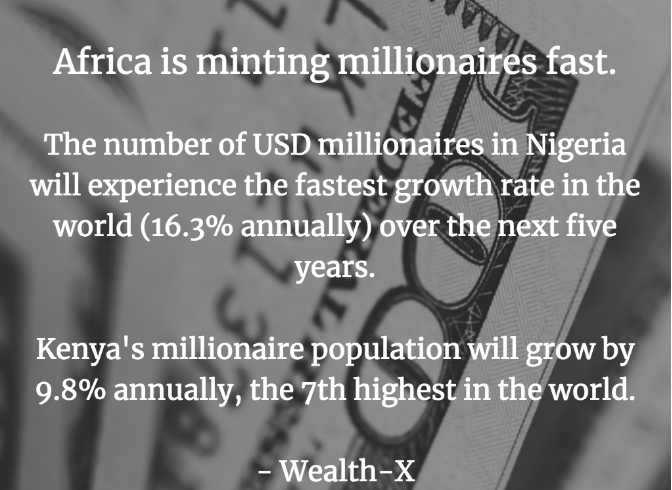

In one startup, after an investment, 17 young people became dollar (paper) millionaires in Lagos. In another one, 11 people joined the club. Yet, there is really nothing to celebrate as while Nigeria is minting rich people, we are also creating abjectly poorest citizens of the world. So, I take caution to report what we all know: startup entrepreneurs are joining the club at one of the fastest rates in the world. CNBC and Wealth-X just confirmed this trajectory. Yes, those young men you see with laptops in Lagos are now richer than some local government areas!

In the first edition of the High Net Worth Handbook which provides unique HNW analysis, uncovering the state of the world’s millionaire population, which rose by 1.9% to 22.4m people in 2018 and is forecast to increase by another 6.2% over the next five years, we got the message: Nigeria is going to be the fastest-growing high net worth country, jumping ahead of China, over the next five years.

The study, taken from Wealth-X’s inaugural “High Net Worth Handbook 2019,” drew on research from more than 540,000 high net worth individuals — those with a net worth of $1 million to $30 million — to forecast its outlook for global wealth growth over the next five years. It took into account current wealth levels, population growth estimates and anticipated future investment opportunities.

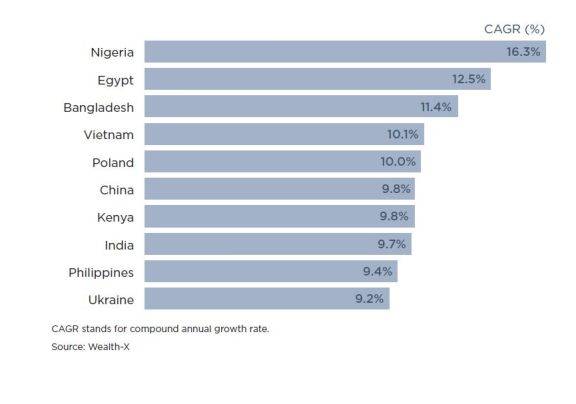

The report found the West African nation of Nigeria to be the front runner, set to see its high net worth population balloon by a compound annual rate of 16.3 percent between now and 2023. It was followed by Egypt at 12.5 percent and Bangladesh at 11.4 percent.

Here’s the full list of the 10 fastest-growing high net worth countries: