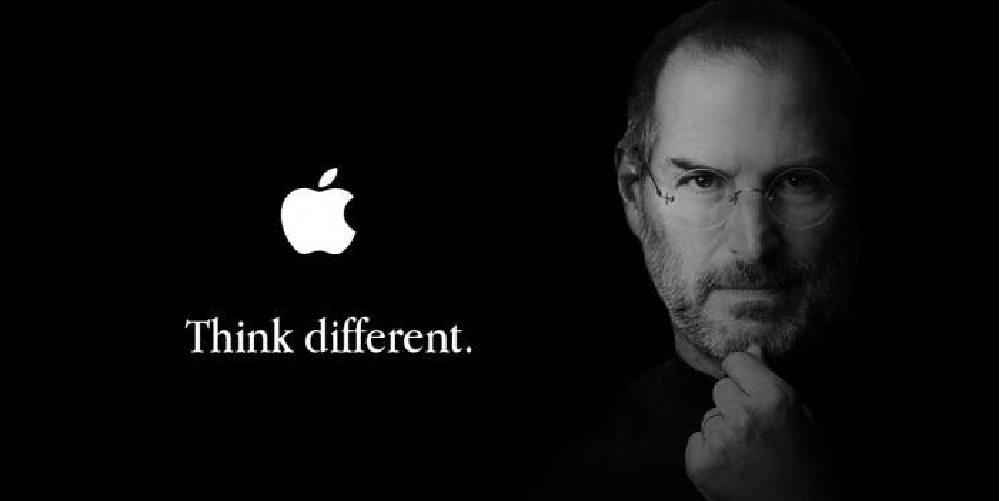

Steve Jobs, an Apple founder, was legendary for stimulating demand. He worked without surveys or focus groups. He was a genius, peerless in his generation. He saw an unborn future many years ago. He was an icon, who changed his world. He developed a good design paradigm of working at the perception of customers, beyond their needs and expectations. He found glory and Apple triumphed with iPod, iPhone, iPad and more.

I discuss why organizations must focus on developing products and services that go beyond the needs of customers to their expectations and perceptions. Focusing on the needs of customers is a recipe for disaster. The whole desire must be to deliver products and services at the level of customer perception where they are offered products and services which they might not have even imagined would be possible. But the day they see the products they will say wow: That is the thing I have been thinking. This also explains the limitations of focus groups because focus groups are tethered to what the customers think they need. Perception of customer level service is offering something which could not have been requested during focus groups, because such products will not come into the imaginations of the people being studied..

I call this Perception Demand because Mr Jobs used his vision to create new industrial sectors. He used his talent to launch the new dawns in the apps economy and the smartphone economy, at scale. Sure, Blackberry and Nokia might have been ahead, but he redesigned the sectors through his products. Blackberry pioneered the smartphone sector, but Apple is the world’s largest public company due to smartphone. Many predict that it will hit a valuation of $1 trillion very soon.

The Perception Demand Construct is a construct where you work on things which are not really evident to be in demand. Yet you go ahead to create that product. The demand may not be existing but you are confident you can stimulate it. Yes, you do believe that your product can elicit demand and grow the sector when launched. This is different from existing demand which could be met via starting a web hosting company or selling light bulbs where you know people actually need those services.

For example, in Africa, we have guys working on Virtual Reality (VR) / Augmented Reality (AR). Some of them are inspired by Oculus Rift, owned by Facebook. They are consumer facing. They are having their conferences and meetups. Yet, personally, I do not see the demand in the consumer market in Africa in the near future for VR/AR handsets. Had they been medical or generally enterprise industry facing, AR/VR could certainly have real value, though at limited scale in our hospitals and companies, at the moment.

My take is that the founders do believe that if they get the VR/AR right, they could create local demand for African techies to spend $1000 to watch virtual world. There is no verifiable and visible demand of this product line at scale in the continent. They want to stimulate the demand by having the product before the demand.

However, I have noticed that stimulating demand is very hard in Africa in the tech space. These are the major issues:

- Raising money: this is very hard because few investors can see the immediate value. You are solving a problem with no real market opportunity

- Talent attraction: attracting talent is very hard because even the workers may not see the relevance. What happens is that the founder toils around for years until he/she gives up

- Lack of ecosystem: the government is not excited, making it hard to plug into any relevant initiative.

Simply, blindly following Silicon Valley to build the local products and hoping that demand comes rarely works. And by the time the founder is done, he has wasted the funds invested to bootstrap the startup. Of course, we do this many times, because we like to remind Silicon Valley people that inspire us, that we are working on the same things they are working on! But doing the same thing with people with largely unlimited resources, in different settings, does not mean it will work.

Apple does not do that: Apple rarely pioneers a new sector. In short, Apple is not an inventive company; it is an innovative firm. It has perfected the art of stimulating demand at perception level. In other words, while it does not do focus groups and surveys, it still uses market data of those in the areas to gauge the opportunities. Once it joins the sector, it radically changes the basis of competition, pushing the curves and then stimulates demand on this new basis. So, as a leader, Steve Jobs got Apple into mastering the construct of Stimulating Perception Demand at scale.

Stimulating Perception Demand

Perception Demand is very risky: you think without much learning curves decoupled from aligning scaling and market demand. But when you add “Stimulating” before it, you have a construct, Stimulating Perception Demand, which focuses on existing trajectories in the markets and how to take them to the next level, and around there massively get many fans to connect. Here, you have seen how the products in the markets are doing. You just want to take them to the next level. The product operates at perception level, but even with that, you must stimulate demand at new heights.

Technically, this is where Steve Jobs plays well. Steve Jobs and Apple in general are innovative and not necessarily inventive. They take ideas which are in the demand and then make them better. They may not be doing focus groups because the performance of existing products is a good data to make decisions. They knew that Walkman was selling but iPod could make Walkman better. They knew that Blackberry was selling but iPhone could take the smartphone business to the next level. They want to stimulate a new level of perception in the demand nexus. So even if there is no focus group, sales data from public traded Research in Motion (then name for Blackberry maker) and Sony were solid insights on the sectors and the products.

Founders working in Africa may not easily have access to capital. But one thing that works here is the model that people can prepay for most things. If you meet the real pain points of most customers, they can fund your business. We see the struggles in agriculture, from insurance to sales, and we do believe that there is a business to build products which by itself can stimulate demand, at perception level.

We have opportunities in education, energy and other sectors which have provided real data that businesses can be built in these areas. But unlocking them will come from doing things in totally different ways. That will help stimulate the new markets we want in them.

Stimulating the process is a new art which Steve Jobs also redesigned. By providing few data, Apple enjoys unprecedented media buzz. That helps to stimulate the demand of products it has already taken to the perception level. Everyone wants to write about Apple and the sequels of products. The fusion of great products and the media interests creates stratospheric goodwill that Apple does not pay. Everyone breaks the news – TV, newspapers, magazines, talk shows, etc – for free, and that is earned media. It is a huge saving.

I do think that if not Steve Jobs and his zen-like mastery, another company could have launched iPhone and the world would think it was just another smartphone product. Steve gave iPhone a personality, stimulating passion in an already great product.

All Together

It is really important that the focus moves from the excitement on the technology to the value created in markets. We have to work on building products that bring perception demand. But just having the products is not enough. We need to find ways to also stimulate demand for them. By moving into perception demand, you have changed the basis of competition, a new curve, and if you do not clearly communicate, you could be alone. I never see Apple as a technically great company (yes, those fashion patents!). It does not need to be to have success. The company is peerless in innovation from the lens of customers and that is what matters.