Closing a funding round is not just about what is written on a piece of paper as a business plan or pitch deck. Most times, investors do not really care. Nevertheless, not having a business plan or pitch deck could portray you as someone who does not plan or take things seriously. That may be the problem and not necessarily the lack of the documents.

Here are business plans/pitch decks used by some of the world’s game changing companies. You can borrow ideas from them as you plan to craft yours.

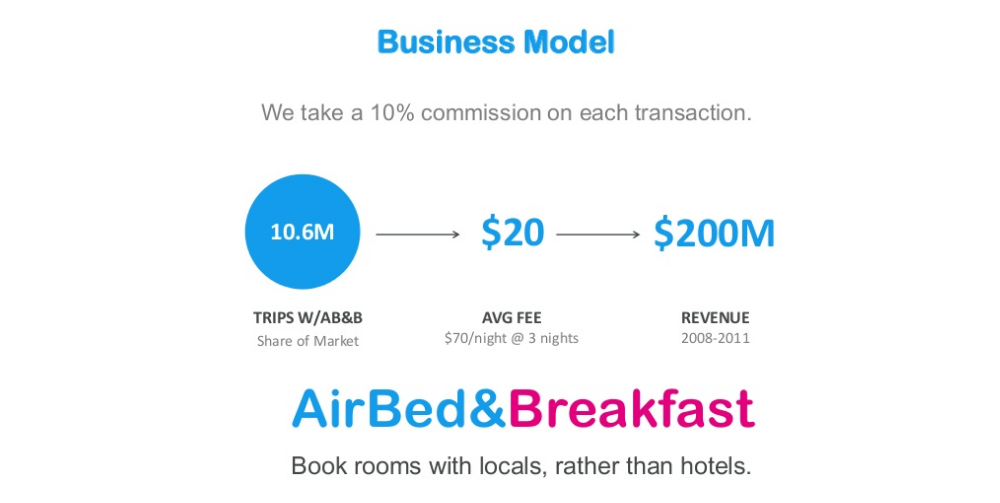

1. Airbnb

Airbnb is an online marketplace which lets people rent out their properties or spare rooms to guests. What started out as an obscure idea has turned into one of the greatest startup success stories of our time. And Airbnb’s pitch deck has become a sort of reference point for entrepreneurs around the world. AirBnB Pitch Deck

2. Buffer

Buffer is a social media scheduling platform that helps you schedule content to Facebook, Twitter, Linkedin and Pinterest. This is the pitch deck that Buffer used to raise half a million dollars. What’s more crazy is the founders don’t even think this is a big deal. This is a great pitch deck because it tells a story, building up to the apex which was the Traction slide. Buffer’s $500,000 pitch deck

3. Square

Square is a company that allows merchants to accept mobile credit card payments via a dongle. I think the major selling point on this pitch deck was the management team. Notice how it was among the first three slides they showed? Seriously, who wouldn’t bet on a company with the big boys from Twitter, Google, Linkedin, Paypal, and more? Square’s detailed pitch deck outlines their business model and a simple financial model that portrays annual revenue and five-year growth rate. Square’s pitch deck

4. LinkedIn

Founded in 2002, LinkedIn is the top business-oriented social networking platform. The company’s Series B pitch deck talks a great deal about how it’s different from other social networks and the value the network brings. It also uses a great analogy to explain it’s value i.e. it talks about “Web 1.0” vs. “Web 2.0”: According to the deck, Alta Vista was “Search 1.0”, and Google was “Search 2.0”; LinkedIn is “Networking for Businesses 2.0”. LinkedIn’s Pitch Deck

5. Buzzfeed

Buzzfeed is arguably the world’s highly clickable site. It provides shareable breaking news, original reporting, entertainment, and videos across the social web. As of today, BuzzFeed has managed to raise over $446.3 million. As you’ll notice in their pitch deck, it doesn’t hurt to start your deck with your most impressive figures. The millions of users visiting the website on a monthly basis and quotations from large organizations such as CNN, I’m sure would convince any investor to bring our their checks. Buzzfeed’s First Pitch Deck

6. Youtube

Youtube was acquired by Google in 2006 for $1.6 billion. Like Facebook, this company doesn’t require any introduction. Unfortunately, this is not the original deck. This is Youtube’s pitch deck to Sequoia Capital (one of the most established VC investors who’s often regarded as one of the industry’s best), which was released through a legal proceeding. Youtube’s Pitch Deck

7. Foursquare

Foursquare is a mobile platform that helps you find the best places to go in your area. Their pitch deck does a great job of using screenshots of social proof. Like all good storytellers know, showing is better than telling. Foursqaure’s First Pitch Deck

8. Mint

Mint is a personal financial services tool that helps people track their spending and find ways to save money. This deck was used in a competition and was never used for raising money, but it’s still a powerful deck that startups can learn from. Mint’s Prelaunch Deck

9. Moz

Moz started out as an SEO company but has pivoted to support marketers across all inbound marketing strategies. This is the series-B deck for Moz which they used to raise over $18 million. Because the company had already been in operation for five years, they were able to present an accurate estimated revenue, revenue run rate, average customer lifetime value, cost of paid acquisition, etc. Moz’s Pitch Deck

10. Tinder

To put it simply, Tinder is a dating app. Tinder’s Pitch Deck

11. Contently

Contently helps brands do great content marketing at scale—with smart technology, content strategy expertise, and a network of 100000 freelance creatives. Contently Pitch Deck

12. WeWork

WeWork is a multibillion dollar office space rental startup in New York City. WeWork’s Pitch Deck

13. Intercom.io

Intercom shows you who is using your product or website and makes it easy to personally communicate with them through targeted content, behavior-driven email, in-app, and web messages Intercom’s Pitch Deck

Related: The one tip you need to turbocharge your customer service

14. Manpacks

Manpacks is a platform that delivers men’s essentials such as underwear, razors, grooming and other products.Manpacks’ Pitch Deck

15. Dwolla

Dwolla is a payment solution that allows users to send, receive, and request funds from other users. This 18-slide pitch deck landed the company $16.5 million. Dwolla’s Pitch Deck

16. Gusto

Gusto (previously ZenPayroll) is a cloud-based solution tool for small businesses to pay employees. The company raised $6 million with this deck. Gusto’s (when it was still ZenPayroll) Pitch Deck

17. Wealthsimple

Wealthsimple is Canada’s first online investment manager. They raised more than $2 million in seed funding.Wealthsimple’s Pitch Deck

18. AppVirality

AppVirality allows app developers to grow their platform using growth method techniques proven by other startups. This deck was used to raise $270k AppVirality’s Pitch Deck

19. Castle

Castle is a startup that lets rental owners put their properties on autopilot. This was the deck Castle used to raise $270,000 for their startup. Castle’s Pitch Deck

20. Swipes

Swipes is a task manager app to help its users increase their productivity. Swipes’ Pitch Deck

adapted from here.

Like this:

Like Loading...