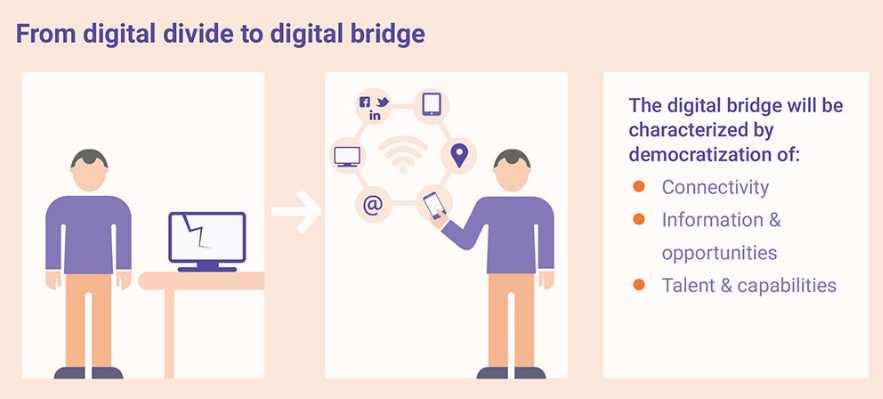

As we move towards the middle of the 21st century, emerging technologies will once and for all close the digital divide that governments, private sector, and entrepreneurs have tried to address for so long. The pace at which technology is spreading and breakthrough innovations are unfolding offers new potential for leapfrogging in Africa, overcoming barriers of making internet connectivity available across the continent without a differentiation between urban and rural areas or socio-economic and demographic groups. In the next years, technologies will allow us to democratize connectivity, access to technology, and capabilities.

- The number of unique mobile subscribers is forecast to reach 725 million by 2020, translating to 54% of the expected population in that year (Source: GSMA)

- Africa’s e-learning market has doubled from 2011 to 2016, reaching USD 513 million, according to a report by market researchers Ambient Insights. South Africa is Africa’s largest e-learning market, along with Angola, Nigeria, and Tunisia. Meanwhile, Senegal, Kenya, Zambia, and Zimbabwe are posting and annual e-learning market growth rate of 25% (Source Ambient Insights)

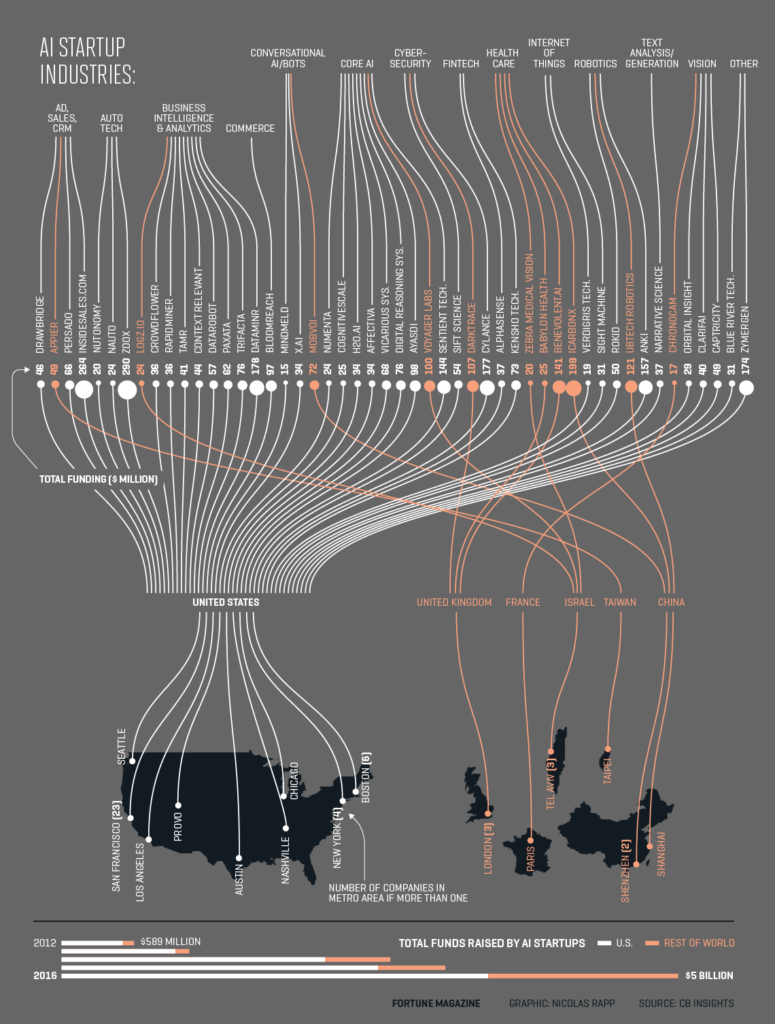

- The global Artificial Intelligence market was valued at USD 126.24 Billion in 2015 and is forecast to grow at a CAGR of 36.1% from 2016 to 2024 to reach a value of USD 3,061.35 billion.

Closing the infrastructure divide: Democratizing connectivity: 75% of Africans lack access to affordable internet today, but rapid change is underway, just like the mobile revolution triggered mobile phone penetration to jump from 1% in 2000 in Africa to 73% in 2016. Today, this figure is over 100% in countries such as Tunisia, Morocco and Ghana. By 2020, Africa will have over 700 million smartphone connections. New entrants into the connectivity game are changing the competitive landscape, working towards making connectivity available to the unconnected masses.

In the short run, small scale, off-grid solar power systems such as the one developed by BuffaloGrid, have great potential to leapfrog the need for grid expansion by providing off-grid internet access, using solar power. Kenya-based BRCK provides a hardware solution that facilitates connectivity in remote settings. Across the globe, startups are beginning to create decentralized solutions that can cut out middlemen and allow peer-to-peer connectivity, matchmaking between end-users and connectivity providers and selling of access internet capacity.

In the medium to long term, aerial infrastructure innovations and drone-based internet such as Google’s Project Loon, and Facebook’s Internet.org and SpaceX are solutions in process to bridge the connectivity gap. Expected to be commercialized in 2017, Project Loon provides internet through a network of high altitude balloons. Each balloon provides internet coverage to an area of 80km in diameter. Mesh networks have the potential to offer a more secure and stable network connection and innovators like goTenna Mesh, Tuse and Village Telco have started to provide connectivity using mesh networks.

Such technology innovations paired with government action will boost connectivity at affordable prices. Countries like Rwanda are leading the way, ranking as highest Low Development Country in this year’s Affordability Drivers Index. Its success is partly due to enabling policies such as the SMART Rwanda Master Plan 2015-2020, putting information and communication technology – especially broadband – at the heart of the national development agenda.

Closing the user divide: Democratizing information and opportunities: Making use of digital technology is no longer a privilege of the “top of the pyramid” but increasingly has a value proposition for Africa’s “Base of the Pyramid”. Encouraged by the success of M-PESA, innovators are figuring out how to deliver real value to low income consumers, embedding digital technologies into devices that BoP-consumers use in their daily lives and making technology as a “means to an end” rather than an end in itself. Businesses have in the past years succeeded in creating consumer touch points using the mobile phone, disrupting distance, speed, and cost of delivering products and services. Today, the usage of mobile phones to access information and basic services is higher in low income segments than in top tier segments of society—and this success story can be repeated.

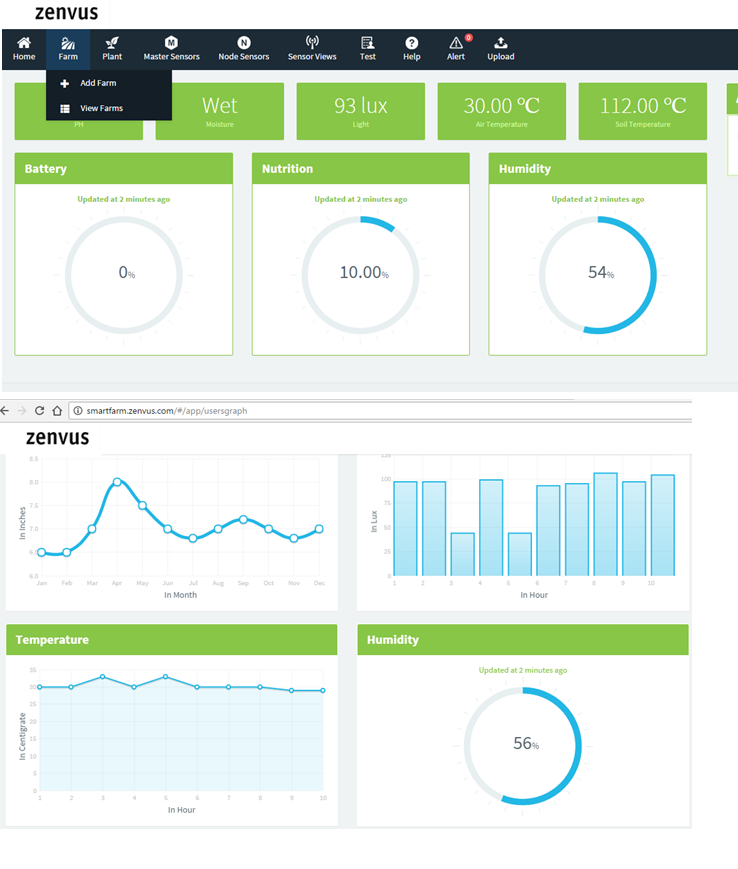

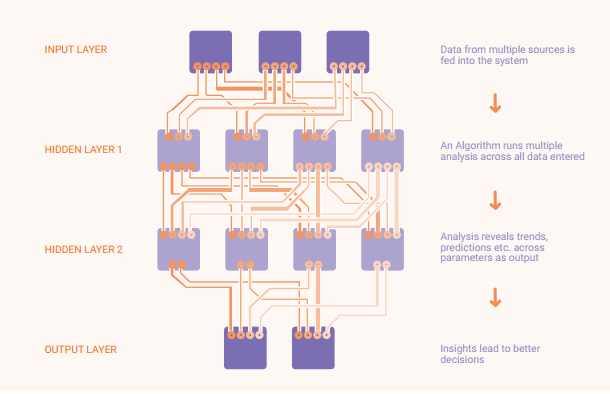

In the short term, bots replace the need for an abstract user interface and provide a natural means of communication. Chat bots are enabling communication with technology and reducing the barrier to usage, especially when it comes to providing support in the native language. SMS-based bots such as Agri8 in Kenya, use machine learning principles to make it easier for farmers to access and navigate agricultural information platforms. Emerging technologies such as AI will act as enablers in the back-end, providing the information, opportunities or services that people need: financial products, water, energy, education, healthcare services or information for example in areas such as agriculture or climate.

In the medium to long term, emerging technologies and smarter devices allow us to make high tech truly inclusive for base of the pyramid consumers: Conversational applications enabled through AI will enable consumers to do basically anything with the help of tech – not relying on high tech skills or literacy. Technology will enable users to communicate directly with computers without the need for a screen. Multimodal communication leveraging eye-tracking, gestures or voice technology will help overcome the literacy challenge.

Closing the skill divide: Democratizing capabilities: Given the speed at which technology develops, adaptability and skill development matter in order to prevent the development of a two tiered society of tech savvy users and excluded non-users. To prepare for the change, Africans can take advantage of new forms of learning and skill building. In the medium to long-term an increasing number of products and services will be digitized, demonetized, and democratized – increasingly removing the intermediary and shifting responsibility to the individual. With this newly won empowerment, there is a need to prepare the individual: Learnability, problem solving and ability to interpret information are key in the new age, where data and knowledge is easily accessible.

Just as emerging technologies enable access, they enable skilling and provision of need-based, customized, and contextual training delivered through videos, text, games and other mediums, independent of centralized educational institutions. While MOOC-enabled distance education has been around for some time, the near-term future lies in a combination of ‘education on your fingertips’ through formats such as nanodegrees and other ‘just in time interventions’. In the medium to long-term more engaging virtual reality-enabled class room education will prepare Africans to solve local problems independent of their location. The locational barrier is already being overcome by companies like Unimersiv, zSpace and nearpod. In the long-run emerging technologies will help create a future-ready generation that bridges the digital divide through skills acquired remotely.

Editor’s: Intellecap contributed to this.

Like this:

Like Loading...