For years, I have subscribed to four magazines – Forbes, Fortune, The Economist and Businessweek (now Bloomberg Businessweek). I have occasionally added Time magazine which I do off and on. The current subscription ends next month and I am not renewing – Time is becoming a discovery and adventure magazine which adds minimal value to me. I also have Wired but I merely skip the pages; their contents are not rigorous and analytical enough.

My best magazine is Forbes. It has the best people on covering entrepreneurial capitalism. The pages inspire me. Few weeks ago, I called them to thank them for putting a black man (software investing legend Robert Smith) on the cover of the 2018 edition of the Forbes Billionaires (I extended my subscription on that call). It was a huge change because for years, only black sportsmen rotate the covers for the few moments they put people of color.

Coming behind Forbes is Bloomberg Businessweek. When Bloomberg bought Businessweek, the company expanded the coverage, making the contents more global. I have not missed a version for more than a decade and subscription runs into 2025. John Micklethwait, the former editor-in-chief of The Economist, has improved all aspects of Bloomberg News.

But The Economist, on a nice subject is peerless. But most times, it is hard to get something that addresses Africa, especially for the North American edition. One special report – A Cambrian Moment- remains the best piece I have ever read on the The Economist. The full piece, typical of the seasonable The Economist’s Special Report, is iconic.

ABOUT 540M YEARS ago something amazing happened on planet Earth: life forms began to multiply, leading to what is known as the “Cambrian explosion”. Until then sponges and other simple creatures had the planet largely to themselves, but within a few million years the animal kingdom became much more varied.

This special report will argue that something similar is now happening in the virtual realm: an entrepreneurial explosion. Digital startups are bubbling up in an astonishing variety of services and products, penetrating every nook and cranny of the economy. They are reshaping entire industries and even changing the very notion of the firm. “Software is eating the world,” says Marc Andreessen, a Silicon Valley venture capitalist.

I really like business and I like to hold a copy of Fortune 500. It reminds me of the power of markets with margins, and the possibilities of human visions and their capabilities. I wish there is something closer to it for Nigeria and Africa in general. Such a magazine in Nigeria could have provided thesis on what works and what does not work as you digest revenues of leading companies chronologically arranged, year after year.

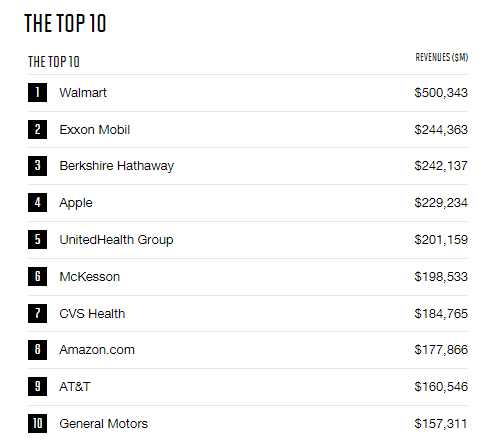

So, it was exciting, today, when I noticed that Fortune had unveiled the 64th edition of Fortune‘s Fortune 500 list of top U.S. companies. Walmart generates half a trillion dollars yearly on revenue and tops the list. Apple brings in $229 billion as the largest technology company (by revenue). Of course Apple commands the largest market cap at about $850 billion and also holds the title of the most profitable U.S. company at $48 billion.

There are many things to look for in Fortune 500. For years, I always consider this: the threshold to make the list. For 2018, a company must have generated at least $5.4 billion on revenues to be in Fortune 500. That number is about 6% more than last year. Simply, that means there is growth for some of the biggest American companies. Fortune Global 500, a global version of Fortune 500, would likely mimic the same trajectory.

Forbes has its own list – the World’s Billionaire list (i.e. the World’s Richest People) and the Forbes 400, a list of America’s top 400 richest families.

When you look at these lists, you will marvel at the regenerative capabilities of the U.S. economy. As GE fades, Facebook blossoms; as barons exit, dropouts take their positions. As you read them, you get inspired that if you work harder and smarter, you could experience breakthrough at your level.

Certainly, it is a message of optimism, and it delivers energy that men and women could achieve. You celebrate men who became legends by being the best on something and the markets rewarded them. You aspire to emulate them, by working harder to find success at your level.

There is power on positive thinking, Norman Vincent Peale would write; Nigeria needs journalism that injects energy in the lives of people. I want to see annual ranking that chronicles entrepreneurial capitalism which can inspire young people to work hard and find success.

COMMENT FROM LINKEDIN

It’s not the size of GDP or amount of money in a country’s vaults that gives it the toga of developed or advanced economy. There are many stars that must align, you cannot decouple them or even attempt to leapfrog them.

Our journalism hasn’t gone beyond the primitive stage, because our education system is also within that bracket. The health sector is in identity crisis, after which we can attempt to discuss growth in that sector. Our banking sector isn’t advanced either, yes, many of them declare huge profits not because they are highly innovative or fantastic, but rather it’s part of a broken system, which oftentimes hands out greatest rewards to those who work least.

Our polical and democratic governance is suffering the same, not much progress has been made.

So, before our journalism must attend such height, many stars have to align, at the moment, that’s not the case.