A vulnerability assessment is a procedure of running automated tools against protected IP ranges or IP addresses to detect the weakness in the atmosphere. Vulnerabilities are usually in misconfigured and unpatched systems. The tools implemented to run vulnerability scans may be available in paid versions or free open source tools. The paid versions usually include […]

10.1 – Pen Test Methodologies

Penetration testing which is also referred to as ethical hacking tests computer systems protection against attacks, and executes a comprehensive analysis of the computer system vulnerabilities. A penetration test can also be useful in determining what occurs when the system goes into reaction mode to an attack, and what information can be gathered from the […]

10.0 – Basics of Penetration Testing

Technically speaking, a penetration testing (pen test) is an organized attempt at penetrating a network or computer system from outside in order to identify vulnerabilities. It works similarly like those techniques which are being used in an open attack. Pen test is one of the appropriate measures taken in systems to prevent vulnerabilities before they […]

The 0.1% Online Commerce Market Share

According to Fortune, “online commerce still makes up less than $1 out of every $10 in the United States”. Yet, online commerce is the future; it would keep growing and that is certain. In Nigeria, we have put that as “online commerce makes up less than N0.01 out of every N10 in Nigeria”. In other words, for every N1000 spent in Nigeria, only N1 is spent online. Again, I expect that number to keep moving north. (Please note I said “online”, not “electronic or digital”. The distinction is very huge as you work on your strategy. POS, ATM and such are electronic but not online.)

Furthermore, in the midst of this rumble, as I travel across Nigeria, I can conclude that the physical commerce would be here, for a very long time. No one is going to kill brick and mortar business in Nigeria. That would not happen in our generation. Consider these two things:

- Before the advent of mobile telephony, many expected GSM to reduce Lagos traffic since people could talk over business on phone. That did not happen. In short, mobile expanded our tentacles making us to move and drive more. So, instead of going to one place in pre-GSM era, in Lagos, you can now connect many places in Lagos on the fly on the same day. GSM did not make us to wake up and be calling people from our homes; we have more people to meet daily because of it.

- The world engineered frozen food, making food preparation on-demand at home. But the world keeps seeing restaurants opened daily. The frozen food industry has not stopped people going out to eat.

This is the deal: Homo sapiens would like to meet and connect. Even in commerce, that element would not die. So, if you want a great online business, make sure there is a physical element in Nigeria. Indeed, it happens that visiting Nigerians (to U.S.) do travel from Atlanta to New York just to shop in Saks so that they could take the photos and post on Facebook. The best moment is coming out with the bags, smiling for the camera. Yes, she shopped at Saks New York. That is the experience: no online commerce can replicate that.

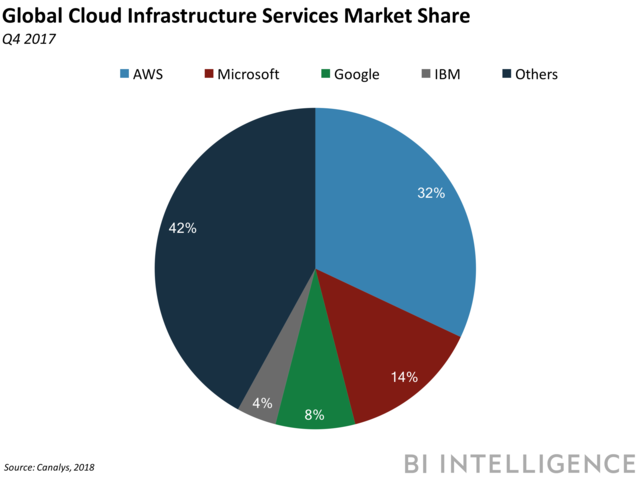

But that does not mean that Amazon would not have its moments. But thinking that Amazon is an online (commerce) business misses the point. While Amazon parades ecommerce as its main business, what keeps it working is the cloud business. That cloud business is extremely profitable and Amazon commands more than 30% of the global market share. Unless you have an ecommerce business which would be underwritten by a profitable business, you have no case. Yes, with Amazon Web Services, Amazon could be losing money on ecommerce, as it pursues market share. No one cares because it has its own money to lose, and in the process causing mayhem to others.

Here’s an overview of how the top three tech giants’ cloud businesses performed in Q4, as each vies for a larger share of the cloud market:

-

Amazon Web Services (AWS) continued to lead the market, grabbing 32% of the global cloud infrastructure services market. However, the company’s share fell by 2 percentage points in Q4 from Q2 2017.

-

Microsoft’s cloud business is closing the gap with AWS. Microsoft Azure’s share jumped to 14% from 11% in Q2 2017.

-

Alphabet’s cloud business trails behind Amazon’s and Microsoft’s, but is slowly inching up. Alphabet’s Google Cloud Platform (GCP) accounted for 8% of the global cloud market in Q4, up from 5% in Q2 2017.

Even Alibaba is not far from that: it has a double play. It charges merchants commissions on sales on Alibaba. Then it has its subsidiary to process the payments. So before any activity ends, it has already made money. As a marketplace, it is asset-light and typically makes money irrespective of the ecosystem condition. The success is not the online; the success is the double play where it charges fees and also makes money for processing those fees.

As you open ecommerce business in Africa, you must model things right. The sub-sector is not as easy as you think. It is still at infancy and would burn cash before it blossoms. This goes beyond a flashy website and wasteful Google advertisement. This is a business dominated by an offline marginal cost. Until you fix that, you have no business.

After Konga, Naspers Closes OLX Nigeria

Naspers shuts down OLX, the classified ecommerce company in Nigeria, Punch reports. Over the weekend, Konga was sold to Zinox. Naspers had invested in Konga.

There are indications that OLX, an online marketplace owned by Naspers, has shut down its offices in Nigeria, a move that will affect over 100 of its employees.

It was gathered that the workers were formally informed of the decision on Tuesday through a notice of termination, which will commence in March, and will be followed by the management team in April.

In an emailed response by the Public Relations and Communications Lead, OLX Nigeria, Uche Nwagboso, the company confirmed that it made a decision to consolidate its business operations in Nigeria.

According to her, the company has made provision for financial compensation for the workers that will be affected.

“We made a difficult but important decision in Nigeria to consolidate our operations between some of our offices internationally. Our marketplace will continue to operate here – uninterrupted – as it has since 2010, and we remain committed to the many people here who use our platform to buy and sell every month,” Nwagboso said.

She added, “We continue to be focused on constantly innovating to make sure that OLX remains the top classified platform in the country. Of course, we are committed to helping our affected colleagues during this transition and have already offered them meaningful financial and other support.

“As we’ve expressed to them directly, we are extremely grateful for their many significant contributions to OLX’s success.”

Naspers is Africa’s largest company by market capitalization, hitting excess of $100 billion in the Johannesburg Stock Exchange. It made it big in when in invested in China-based Tencent. But repeating the luck in Tencent has eluded it for years. From Mocality to Kalahari, from Konga to OLX, it has struggled to repeat China in Africa.

Africa’s largest company by market capitalization which is so big that the whole of the Nigerian Stock Exchange is not up to 40% of its value is still searching for another winner. It saw alpha when it hit glory with investments in China’s Tencent. Naspers has seen many disappointments in its broad internet (ecommerce) investments in Africa. It shuttered Mocality, a digital business directory, and also killed Kalahari, one of Africa’s foremost ecommerce companies. In all these entities it closed, it complained of one thing: lack of profitability.

Largely, the ecommerce business in Nigeria would see more massive redesigns. As I have written in the Harvard Business Review, the sector could be profitable but it would take time for that to happen. The unit economics does not make sense due to logistics issues which increase marginal cost with growth. I have preached a strategy that depends on aggregation construct for alpha.

Distrust: Rich Africans have yet to embrace online shopping, due to online fraud. In Nigeria, for example, where phishing is common, people are skeptical about putting their credentials online.

Cost of broadband: Africa enjoys tremendous growth in mobile internet which is the popular means for people to access the web.

Logistics: Amazon.com and eBay are great companies that depend on the U.S. postal system to serve their customers.

African open market: In Africa, there are “markets” everywhere, starting with the security guards who run stores in front of their masters’ mansions.

Fragmented markets: For all the efforts to make Africa appear as one market, it is not.

Literacy rates: Even if all the infrastructure and integration issues are fixed, illiterate citizens may be unable to participate directly on e-commerce sites that require reading and writing skills.

OLX joins Efritin.com Nigeria which folded in 2015, citing “high cost of doing business as reasons”. You can also add Tradestable and Ady in that list as companies that exited the sub-sector.