Facebook is doing great. But in the next fifteen years, if Facebook does not evolve into a real-identity social media, it will struggle. As banking, insurance and more services move social, we will need social commerce. That social commerce will be anchored on real identities. Facebook does not have that today. Anyone can create a Facebook account without the real authenticity as maintained by government.

This assertion goes beyond government efforts to track its citizens. As China modifies its laws to demand that users of social media sites use their real names before they can be on registered, with posting/commentary privileges, on websites, phone apps and digital forums, other countries will pick that and adopt the philosophy. In Africa, Cameroon may prefer that over shutting down Internet. Eritrea and Sudan may join easily, telling citizens to use their real-identities on social media.

Starting Sunday, backstage real-name registration is a must for all Chinese Internet users before they can post comments on platforms in China.

Without registering their real identities in the background, previously registered users cannot post anything, including replies to posts, on Chinese platforms, said the circular released by the Cyberspace Administration of China on September 7.

Users, however, do not have to reveal their real identities on the frontstage of the platforms.

‘‘Such rules will apply to all websites, phone applications, interactive public platforms and any other communication platform that features public opinion on news or with the nature to mobilize the society,” stipulates the circular.

Screen bullets, or known as danmu in Chinese, together with other forms of posts that include such things as emojis and pictures also fall into the regulation scope, as explicitly stipulated in the circular.

The new law is simple: you can be on social media with a fake identity but you cannot have a voice unless you are real. By demanding this, fake news will be managed and decency online will be enforced. Of course, government will be watching. But they are already watching.

Outside China

Initially, this will be a very hard business model to execute outside China. But what I do believe is that some Chinese companies will perfect this and when they do, they will export the ideas to the world. These firms will work to find value in everyone using real identities online. If China makes it easier for people to get services online seamlessly, some will forget the privacy issues and go real in other countries. Over time, more people will register with their real identities. I do believe that as social media matures, there will be a convergence between online persona and the real persona of users. China could be providing a solid case with the new law to test how this will work at scale. Using real-identities online will unlock more opportunities and seed a new business model across many industrial sectors. No one knows but China will offer a case study in coming years.

All Together

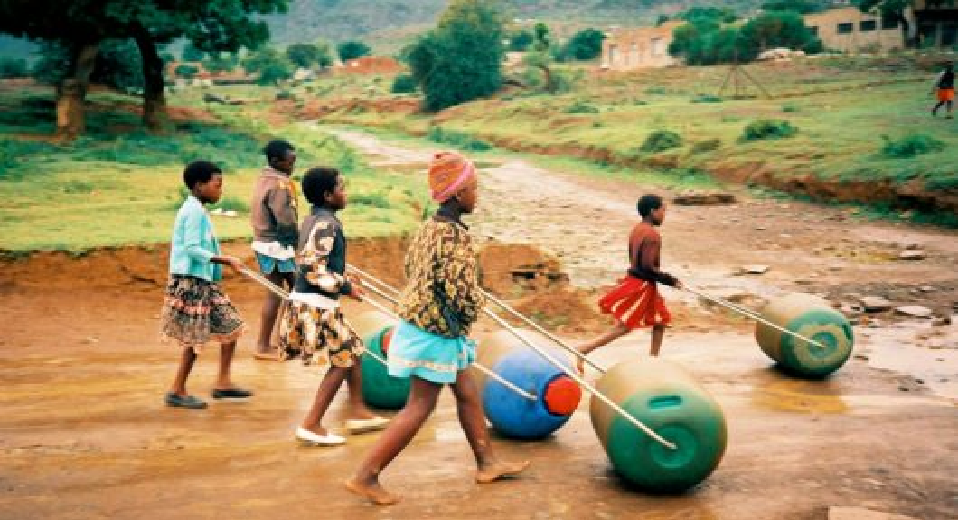

I do not think this real-identity social media will work in Africa at the moment. So, there is no need wasting resources pursuing it. My recommendation will be to monitor how the new law in China is utilized not just by the government but by companies. If a social media account can be used seamlessly to provide insurance, it means that “Twitter” handle can become a trusted identity since that is tied to government records. The use of real identities online has a promise but no one knows the full implications.

Is there a collective power that once you take a loan, you may be worried that if you do not pay, your social networks will know because your social media account is tied to that loan? Can companies create products that will appeal to you based on that social connection? It is too early to ascertain all the possibilities but if we run the meatspace (i.e. offline) with real identities, I do think in the near future, internet and social media will need to be managed with real identities. Doing that may not necessarily be bad, if the government element is taken out. Businesses will find more opportunities to provide services right in the places where customers are spending time.