The Internet, video games, television, and filmed entertainment segments of sub-Saharan Africa’s entertainment and media industry are projected to continue to grow in the following years but the publishing industry is having to work very hard to make any headway, according to PwC’s Entertainment and media outlook: 2016 – 2020 report (South Africa – Nigeria – Kenya)released today. Despite a relative slower growth projection for the industry, the Outlook forecasts that South Africa’s entertainment and media industry is expected to grow from R125.7 billion in 2015 to R173.3 billion in 2020, at a compound annual growth rate (CAGR) of 6.6%.

Digital spend is expected to drive the overall growth. South Africa’s Internet access market will rise from R39.4 billion in 2015 to R68.5 billion in 2020, as broadband – both fixed and mobile – becomes an essential utility.

The Outlook presents annual historical data for 2011 – 2015 and provides annual forecasts for 2016 – 2020 in 11 entertainment and media segments for South Africa, Nigeria, and Kenya: the Internet, television, filmed entertainment, video games, business-to-business publishing, recorded music, newspaper publishing, recorded music, magazine publishing, book publishing, out-of-home-advertising and radio.

South Africa has the largest TV market in Africa and continues to grow strongly, with pay-TV subscription revenues expected to expand by a 5.0% CAGR to reach R25.2 billion in 2020. The video game market is also performing well and revenue is forecast to grow at a CAGR of 5.6% to reach R3.7 billion in 2020, up from R2.8 billion in 2015. Social/casual gaming revenue overtook traditional game revenue for the first time in 2015 and is expected to be the key growth area over the next five years, exceeding R2 billion by 2020.

Alongside video providers, the B2B market will be a strong source of revenue for South Africa’s entertainment and media industry over the next five years. The amount of data that businesses are using for decision-making is increasing, and the tools used to access the information are increasingly cloud-based with more and more users gaining access via mobile handsets. The market is forecast to grow at a 4% CAGR to reach just under R11.6 billion in 2020.

By contrast, the newspaper market in South Africa is expected to be R1 billion smaller than in 2015. In 2015 total newspaper revenue was worth R9.1 billion, but this figure will drop to R8.1 billion in 2020. Circulation figures are also forecast to start declining, as price rises are unable to compensate for the declining numbers of copies sold.

By the same note, South Africa’s consumer’s magazine market is also forecast to see a decline in later years. A growing number of South Africans are accessing magazine content and websites via their smart devices, but the boom in smartphone and tablet ownership will be the biggest driver for digital magazine revenue growth over the forecast period.

Although physical music continues on its downward trajectory, it is streaming revenue that will be responsible for keeping recorded music revenue from large falls. Digital music streaming revenue is forecast to rise from R74 million in 2015 to R437 million in 2020.

The report shows that South Africa’s total entertainment and media advertising revenue is expected to rise from R43.4 billion in 2015 to R53 billion in 2020, a CAGR of 4.1%, with only newspaper advertising revenue forecast to take a downward turn. TV advertising continues to dominate the market, but Internet advertising is combining scale with a great pace of expansion, and will become the second-largest contributor to revenue by 2020.

Nigeria

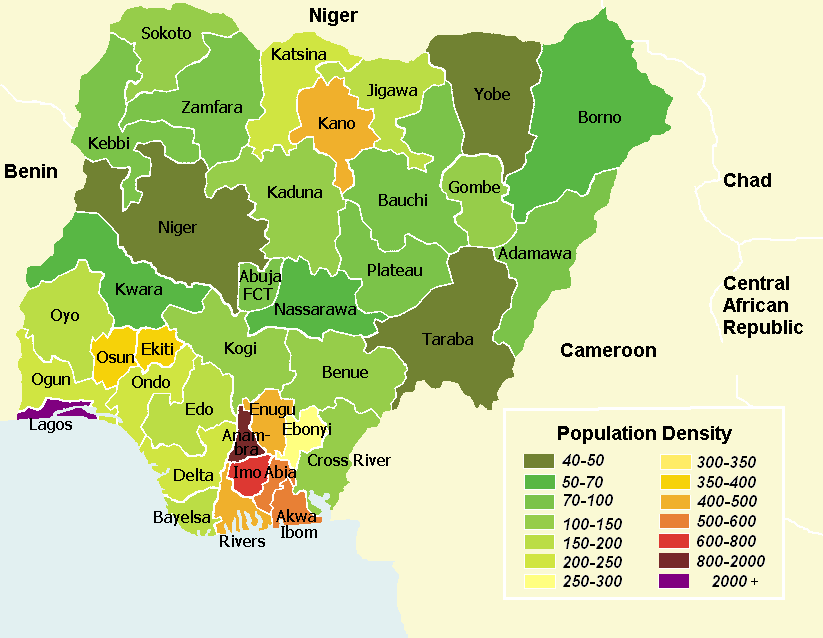

Nigeria has one of the fastest-growing markets in the entertainment and media industry. In 2015 it saw 15.7% growth to reach US$3.8 billion, and with all segments forecast to rise over the forecast period, an 11% CAGR is anticipated. Internet advertising will see the fastest growth over the forecast period, and will come predominantly in formats designed for mobiles, in keeping with the prevailing method of Internet access in the country. TV advertising is also benefitting from strong economic growth and an emerging middle class with a higher disposable income.

Kenya

Kenya’s total entertainment and media industry was worth US$2.2 billion in 2015 and is expected to be worth US$3.3 billion by 2020. Internet access again will be the main contributor, if not as dominant in Kenya as in Nigeria, accounting for 43% of the total market in 2020.

Like this:

Like Loading...