Africa has problems with continuity and succession in our family businesses. And when bad things happen (yes, the company collapses), the usual thing to say is that the family member that took over was not well “prepared”. Personally, I do not think that is the main issue. If you check, some of the sons who took over from their fathers spent time in those companies. Yes, some worked excess of 10 years at different “leadership” positions. Sure – holding a big title does not make you a leader: you simply have a nice commanding business card for conferences.

Instead of looking for preparation from the lens of experience, we need to focus on Capability [edited out natural as it was tripping people] which goes beyond work experience to energy, vision, intellect and raw leadership. Some people are great followers while few others are great leaders. If your son is a follower, and you make him a leader, he will fail. It takes more than a title to lead a company.

There are different levels of leadership. Head of Cleaning is a leader to cleaners in a company. But when you come at the level of that disruptive leadership, you do not prepare people into it with a manual. You can make people better but you cannot move someone who does not have it to become it. I doubt if there is anyway you can prepare any person not Elon Musk to become Elon Musk. But you can create many CFOs in SpaceX and Tesla. My point is this – watch the person to know if he/she has it before you start throwing efforts if you expect that TOP leadership to thrive. It is not about biology – it could be life experiences, training, education and exposure.

[…]

But anytime biology comes in over competence, few quarters will decide the outcome of the debate. In Qualcomm, the son of the founder grew to become the CEO of a public company. FOX 20th Century is run by families. Yes, families can have the greats inside. See the Agneli in Italy (Juventus owner). I am simply saying – take away biology and follow competence.

[…]

But note that “natural” in my piece did not mention anything “biological”. My point is this: you cannot prepare any other person to become Elon Musk. In companies, the CEO is the leader. It is better you have your son or daughter as assistant to the CEO than ask your either to run the show when that person is not naturally ready for it. While you can prepare me to be a fair footballer, I am not sure I will be a great one. CEOs must be great to thrive. It is better as Huawei founder is doing to look for greats for that #1 job. Willingness and Preparation is fair. But I can say that there are things we cannot do well as humans while others can do them better. You may be willing and ready to be prepared but you may never be great. But you could be a leader at your level. This does not mean that son/daughter can’t be that great. My point is this – do it on merit.

Look at Huawei, one of the finest companies in Asia. The founder had already said that none of his children has the intellectual vision and business capabilities to lead the company. But he is confident they would support any CEO as they are good at their own levels. The founder could have pushed for his daughter (now CFO) to become CEO and then mess up the company. You cannot say she is not well prepared after working for years in different “leadership” positions in Huawei.

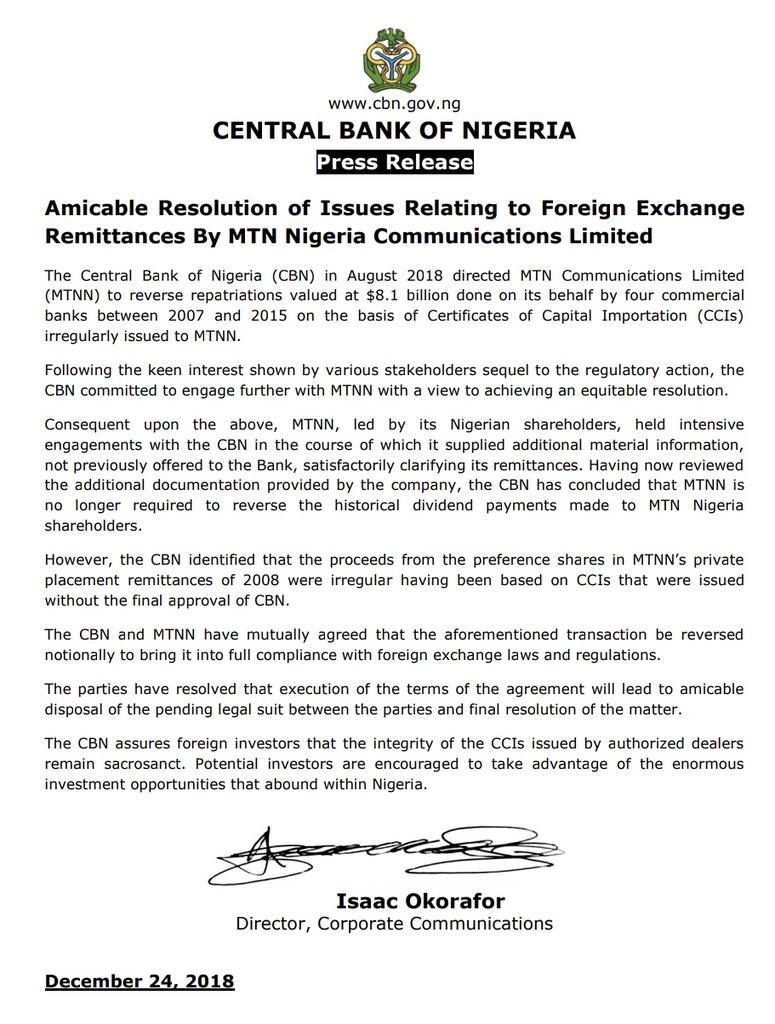

The Chinese telecoms giant won’t be listing itself on any public exchange, and the founder’s kids won’t be taking up the reins either – as their dad reckons they’re not up to the job.

Ren Zhengfei, who founded Huawei with a fistful of cash back in 1988, is now 68 years of age. Rumours have been circulating that he’d pass control to his daughter (the firm’s current CFO) or his son (who works at the company in an unspecified role), but in an email to staff seen by Sina Tech he scotches that idea – along with any thoughts of a public listing.

So, let us move away from this “preparation theory”. Let us focus on if the person has it. No matter how well you prepare me for 100 meters dash, I will never win the race if decent competitors are lined up. Yes, I was always coming last in secondary school during inter-house sports heat. At the end, I would smile at the winners – “I won from the back”.

Simply, preparation is not the only thing: you have to check if the person has the natural capability. If that person does not, no amount of preparation will yield great impacts. And holding prior big title does not mean preparation. Until we understand that, we would continue to see great companies go down after the father-founder exits and son takes over.

Like this:

Like Loading...