Question from a Tekedia subscriber:

“I have N20m which I have in Union Bank for treasury bill. The money was payoff from previous job. But unlike in the past where TB instructions could be in perpetual, now the bank does not reinvest automatically. I can’t be doing same monthly. I want to move the money and invest in something else. Any suggestions on good options in Nigeria. I look for max of 3 years with highest safe returns. Prof help.” Kinsdon.

My answer

Dear Kinsdon,

I will break this into components to provide the basis upon which I will offer an opinion, at your own risk. Here are pillars:

- Duration: You want duration of maximum of 3 years. This essentially cuts out many investment options in Nigeria

- Hedge: I will be looking at how to break the N20m. So, instead of investing in one specific area/project, it can be distributed

- Country: The country is Nigeria with our political economy, growth prospects, market trajectories, etc. I will take into consideration that the investment will be in Nigeria

- Indicators: I know that inflation is a huge factor and we have to look at value of money and not just the face value. In other words, N20m today at $1=N350 may be ‘bigger” (think of value for money due to inflation) than N22m in three years if $1 becomes N620 (we hope not of course, but this is for scenario mapping)

- Others: You are sector agnostic as you did not notice any sector you think you want to put this money

Your Investment Thesis

By reading your question, I can infer the following:

- Planner: You like planning. That is why you have put a time frame on this investment. Possibly, you have something you want to do with the money after 3 years

- Risk Appetite: Though I do not know how long this money was in treasury bill, I can infer that you seem happy with its returns. After all, if not that the bank has offered you a poor service, you may still be there. It was working. Simply, you seem to be happy with TB-level returns

Options

The following are the options, based on my synthesis of the scenario. This is happening as I am typing. The thought-process is how long it took me to type this, which is live.

- Fixed deposit: You fix the money for three years in a good bank in Nigeria. That will do better than TB

- Treasury bills: This can be substituted with the fixed deposit for higher returns

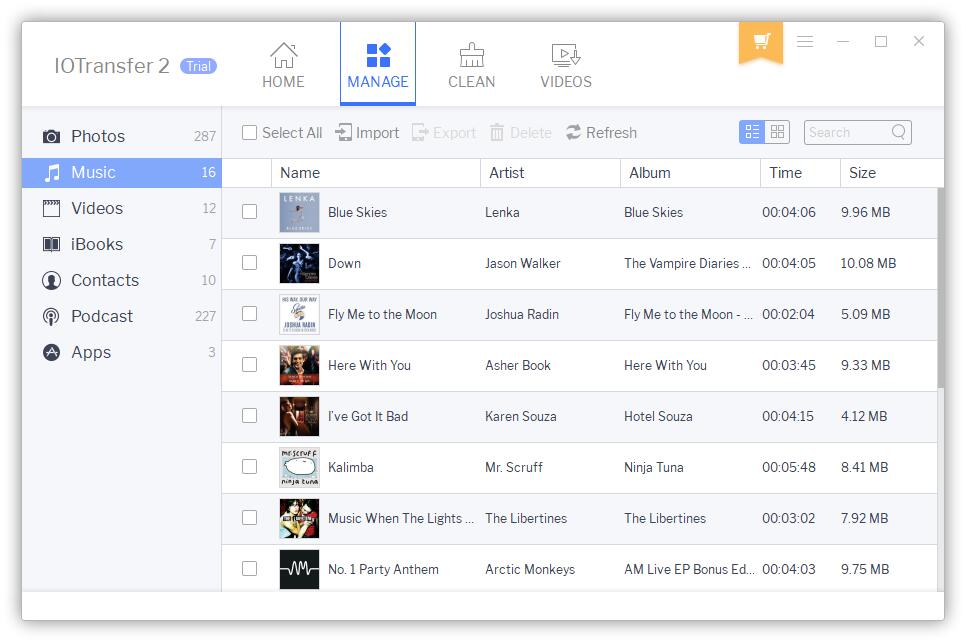

- Stock market: You look for some good stocks especially in banking and invest. The risk is there but most are so beaten that they have no room to fall further.

- Agribusiness: You explore agro-investing through aggregation with those doing so. Read my works on Aggregation Construct by searching tekedia.com. There are companies doing so. I listed some in my new book

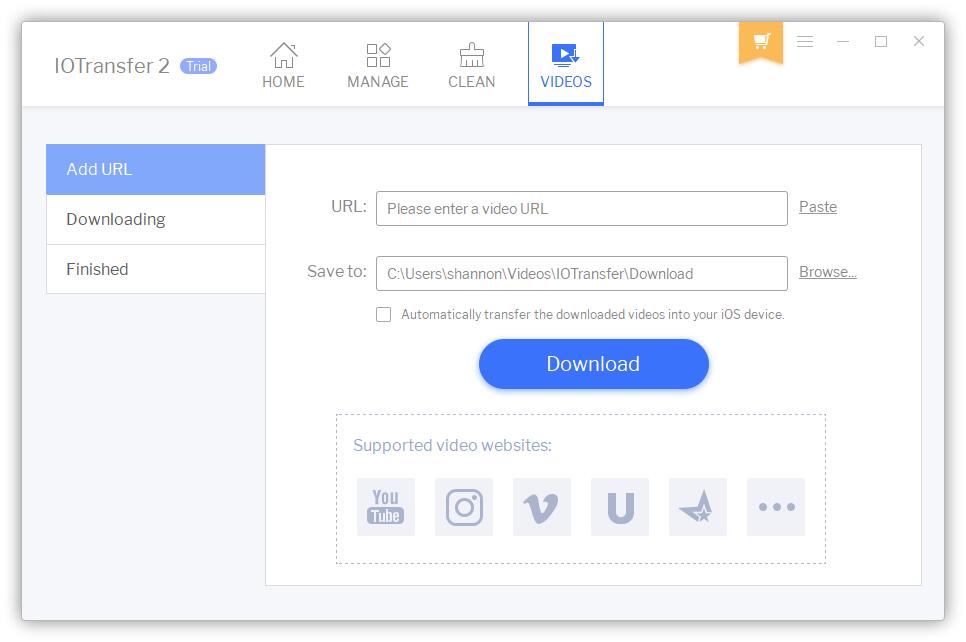

- Trade financing: You contribute to finance trade in some Igbo men going to China. But you need to have the right people. They mop money and use that money to bring container. This is a thriving business in Aba and Onitsha as most have shunned banks owing to the fees. And with the good returns, some people are taking risks. They offer good contracts and in some cases provide collateral as they own shops. Make it formal.

- Startup/Angel investing: This is off for you as the 3 years will be too short for any meaningful support to the startup. You need to have a window of about 6 years to invest here

Recommendation

At your own risk, here are my recommendations:

Put 50% in fixed deposit for three years. Most banks will give you more than the yield on TB. Since you are already happy with TB, I can say that FD will be good for you. The only issue here is that you cannot have access to the money until three years. Yet, fixed deposit rate is affected by amount. Some banks can beat the TD for three years.

Put 25% in stock market. Notice that some of the beaten banks are coming up. Over the last two years, UBA had moved from N2.80 to about N9 (updated to N12). I am not saying that you should buy UBA but I am saying that there are values in the market. Stay with banking as that is the most liquid sector in Nigeria now

Put 25% in either trade financing or agribusiness. On the agribusiness, you may need to do some works. There are many young entrepreneurs who are helping people invest in farming. That seems lucrative from their reports. I do not know where you live. In Aba and Onitsha, some people put money to finance trade. Some men mop cash and travel to China to bring containers. The return if you pool money with them is around 20-30% in four months. It is a solid business outside the banking sector run by some Igbo men. Say someone needs to import something of N120 million, they pool money and once the items come in, they sell wholesale and balance the people that funded them.

Good luck

Nd

I like how you emphasize “at your own risk.” Clearly, each of the prescribed alternatives possess unique risk and return characteristics, and these should be critically considered. I am no expert but assuming that the benchmark return is domestic treasuries with zero (or negligible) risk, then how much additional return should the investor be looking at per unit of incremental risk assumed in non-treasury options.

Other areas that I think the investor should also consider include:

1. Taxes should be considered and the after-tax return should be used for analysis. I assume the alternatives have different kinds of taxes to consider (withholding, capital gains, and income tax).

2. Other issues that may be unique to the investor

3. Liquidity: Although you mentioned liquidity in the piece, I will like to quickly state that the investor can gain exposure to real estate without necessarily purchasing a piece of real estate by investing in REITs or purchasing the shares of Real Estate Operating Companies.

Given all of the considerations (Risk, Return, Time, Taxes, Liquidity, etc), I personally lean towards financial assets (Treasuries, Bonds, Shares including mutual funds).

This was originally published in the Forum.

Like this:

Like Loading...