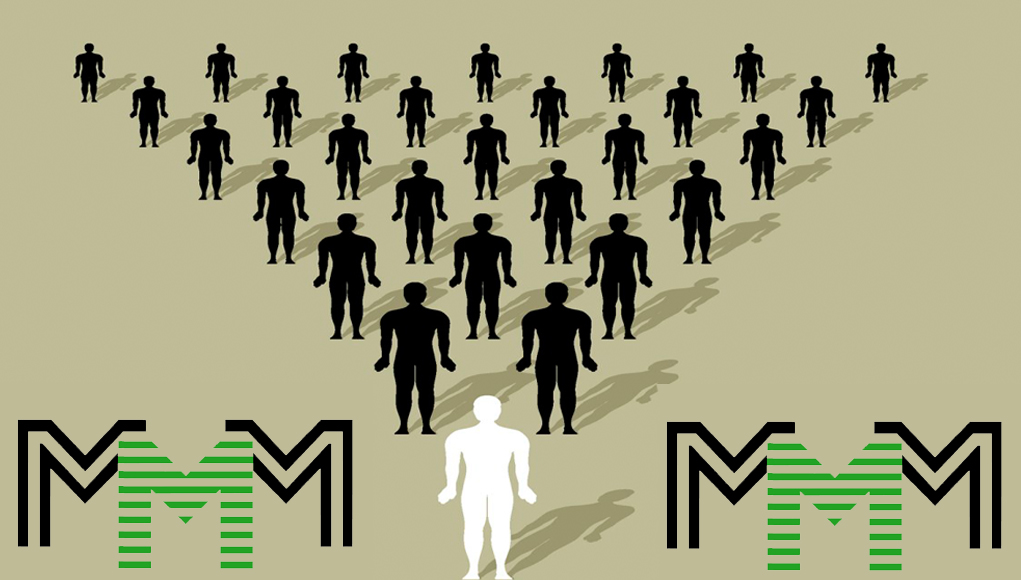

Move over MMM, welcome innovation and training. We are looking for Students Ambassadors to cover all universities, colleges of education, and polytechnics across Nigeria. This is to assist the enrollment of students in our online cybersecurity business, First Atlantic Cybersecurity Institute (Facyber), which is U.S.based, but coordinated in Nigeria by Fasmicro.

About the Job

First Atlantic Cybersecurity Institute (Facyber) is a cybersecurity training, consulting and research company specializing in all areas of cybersecurity including Cybersecurity Policy, Management, Technology, Intelligence and Digital Forensics. The clientele base covers universities, polytechnics, colleges of education, governments, government labs and agencies, businesses, civil organizations, and individuals. Specifically, the online courses are designed for the needs of students of any discipline or field (CS, Engineering, Law, Policy, Business, etc) with the components covering policy, management, and technology. Please see complete Facyber curricula here.

The programs are structured thus:

- Certificate Program (Online 12 weeks)

- Diploma Program (Online 12 weeks)

- Nanodegree Program (Live 1 week)

The purpose of a Students Ambassador is to promote Facyber training programs in the respective campus. The incumbent will coordinate the enrollment of students in his/her campus. When necessary, the incumbent will help coordinate cybersecurity and digital forensics seminars/workshops in the campus in partnership with Fcyber local partner, Fasmicro.

Qualifications for Students Ambassador include:

• Be an active student of the school to be represented

• No sales experience needed

• Tech-savvy with strong presence in social media

• Relationship development skills a must. You must be self-driven . We want students with good networks in their schools.

All the students will report remotely to our Director of Campus Initiatives who is based in Owerri, Nigeria.

Qualified applicants are encouraged to send an intent email (add a short CV please) to info@facyber.com. We plan to have 2-3 students per school and once we meet our targets, the opportunities will close.

This is an opportunity to earn extra naira while in school, so do not delay.