The LinkedIn feedback on my piece that Interswitch could get a bank license is deep. Many commenters noted that (1) It would compete with banks, its major clients and (2) That Interswitch should focus on making sure that customer experiences are improved noting that “decline and irrelevant debit on customers still occur and are not immediately corrected” […]

Running Conglomerates: GE Needs To Take Internships in Google, Amazon or Alibaba

GE is struggling. It made some big mistakes over the last few years. When GE sold GE Capital, a cash cow, which has a history of generating free cash, and bought new assets like Alstom, I was not comfortable. (I hold GE shares because of the dividend.) GE had premised the acquisition of Alstom Power and Grid businesses on the potential growth of power in the emerging market including Africa. The plan was to sell off non-core businesses and become a premier industrial company. For me, it was not an issue then because GE promised to be paying dividend, the only reason for holding the laggard.

Today, we announced an exciting and promising new chapter for GE, a plan to create a simpler, more valuable industrial company by reducing the size of our financial business. As a first step, we also announced agreements to sell the bulk of GE Capital Real Estate assets for a total value of approximately $26.5 billion.

[…]

GE today is a premier industrial company with businesses in high-growth industries. We are leaders in technology, well positioned in growth markets and delivering higher margins and lower costs. This transformation positions GE for long-term success as we pair our best-in-class industrials with financial businesses focused on growth.

Unfortunately, Africa like most emerging countries may not need power turbines for electricity in the way that GE had modeled its business. They are going all the way to renewables, by-passing the products which GE has positioned itself. When Dangote Group plans to drop $50 billion to develop the renewable energy, it does mean that GE had simply lost the (potential) market. The highly fragmented renewable energy is the reason why GE Power is struggling. Unlike in the past where clients needed 200MW of generating power, today, they can ask for pieces of 2MW generating power systems through renewable.

The dividend crises this year, on the most celebrated element of GE, i.e. the capacity to pay dividend, was largely because the new companies could not generate as much cash as the ones sold to get them. GE Capital provided cash, Alstom and others are not doing well.

GE said “a significant decline in orders” at GE Power prompted the layoffs in Schenectady. Workers will receive severance and help finding new jobs, GE said.

According to Bloomberg, GE has eliminated a total of 14,742 jobs in 2017, reducing its power-business workforce by 12,000 people. That is not what happens when a business is growing. Simply, the GE Power is burning cash and GE is struggling to manage it.

GE stock has fallen 44 percent this year as of 3:45 p.m. Thursday in New York. That’s the worst performance by far of any member of the the Dow Jones Industrial Average. The index is up 22 percent.

The Lessons

There are many things to learn from GE as it struggles to find a promising future. Here are two I am interested in:

- Cashflow Stress: GE wanted to streamline its business, cutting off GE Capital which was very important in deal financing and generating good cash flow. The cashflow has been critical in GE’s capacity to sustain its dividend tradition, despite the lack of growth in the stock. Selling GE Capital was also problematic in another angle: the GE Capital was making it easier for GE to sell its wares by providing easier capital to clients. Partly, GE could be struggling because of the absence of GE Capital.

- Industrialized Conglomerate: GE is an industrialized conglomerate and was thinking in the same old way. It felt that it had to consolidate the business to the areas of its core competency. So, sell a financial services firm and load on a power company. That was a poor playbook. If GE has taken note of modern conglomerates like Alphabet, which runs Waymo (a car company) and Google (a search company), the era of core competency is largely over. Building a new business is far easier for these great companies today. GE could have left GE Capital because there will always be finance. Most things GE had promised when it started selling the financial services and the real estate business have not happened.

The Management Process

GE has an enviable management system. It has been celebrated for decades for inventing new ways of running companies. The question right now is whether the GE management system is relevant in a knowledge-driven economy. That you ruled the industrial economy with management systems does not mean that those systems can work in a knowledge economy era. Peter Institute will rank institutions like GE as the best in management, but that does not mean so, in market performances.

The Drucker Institute, set up to advance the thought of management guru Peter F. Drucker, put Amazon at the top of its inaugural list of the U.S.’s most effectively managed companies. The methodology is based on 37 different rankings including patent registrations and employee reviews on Glassdoor, which explains why companies in the news for chronically falling revenues (IBM) or poor shareholder returns (P&G, GE) fare surprisingly well in the list.

Leading in a time like this will require picking ideas on how modern digital conglomerates are run. Jack Ma, the founder of Alibaba explained in a recent speech in China during the Fortune Global Forum.

According to Fortune, Alibaba’s Jack Ma had three pieces of advice for businesses that want to do business in China. They as follows:

- […]

- Send great entrepreneurs to lead your business in China, not professional managers. “Those people make the boss happy, they do not make the customers happy.”

Yes, GE needs to make way for entrepreneurial management that is not focusing on the industrial economy. This is a knowledge economy but GE has not gotten it. The biggest flaw in GE management system is the imagination that power units will compensate for financial services and real estate businesses. GE lost the memo on services which remain critical to any business, bringing good margins when industrials struggle.

All Together

I do think that GE needs to take management internships in Google (yes Alphabet), Alibaba or Amazon to have a better idea on how the world (knowledge) economy works. A “premier industrial company” does not mean that one cannot bring the knowledge business in the same economy. Alphabet runs any type of business today and finds ways it can build synergies across them. GE is simply fixated on making heavy equipment which may not be needed in the ways it has imagined. Everything is changing, including transportation, and GE is right to be thinking of leaving the locomotive business: with Uber, Lyft and others, locomotives may not be a really good business in the near future. Simply, GE lost the world; it has a lot of work to do, to recover. Its problems are severe, because it has sold some of its best assets, when it expected the world to align to its future, instead of adjusting to the emerging and evolving new world. A more agile Board may not be a bad idea: I need the badly beaten stocks to rise.

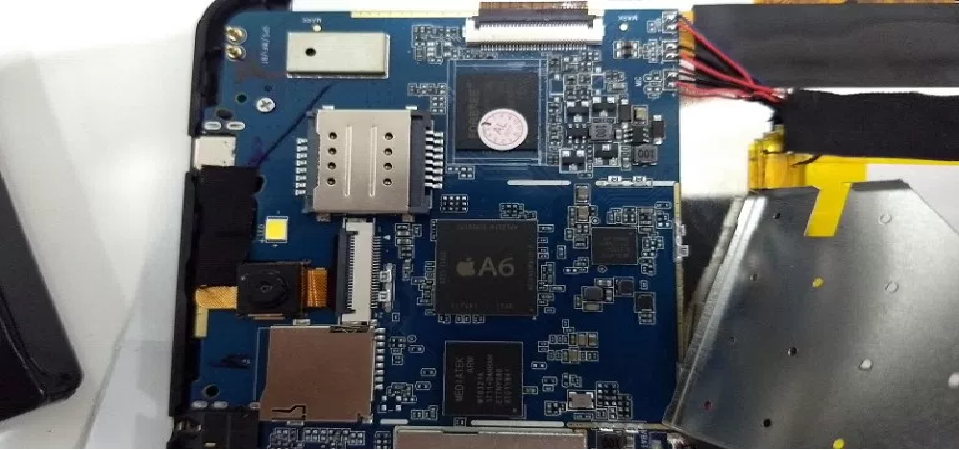

This Is What I Am Learning – Generative Adversarial Networks (GANs)

As an entrepreneur working at the interface of electronics and big data with the analytics, competitive capability is about finding how to create better models. To do that, you work to be at the state of the art. In the electronics world, I do believe that Generative Adversarial Networks (GANs) will take over and extend the capabilities of GPU (graphics processing units) in coming years. Implementing GANs enablers in circuits and boards will be very catalytic for those that process and manipulate data, at scale, within the whole constructs of AI.

Generative adversarial networks (GANs) are a class of artificial intelligence algorithms used in unsupervised machine learning, implemented by a system of two neural networks contesting with each other in a zero-sum game framework. This technique can generate photographs that look at least superficially authentic to human observers, having many realistic characteristics (though in tests people can tell real from generated in many cases). It was invented by Ian Goodfellow.. (Wikipedia)

Generative Adversarial Networks (GANs) has transformed deep learning by accurately modeling real world data better than any model developed before.

In Fasmicro Group, we are working to improve models used in our products, already anchored on neuromorphics which emulate human biology to make better systems. I am learning GANs to see how we can extend our capabilities as we serve clients through our products. GANs is going to be huge, and we want to have deep understanding of the applications as it scales.

Here, we have a history of tearing things apart, but in this specific one, it seems we have to build something. As Intel FPGA partner in Africa, we are exploring how to implement GANs in hardware to examine how it could improve some of the things we are doing.

Leveraged Scaling

When organizations accumulate capabilities, they can put themselves in positions to win. Usually, capabilities help them move from the downstream operations to upstream operations where they can do business and command higher price premiums in the markets. This jockeying requires knowing the best product, and how new products can support it, and how the existing products can seed new ones in future (one oasis strategy). Amazon Web Services was created to support Amazon’s best product (the ecommerce), removing any market demand risk from the strategy. But over time, AWS flourished and became a product even though its core value remains to serve the Amazon’s ecommerce.

In this video, I explain how a Kenyan telecommunication company, Safaricom, is using the one oasis strategy to grow. It has a new ecommerce operation, Masoko, which is leveraging the shops which have served the telecom operator. Through this leverage advantage, via the Safaricom retail shops, Masoko will have more pick-up locations overnight than Jumia. With that advantage, it could become a wonder success overnight because Masoko will not just attract more people to the shops (some will buy things), it will expand the growth of another unit of Safaricom, MPESA, a popular mobile money. As more commercial activities take place in the Safaricom ecosystems, it will become more resilient to overcome whatever the banks are plotting against it.

In your business, you need leveraged scaling, which taps into your existing capabilities, to grow.

My Email To A Mentee Who Got Rejected By A Top Business School

Yesterday, I received an email from one of the young people I have mentored. His MBA application was not successful. This is my email to you:

Dear [ ],

I got your phone message on the rejection of your business school application. Certainly, that is discouraging and I understand the feeling. But I am writing to let you know that it should be a past tense, right away. They have rejected your application, the same way they have rejected legends and icons across human generations. The key now is how to continue to make progress in your career and quickly activate alternative options. I will share something I read recently in Forbes for you.

One of the greatest investors of all time, the Oracle of Omaha, could not get into Harvard Business School (HBS). Warren Buffet – who spent two years at Penn before transferring to the University of Nebraska – traveled ten hours to Chicago to interview for a spot at HBS. They rejected him within 10 minutes! Yes, Harvard Business School admission team rejected Warren Buffet.

But there was good news for Mr. Buffet. He was accepted in Columbia and he studied under legendary Ben Graham who pioneered value investing philosophy. That philosophy is the reason Buffet is very rich. And today, you may not have Harvard Business School experience without understanding the Buffet business philosophy. The school that rejected him has built a small business around him.

Pick a copy of Harvard Business Review, you will see how Buffet is celebrated. The same Buffet that was rejected within 10 minutes. I write in HBR and I have used Buffet in many examples. He is a legend and the school that rejected him now celebrates him.

This is not to make you feel good. It is bad when the “first option” is not available. Yes, that was failure, Yet, that is not the end of the journey. You liked MBA while I suggested engineering PhD because the latter offers career insurance: there are always schools to teach if everything goes bad.

MBA is life tool. PhD is a life tool. They are all elements to liberate the mind, and then have a better life. But none is like you – the being and the personality. I do believe that only you can shape the future you want because the best way to predict that future is to create it, they say.

A rejected admission cannot stop that creation process: let this motivate and inspire to be better next time. I do think this could work well. If you decide to try again next year and by the time you arrive on campus, you have another year of work experience. Possibly, upon graduation, you will play at a higher level as you re-enter the labour market.

Finally, note this as a setback. Let us work hard to reduce such in America. Being rejected means that we were not the best, and that has to be worked upon. I have no idea what they look for in MBA admission. You need to find out and prepare better.

I fly into Redmond later in the weekend. I will call you.

Nd