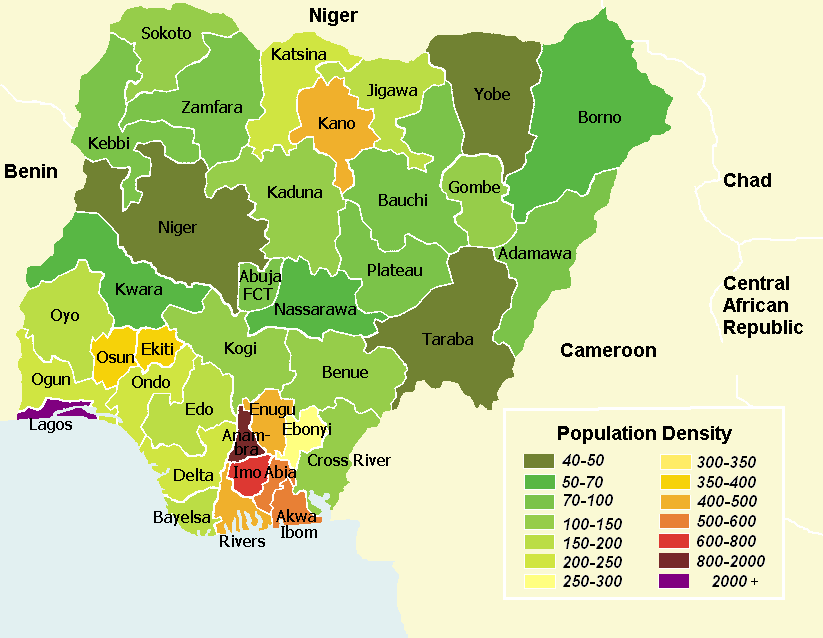

Nigeria is owing real money to foreign investors. In a new article by Punch, Lagos, Kaduna and Edo, with a combined foreign debt profile of $1.84bn, are the most indebted states of the federation as far as subnational foreign debts are concerned.

Statistics obtained from the Debt Management Office in Abuja on Wednesday showed that the 36 states of the federation and the Federal Capital Territory owe $3.65bn in foreign debts as against the $7.61bn owed by the Federal Government as of June 30, 2016; bringing the country’s total foreign debt to $11.26bn.

Lagos, which has the biggest economy in the country, retained its topmost position as the most indebted state of the federation with a total of $1.43bn in foreign debts. Thus, the state holds 39.17 per cent of the country’s total subnational foreign debts.

Kaduna State, with total foreign debt of $225.28m, comes in the second position. It holds 6.16 per cent of the subnational foreign debts.

Edo State, with a total of $179.52m as of June 30, holds 4.91 per cent of the country’s subnational foreign debts.

The highest owing states in the subnational foreign debts include Cross River, $141.47m or 3.87 per cent; and Ogun, $103.55m or 2.83 per cent.

Others are Bauchi, with $97.23m or 2.66 per cent; Osun, $78.93m or 2.16 per cent; Adamawa, $77.14m or 2.11 per cent; Enugu, $74.46m or 2.04 per cent; Katsina, $68.99m or 1.89 per cent; and Oyo, $67.56m or 1.85 per cent.

Some of the least indebted states of the federation are Borno, $21.89m; Taraba, $23.01m; Plateau, $29.24m; Yobe, $29.28m; Jigawa, $32.62m; Kogi, $33.56m; Benue, $34.26; FCT, $34.8m; Zamfara, $35.07m; and Delta, $42.21m.

Our correspondent reported that the 36 states of the federation and the FCT grew their external debts by $1.37bn in five years.

The external indebtedness of the subnational governments as of December 31, 2010 stood at $2bn. However, by December 2015, it had risen to $3.3bn.

This shows that the subnational governments grew their external debts by 68.44 per cent within the five-year period.

Some states, over the period, maintained their top positions in the borrowers’ club, while others jumped onto the list in the period.

With an external debt of $41.19m in 2010, Edo State, for instance, was not among the most indebted states in the country.

However, by the end of December 2015, the state’s external debt profile had leapt to $168.19m, showing a difference of $127m. This means that the state’s external debt rose by 308.34 per cent in five years.

Like this:

Like Loading...