IBM has a history of elevating the game of technology, finding ways to transmute itself as a pioneer and an established reliable innovator. It continues to invest in emerging fields, filing patents like it is collecting high school prizes. IBM inventors received a record 8,088 patents in 2016 representing a diverse range of inventions.

Besides the Watson, the IBM supercomputer, one of the most important units in IBM today is the IBM Blockchain business. IBM is not in this business for the largely mundane thing of moving money from one region of the world to the other using Bitcoin. Certainly, it is not interested in the gyration of the price of the cryptocurrency.

Watson is an IBM supercomputer that combines artificial intelligence (AI) and sophisticated analytical software for optimal performance as a “question answering” machine. The supercomputer is named for IBM’s founder, Thomas J. Watson.

IBM cares about the technology which underpins Bitcoin – the blockchain. Blockchain is one of the most important technologies which have been invented in the last few decades.

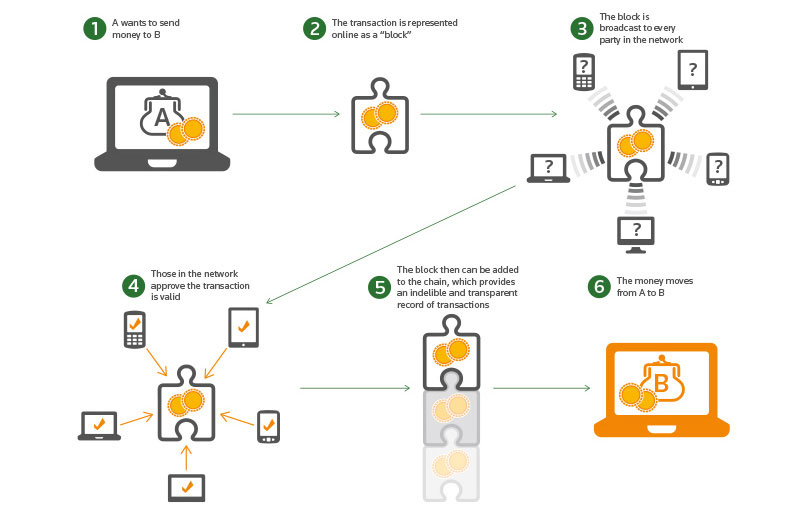

A blockchain is a distributed database that maintains a continuously growing list of ordered records called blocks. Each block contains a timestamp and a link to a previous block. By design, blockchains are inherently resistant to modification of the data — once recorded, the data in a block cannot be altered retroactively. Through the use of a peer-to-peer network and a distributed timestamping server, a blockchain database is managed autonomously. Blockchains are “an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. The ledger itself can also be programmed to trigger transactions automatically

Forget the hype, on its face value, the technology can accomplish many things not just in the long-term, but right now. It can help to transform cities and governments – making them more agile and cheaper to run.

How blockchain transaction works

Wiring the New Business Grid: The Blockchain Grid

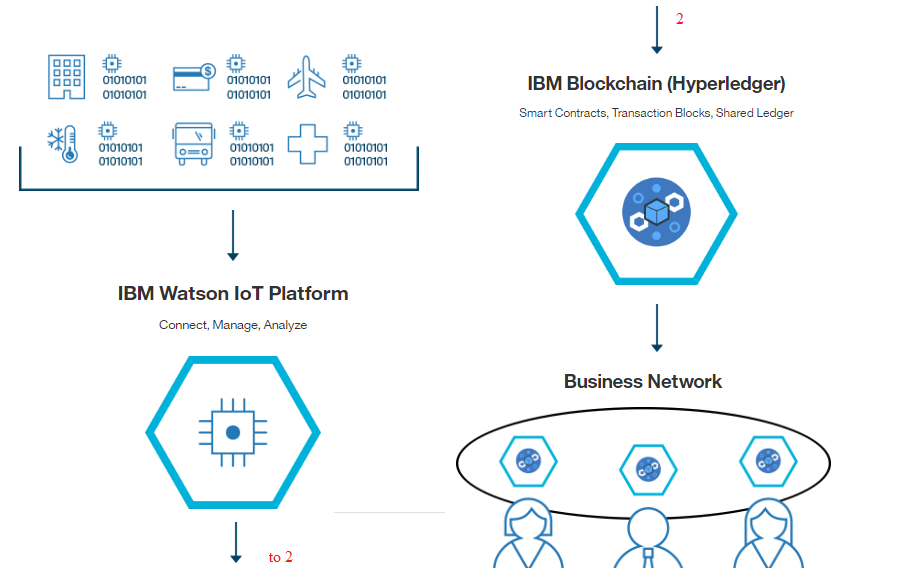

IBM has built a fusion between IBM Watson and IBM Blockchain. IBM Blockchain provides the private blockchain infrastructure of distributed peers that replicates the device data and validates the transaction through secure contracts. Watson IoT Platform translates existing device data, from one or more device types, into the format needed by the blockchain contract APIs. Through this, IBM offers a set of customized service engagements allowing clients to experiment and innovate with the IBM Watson IoT Platform and blockchain technologies.

What is happening here is profound because IBM has brought hardware, via IoT, into its blockchain business. With its experience in hardware building servers, computers and intelligent systems, IBM is one of the few companies that can bring blockchain technology into the mainstream of citizens and governments.

Most others will remain at the software level, but IBM will use blockchain to bring intelligence to what GE has called the Industrial Internet.

The Industrial Internet is the integration and linking of big data, analytical tools and wireless networks with physical and industrial equipment, or otherwise applying meta-level networking functions, to distributed systems.

With this integration of Watson and Blockchain, IBM can build a new grid that will run the world – the blockchain grid. This is going to be as important as the electricity grid and will permeate any level in our lives and governments. It is the new world order that will shape any industrial as we know it in the 21st century.

IBM Blockchain

Making a Redesign and Disruption

Blockchain will redesign commerce and industry. That will bring disruption across industrial sectors.

The blockchain technology has the potential of disrupting industries such as financial services, remaking business practices such as accounting and auditing, and enabling new business models. For agile firms, to avoid disruptive surprises or missed opportunities, strategists, planners and decision makers across industries and business functions should investigate applications of the technology.

The key attributes of the technology are the following:

- Security – hacking is impossible given the ledger is distributed across thousands of computers, reducing server maintenance requirements and improving security for banks.

- Transparency – the sender and recipient of each transactions are recorded and all transactions are publicly available for inspection.

- Privacy – users are anonymous and can move money around instantly and securely. This allows banks to save time and reduces costs on international transactions.

- Risk – currently, if a bank’s system goes down, users are unable to perform transactions. Using the blockchain technology, the bank’s system would continue as normal.

The Dubai Experiment

IBM is partnering with Dubai to advance the nation’s blockchain strategy.

IBM is collaborating with Dubai Customs, Dubai Trade and its IT provider DUTECH, to explore the use of blockchain for a trade finance and logistics solution for the import and re-export process of goods in and out of Dubai. Using Hyperledger Fabric and IBM Cloud, the blockchain solution transmits shipment data allowing key stakeholders to receive real-time information about the state of goods and the status of the shipment. Taking the example of a shipment of fruit, stakeholders involved in the process will receive timely updates as the fruit is exported from India to Dubai by sea, and then manufactured into juice in Dubai, and then exported as juice from Dubai to Spain by air.

We do think that this project will extend from Customs to Central Bank and anything you can imagine in the near future. Essentially, Dubai, as a nation, can live within the IBM technologies. IBM is using IBM Cloud for this and that will help it attain any level of integration it needs to build a very seamless product.

As you read further that press release, you can see where this is going

Additionally, as part of the solution, IBM is also working with du, a UAE-based telecommunications service provider that is conveying data from internet of things (IoT); Emirates NBD Bank, the letter of credit issuing bank; Banco Santander, the letter of credit responding bank; Aramex, the freight forwarder; and a leading Airline, as the airway carrier.

IBM is working with telecoms, working with the banks and other strategic partners. When IBM finishes, one will expect that some of these partners will cut-off existing relationships if IBM experiments work. With that, IBM will become the engine that runs the bank, the freight forwarder, the airline and more. Practically, IBM can build a new financial and business grid within its IBM Watson-Blockchain portfolio.

As has been noted, the “potential applications of blockchain are limitless, ranging from storing client identities to handling cross-border payments, clearing and settling bond or equity trades to smart contracts that are self-executing, such as a credit derivative that pays out automatically if a company goes bust or a bond that regularly pays interest to the holder.”

Implications for Africa

Africa has a lot to gain from technology. Most systems are broken and technology can provide real impacts. At both firm and government levels, Africa needs affordable technologies that work. That is why cloud computing will be a winner in the continent. Blockchain falls into that league also.

Globally, IBM is rapidly expanding its blockchain capabilities and actively working with companies to understand what it takes to make blockchain ready for business. Financial services, supply chains, IoT, risk management, digital rights management and healthcare are some of the areas that are poised for dramatic change using blockchain networks.

Technically, there is no sector in Africa that IBM Blockchain business cannot affect. We do think that this is going to be the real smart city initiatives without the expensive feasibility studies. Blockchain will make this a piecemeal process which will later converge into one hub. IBM is ahead and we do think once the Dubai experiment is over, forwarding thinking nations like Kenya and South Africa will sign-up IBM for help.

For countries and their institutions, struggling to modernize their outdated legacy systems in the face of increased pressure from decreasing foreign earnings, digital challengers and cyber criminals, blockchain represents an opportunity to rethink much of what they do and redesign business processes.

Nigeria and Angola will benefit significantly here as they streamline businesses in the period of uncertainties fueled by diminishing value of commodities.

It is not just for the big banks, the blockchain applications can make transportation, corruption fighting and management of social benefits better. For the financial services sector blockchain offers the opportunity to overhaul existing banking infrastructure, speed settlements and streamline stock exchanges. Thus, the shared public ledger has the potential to radically simplify banking by reducing costs, improving product offerings and increasing speed for banks.

The promise of an integrated African bigger stock exchange will happen faster under blockchain technology. African exchanges are still analogue. The promise of making them fully digital and integrated is catalytic to unlock more value.

Rounding Up

Blockchain will cause a major disruption in the business ecosystems as we know it today. Expect banking, insurance and all major industrial sectors to change.If IBM succeeds in Dubai, we will begin a new phase in human civilization that will redesign everything we know. The interesting thing about IBM is that it is not just selling blockchain, it is bringing blockchain with the intelligence of Watson.

We have to welcome this and understand the new reality of global redesign. Buy hey, African entrepreneurs must respond to the possibilities and opportunities, fast.

(Sources: Reuters, IBM, Deloitte, Wikipedia)