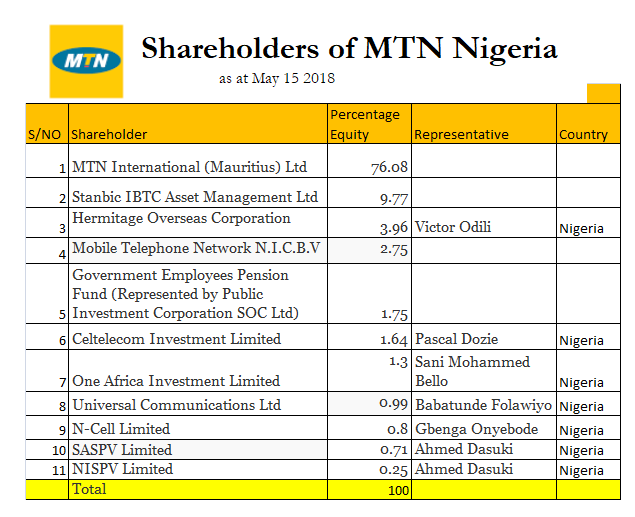

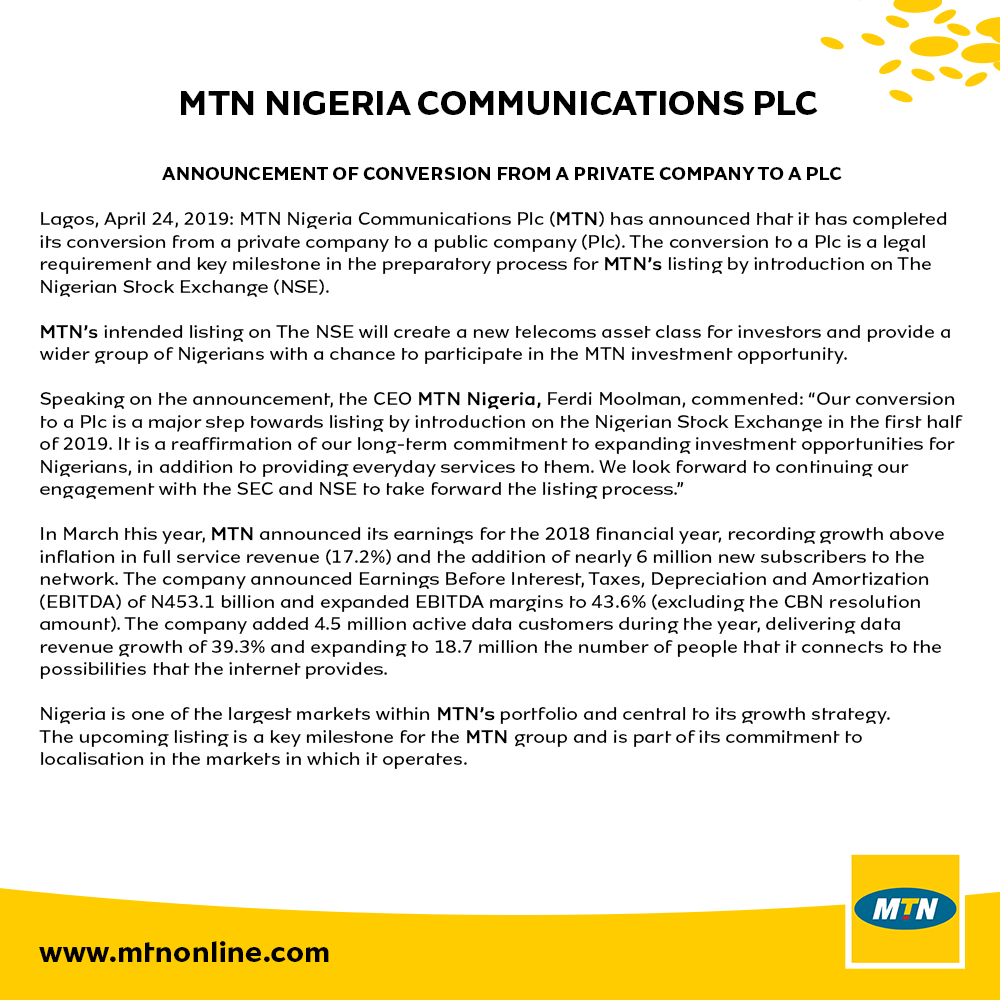

Many Nigerians are not happy that they are yet to have the CLEAR ability to buy the shares of MTN Nigeria on the Nigerian Stock Exchange. MTN had listed via Introduction which means unlike the typical IPO, the holders of the shares are not obviously obliged to make the shares available for trading. Technically, it was listed publicly but not evidently tradable publicly. That the Securities and Exchange Commission (SEC) is investigating this is not great news because Nigeria has listing by introduction in the books. That MTN decided to use it should not be handled with bad blood. I understand the frustration – everyone wants to get into the game but right now you need to know big connectors before you can get the shares. Largely, it is not really public since without knowing the current holders, you will be out of luck to buy the shares.

The Securities and Exchange Commission (SEC) is investigating the process that led to the listing of MTN Nigeria on the Nigerian Stock Exchange (NSE) last Thursday, THISDAY learnt yesterday.

A source said the application of the telecom firm was initially turned down by the NSE Council before it was later reconsidered, without the authorisation of SEC[…]

“For Listing by Introduction, you are not obliged to make shares available to the market to buy at all. For Listing by Introduction, shareholders that were existing prior to the company being listed have the opportunity to trade their share.

“So, if you are not a shareholder of MTN Nigeria prior to the listing, you will not be able to sell any share. You only buy from willing sellers in the market,” the source added.

The implication of this listing path was well documented. I did write thus “MTN Nigeria is arriving on the floors of the Nigerian Stock Exchange (NSE) via a special gbaam – listing by introduction and not through the typical IPO (initial public offer). Simply, the company will list already existing shares without any requirement to issue new ones or raise new funds”. Simply, MTN Nigeria has planned not to raise new funds and that means it is possibly not going to trade shares. Nigeria knew this and approved its papers. MTN followed the books – and tested elements which many have not used. We should not make life hard for it.

Comparison between IPOs and Listings by Introduction:

| IPO | Listing by introduction | |

| RAISE NEW FUNDS | ? | X |

|---|---|---|

| ISSUE NEW SHARES | ? | X |

| LISTING OF SHARES ALREADY IN ISSUANCE | X | ? |

What needs to happen is that SEC needs reforms. It is SEC that needs help so that we can examine our market rules to be sure they are up to date as our economy has been redesigned since those rules were written. On this one, Nigeria needs to allow MTN to have peace. This company never wanted to raise money from any listing. Magically, it saw a way to comply with the listing requirements without messing up with its share structure. It did that – and it is not a crime because everything it did is in the books. If you hate the style, go and change the market rules! A simple line – “If you list by introduction, you must make 5% available for public trading” – will fix this in future.