In this video, I explain why Africa needs to stimulate its VC sector with tax incentives. The supporting article is here.

Fixing Aba Shoe And Leather Industry

Nigeria is proud of Aba, for the creativity, ingenuity and resourcefulness of the makers and artisans working therein. However, Aba has been a promise which for decades has not delivered on its leather industry. The professionals have not evolved their production processes for generations, resulting to products, which have sparks of genius, but which are at the end, defective in quality.

Lack of automation is one of the key factors stifling innovation there. The designers and their administrators have failed to learn modern industrial processes, making them largely remaining as craftsmen instead of businessmen. New ways of making modern shoes and bags, by using computer software, to improve specifications and quality, are yet to be adopted, at scale.

The implication is total frustration: why can’t Aba rise for Nigeria?

Aba is not a man-made cluster. It rose without specific government intervention policies. Also, unlike most global clusters, Aba does not have much affinity to any university and local government lab. The people are the researchers, guiding their business processes, to the levels where they are today. The implication is that Aba leather sector is subsistence, with men working for years with nothing to show for it. It is not seen as a business, it is a cultural career with men having fun, and not being in positions to earn decent wages to help and support families. They make shoes with their hands and barely can find margin to send kids to good schools and cover medical expenses. They are artisans in a global industry, full of legends, who make money doing what they, but in different ways.

The poor innovation capabilities in Aba is the weakest link in that city. Poor R&D activities, management talent and infrastructure, make it extremely difficult for Aba to shine. Unlike in the past, when manufacturing firms like Bata dotted the Factory Road (Aba), the infrastructure problem is keeping many multinational firms out of the city, as they cannot setup R&D operations without the necessary basic amenities. The security issues in the past, have also affected the perception of the Enyimba city despite any award Enyimba Football Club had brought to Nigeria. Financing at corporate level that can help transform makers to companies is lacking. Aba has become a Tier 2 city going down the drain of Tier 3 city, in Nigeria.

It is a broken promise, because in the Aba leather industry, we have men and women, struggling to have decent lives, in a market with a verifiable demand to meet. They come to work in the morning, they pray for light to come so that they can work.They sing in Ariaria Market and invite pastors to make light come. These problems have been there and it is largely the Nigerian problem. Light has refused to come. And everyone is frustrated, and as soon as the drum of IPOB (Indigenous People of Biafra) beats, men with nothing to do, rise up.

Nigerians are entrepreneurial, mobile and ambitious. Some little support can help unlock the opportunities that exist in Aba to compete with Italian brands, at least in Nigeria and Africa. We can make Aba great.

In this piece, my focus is the shoe, bag and general leather sector (textile is excluded). Here is how to fix Aba.

Branding/Rights

We propose for Aba to have at most five core brands under which the players can market their products. This branding will bring noticeable differentiation and equity in the market. The essence of the branding is to help them make Aba innovation a living entity that needs to be nurtured and supported. To do this branding, we suggest for the local government to organize an auction where the top five companies will be selected, based on capital capacity, global insights and other factors. The makers in the industry will commit to sell within those five brands, for support. The structure will enable the investors have scale and also offer the designers promise that any volume they produce will be bought. They will have to produce based on the quality level of the brand owner. Having this branding structure does five things

- Provides a managed identity (brand) for the makers

- Makes it possible to have scale from the subsistence designers

- Provides vehicles to enter into global partnerships through higher quality

- Makes it easier to invest in logistics and distribution

- Drives economies of scale when one person buys all materials over pockets of makers

(The brand owners will work with the administrators to do thorough cluster mapping of all the players in the sector. In other words, they have to know all the players and those making things in the leather industry. They are already organized, but they need to make that organization more structured)

Shared Infrastructure

Aba will need a hub where many designers could share infrastructure. For example, the brand owner can have a dedicated area in Aba where the designers can do their computer aided designs. This is important since some of the design offices are so small that new modern equipment cannot fit. This shared infrastructure means designers will schedule time to come and use them. This will save the brand owner cost and also reduce the temptation to move the designers from their present natural ecosystem. That can happen,in future, but that is not the most important challenge at the moment.

Capacity

The companies that have the brand rights will then help the makers in their networks, who are largely going to produce like franchises with the promise that all the outputs from the makers will be bought. The firm will invest to boost capacity for the designers so that they can produce more shoes and leather materials. For example, a shoe designer producing 20 shoes in a day, can be supported to expand to 200 in a day. With assured right control, the brand owner will be in a position to tap capital to support all within his or her system.

Quality

A key element of the new system will be quality. The makers have to produce quality shoes and bags. delivering consistent quality which can be sold internationally. The brand owner will give them the specifications and then offer training to assist them do the job right. This will include better materials, use of Computer Aided Designs (CADs) and general automation to improve quality. Quality, defined by the brand owner, becomes the identity of that brand.

Advertising

A globally structured advertising will be done, using the Aba Innovations (Aba needs a city brand which has to be nurtured. While Enyimba is great, something that transcends culture may be needed) emblem and the brand rights. This will go online, and put in TV, newspapers and magazines around the world. We do think Aba is Africa’s Zara and can compete in any market. Developing that advertising must be organically engineered so that authenticity can come in it. Think of a message like “Discovery my story” with products of makers shown and readers asked to visit a website to get that great story. There are many ways the ads can be made, to be organic.

Marketing

The brand owners will be expected to be international with experience in the luxury and non-luxury leather materials. They will open small stores in at least Paris, London, New York and across major African capitals. Quickly, all the five will have strategic partnerships with Amazon.com and Alibaba to reach the world, at scale. Their abilities to keep quality and drive logistics will be strategic. The makers, who are now franchises, will produce for them, making sure they can meet global production capacities.

Global Anchors

The brand owners must look for global anchors who can help make the message of Aba Innovations powerful. These are celebs who can help promote Aba in its authenticity. I recommend

- Chimamanda Adichie: Brilliant and authentic woman with passion for Nigeria

- Victor Moses: Ace footballer that is easy to like

- Beyoncé and Jay Z wearing Aba to any popular global event and saying so on live TV or tweet. They bring the African heritage and may ask for cuts. But they can help add global searchlights to Aba. If Beyoncé wears Aba to Grammy Awards, Aba is global.

The brand owners must work to secure strategic arrangements with these celebs who can help them drive the message. The indigenous actresses and actors will also help within the African scene. Pete Edochie and Tiwa Savage will be great messengers.

Ladies wears – made in Aba (source: Channels)

Nollywood (Aba – Made for World)

The brand owners will commission a documentary, and movies staged in Aba within the lives of families who generate income through the Aba leather industry. The goal is to expand the audience of the city and reach out to the whole of Africa where Nollywood has become Nigeria’s best export. This movie will become a simple way to tell the world about Aba shoes! It is structured marketing and advertising at scale.

Abia State Polytechnic Department of Industrial Designs

We recommend the establishment of a new department in Abia State Polytechnic Aba to help facilitate knowledge base in the sector. This department will train, educate and facilitate knowledge and collaboration in the overall area of designs. Inside this department will be a Leather Design Hub where makers and designers can come and learn new processes used by global players. The goal is to be sure of pipeline of designers for continuity and succession management.

Rounding Up

Aba could be great and has the sparks of genius to compete with Italy and Spain in the leather industry. I have offered some clear strategies to redesign the sector. Establish a vehicle that will galvanize the different shoe making entities into brands. Each brand will push for higher quality through better tools and training and advocate more collaboration among players. A requirement that a brand buys from the entities will be established. It will be similar to a merchant buying farm outputs from farmers even as the merchant has provided seeds to the farmers at planting season. Through strategic advertising and marketing, Aba will reach its promise.

——

About Aba, Abia State NIGERIA

Aba is a big trading center in Abia State in the southeastern part of Nigeria. It is considered to be the economic heartbeat of the state which has Umuahia as the political capital. It has more than a million people and is home of legendary craftsmen and handcrafters especially in the leather industry. Its main tertiary school is Abia Polytechnic Aba. It hosts Ariaria International Market, one of the biggest markets in West Africa. Enyimba people, the nickname of Aba residents are traders, businessmen and are respected in Nigeria for their entrepreneurial brilliance. Educated or not, they know how to simplify commerce and build new opportunities.

Some of the key sectors include light manufacturing in brewery, textiles, pharmaceuticals, plastics, cement, and cosmetics. Aba has a relatively developed manufacturing sector along the Factory Road, very close to the railway station. The iconic Unilever towers in the area along with PZ and Nigerian Breweries. It is a hub for gateway from eastern part of Nigeria to many other regions with luxury buses. Before the collapse of the Nigeria Railways, Aba Railway Station was a strategic hub for moving agricultural produce from the northern part of Nigeria to eastern part of the country. It hosts the most successful, at least at the continental level, football club in Nigeria – Enyimba FC.

However, Aba could also look dirty and neglected. The roads are bad with dumps of refuse everywhere. During rainy season, Aba floods. The connecting road to Aba from Port Harcourt was one of the most strategic for the city. But for years, that road has been neglected. The popular Oil Mill Market in Port Harcourt is important to Aba traders just as Arriara Market is to the Port Harcourt dwellers. Because of this, Uyo has been attracting some companies that used to operate from Aba. The traffic congestion problem especially after rainfall is turning once a virtuoso city into decline.

Though it would have been the official capital of leather works in Africa, Aba is very notorious for poor branding of its products. It is hard to see a shoe made in Aba Nigeria with the label that it is made in Nigeria. They feed into the wrong assumption that nothing made in Nigeria will be patronized by customers. So, you see quality products from Aba workshops with fake tags of Italian and French fashion houses. They export them to neighboring African countries but never capitalize on their product pipelines as they never ever claim they made them with their unpatriotic branding. Education will certainly help to change those understandings and help transform the market.

We see automation to be the future of this city. Most of their operations especially in craft are manually done, businessmen must use machines to scale and reduce cost. Automation will position Aba to compete with foreign companies that export their wares into Nigeria. But for that to even happen, they must learn to put their labels proudly on their products.

Credit: I thank Tony Elumelu Foundation for funding my non-profit African Institution of Technology which has done many research works across many clusters in Nigeria. The outcomes have been published in Harvard Business Review and other leading publications.

CEO (Matthew Willsher), CFO (Olawole Obasunloye) Departs Etisalat Nigeria

The CEO and CFO of Etisalat Nigeria, Matthew Willsher and Olawole Obasunloye, respectively have resigned.

This is coming some days after the resignation of the Chairman, Hakeem Bello-Osagie and some Mubadala directors of the United Arab Emirate (UAE) firm.

A new board has been constituted. The new board appointments are: Dr. Joseph Nnanna (CBN), Mr. Oluseyi Bickersteth (KPMG), Mr. Ken Igbokwe (PWC), Mr. Boye Olusanya (former DMD of Celtel) and Mrs. Funke Ighodaro (former CFO, Tiger Brands)

Their resignations came on the heels of the protracted loan impasse of the $1.2 billion the telecommunications firm is owing a consortium of 13 banks, which has subsequently led to the pull out of the parent body and major investor, the Mubadala Group.

Why Founders Are Best Chief Product Officers

The role of the Chief Product Officer has become popular over the last few years, especially in technology-enabled startups. Few people can hold this title and fewer people should even be responsible for the duties. In the time of change, and organisation continuity redesign, founders are the best positioned to lead product development and evolution.

Chief product officer (CPO), sometimes designated as chief production officer, is a corporate title referring to an executive responsible for various product-related activities in an organization (Wikipedia)

As we saw in Twitter when they had product problems, they brought back Jack Dorsey. In IROKO, when the radio business had some issues, Jason Njoku took over. In both cases, the founders became custodians of businesses they helped to create.

Founders bring vision, authority and trust necessary to change things when they are necessary. In this video, I explain why the best chief product officers are founders and if a founder cannot do that job, the startup should simply close the door.

Why Africa Struggles With Tech Investors

It is very hard to setup a technology startup, in Africa. One reason is the dearth of investors with capacities to make visions become realities. Across most African cities, technology-enabled entrepreneurs continue to struggle, without capital to scale. They look for investors, they rarely find them.

It is well established that some of the richest men in Africa did not make money through technology. The implication is that most do not understand that sector. So, they are cautious to put money in areas they do not have good domain expertise. You do not blame them – they cannot play chess games with their resources.

There is also the fact, in some countries like Nigeria where some politicians and ex-military men are extremely rich, but yet fearful to invest in companies, because they could be asked to show the sources of their funds. (One evidence against Olisa Metuh, former PDP spokesman, in his trial, was an investment.) To avoid that beaming of high voltage searchlight in their lives, they simply “bury” the money in their yards or build houses no one can afford to rent.

So without much support from home, African entrepreneurs begin the journey of looking for capital in North America and Western Europe. After all, they do read how companies have raised capital and they are certain, they have got great business plans to compete. Unfortunately, informally, 99% fail because at that level, there is really nothing to invest in. from the angle of the investors.

Nature of Global Venture Capital

One of the most challenging sectors in the world is the VC sector.It looks easy from the outside – get money from rich people, distribute same through investments to smart people building companies. Then follow-up and then wait for the value to be created. Sooner or later, everyone is rich! It is largely a sweet world, except that is not really what happens.

The VC industry is merciless. Most doing it fails miserably. And that makes them so fearful to invest in unknown entities or markets like Africa, with no largely demonstrated records of generating huge value.

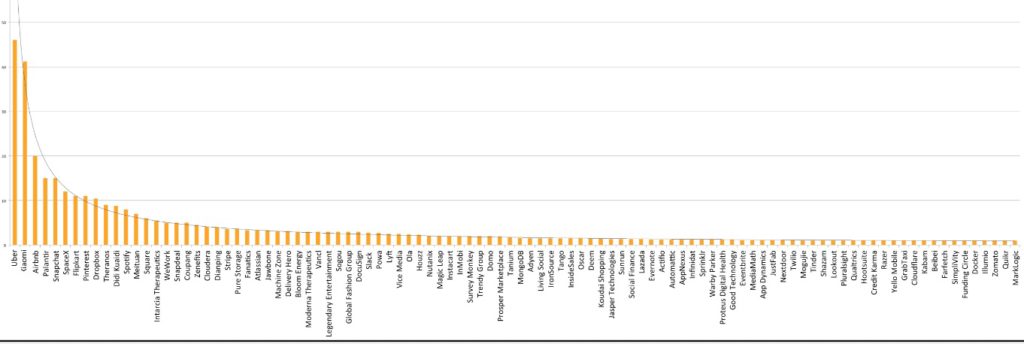

If you visit the Fortune Magazine’s The Unicorns List, you can see a very interesting trend – nothing of huge interest happens outside of the top 20 companies; the top 20 unicorns account for more than 50% of the entire list of 121 companies. (A unicorn is a tech-enabled private company with a valuation of at least $1 billion.)The top five or so (Uber, Xiamio, Airbnb, Palantir, Didi Kuadi) take more than 20% of the entire list.(I removed Snap which had since gone public in the list). In other words, the value in most private companies are concentrated in the top 20. Though I have focused on using the Fortune unicorn list which tracks technology private companies with valuations of at least $1 billion, the trajectory is correct because that list is global.

Some unicorns in Fortune Unicorns List

A power curve of the whole 121 unicorns shows that is concentrated at the top 20

If you take those valuations into a power curve, the trend becomes more visible, as noted in the plot above.. So, anyone that is outside the top 20, as an elite VC, is not doing well. Since a VC will not likely invest in all of them, the play is to make sure that it is in one. They have this feeling that they do not want to miss out, so all efforts are concentrated at the top, because that is where the value is created.

Uber’s valuation is largely the same as the GDP of Kenya.. This means that you cannot necessarily be having Uber in Kenya. (Sure, this statement can be challenged since Uber is asset-light and can be born in Kenya. Yet, even if Uber was made in Kenya, they could have considerred the size of the home market in its valuation.) But the fact is: while will an elite VC pursue opportunities in Kenya, if it can get into top companies like Uber, where that is possible? With these mindsets, they can take Africa as a secondary market which becomes like a backup when the sources of great returns, usually in America, are out of reach.

Besides, most times, it is winner-takes-all. Most times the unicorns dominate their areas and domains. Once they have taken control, no one around the world and especially Africa will be of relevance in that category. It is that mindset that makes it challenging to breakthrough when you want to raise money from foreign investors. By the network effect in most technology areas, the number of potentially great companies are limited. You have few great ones and then all-rans because one, the category-king, the winner, had locked the value, in a category.

The African Challenge

We have a really challenging issue because top VCs have the methodologies to win big or lose big. The greatest VCs lose, most times, the most money, but they also win BIG. That winning big compensates for all the misses. For example, you can invest $10 million and lose it but another $10 million investment can turn into $500 million. An average VC will not bet like that, being so cautions not to lose that $10 million. However, it rarely has the opportunity to make that $500 million, also. Owing to this scenario, what matters is the market size. If they do not see how the size of the market can justify that winning big, they do not show interests. It simply means, win, they lose, and loss, they lose, since even what you may think is winning may not be enough for them. Owing to that, they show no interest to business plans addressing small markets or market segments.

So, what happens – you are now left with lower tier VCs who cannot get into the left-hand side of the power curve where the game is played and where most of the value is created. Unfortunately, those lower tier VCs are extremely cautions – they hate to miss a strike. That is their inherent characteristics. The implication is that they waste your time, and at the end, you get the message that they cannot invest.

The market makers that hit big and lose big need to show interests for us to get our moments. Until we get their attentions, the struggle will continue. We need people who can take risks, not overly cautious investors that largely add marginal value, who always want you to be post-revenue, when it is obvious you cannot execute without capital.

Making Them To Come

I do think governments across Africa must offer tax-holiday on VC capital over ten years to get them interested in Africa. We need to offer something to unlock capital so that we can build our future companies. The money invested will not be taxed along with the proceeds from exits. If we do so, Africa will see massive growth in the VC sector.

Rounding Up

Africa will continue to struggle in attracting investments in technology-enabled companies until we can attract a new category of investors that really want to win big. At the moment, we are getting attention of over-cautious investors who are not necessarily the elite. The elites play hard and also win or fail hard. They make category-kings possible because they invest in things most have never invested on. In other words, they know how to take risks. They do not over analyse scenarios and run due diligence for months, hoping during that time, you might have magically succeeded only for them to join the party. People like Peter Thiel, Andreessen Horowitz and John Doerr are desperately needed to show interests in Africa. They are people that can catalyze the local entrepreneurs to take more risks and also unlock the untapped opportunities in Africa by giving them resources. Without such investors, African will continue to struggle in scaling great ideas in our continent. I recommend for African Union to lead a 10 year tax-holiday on VC capital and associated proceeds in Africa.

image credit: allaboutunicorns