The Central Bank of Nigeria’s (CBN) directive on the geo-tagging of Point of Sale (POS) terminals marks a new phase in the evolution of Nigeria’s digital payments ecosystem. The rule requires all POS devices to be tied to specific physical locations and restricted to operate within a 10-meter radius of their registered sites. The policy aims at reducing fraud, improving monitoring, and enhancing public confidence in the system.

While the goal is commendable, successful implementation requires more than compliance for its own sake. Each stakeholder must understand the steps they need to take and the opportunities that lie within them. In this piece, our analyst presents a process-driven roadmap designed to help stakeholders adapt and even thrive under the new framework.

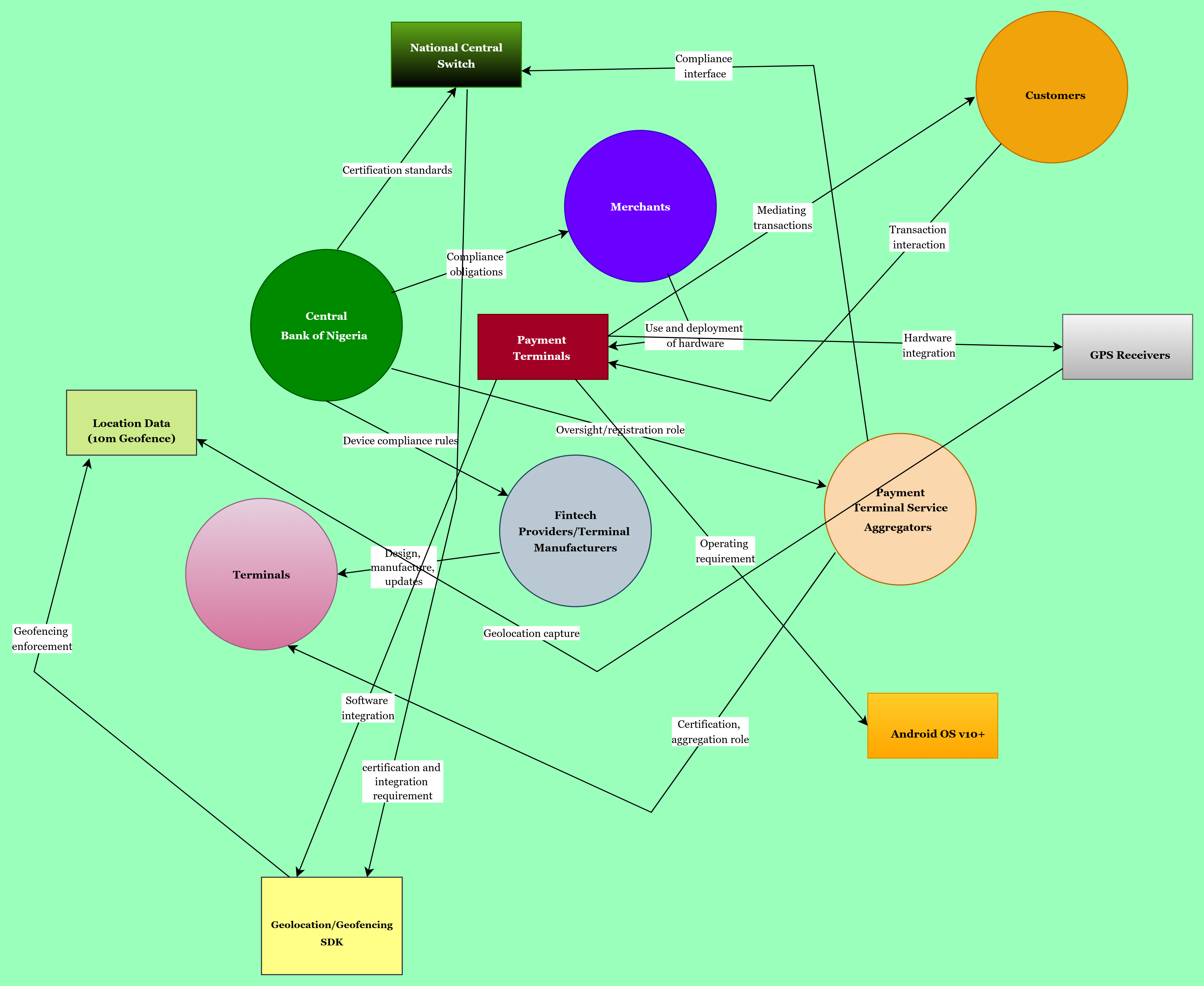

Exhibit: Network of actors towards successful implementation of geo-tagging POS policy

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Step 1: Build a Shared Understanding

The first step toward successful implementation is clarity. CBN must publish easy-to-understand policy briefs that explain the purpose, scope, and compliance requirements of the geo-tagging rule. Aggregators should organize workshops and digital sessions to help fintech companies and merchants interpret the regulations.

Fintech providers and terminal manufacturers need to examine the technical requirements closely, while merchants should begin by identifying the POS terminals in their possession and confirming the addresses where they are currently deployed. When all actors start with a common understanding of what the policy means, confusion is minimized and implementation becomes smoother.

Step 2: Map and Audit POS Deployments

Accurate data is the foundation of compliance. Aggregators must create a reliable registry of every POS terminal, capturing both device details and deployment addresses. Merchants should cooperate by submitting information about the locations where their devices operate, while fintech providers can make the process easier by building audit features into merchant dashboards.

This step is critical for identifying terminals that are frequently moved between locations, such as those used by mobile merchants in rural markets. Addressing such cases early helps prevent penalties and ensures smoother adaptation to the new rule.

Step 3: Upgrade Devices and Integrate Technology

Once the audit is complete, stakeholders must turn to the technical side of compliance. Many older POS terminals lack the software and hardware capabilities to enforce a 10-meter restriction. Fintech providers and manufacturers should therefore upgrade devices to run on Android OS version 10 or higher, integrating approved geolocation software development kits that ensure accurate GPS monitoring.

Technology partners such as GPS and SDK developers have a key role to play here. They must provide lightweight, efficient solutions that work reliably even in regions with weak connectivity. Aggregators should only approve terminals that meet certification standards to ensure long-term compliance.

Step 4: Train and Support Merchants

Policies often fail when frontline actors are left behind. Merchants, who depend on POS transactions for daily income, need training and support to manage the transition. Aggregators should roll out simple guides and helplines to help merchants troubleshoot issues and understand how the 10-meter restriction works.

Merchants themselves should begin adjusting business strategies to focus on fixed-location usage and communicate transparently with customers about possible disruptions. Fintech providers can support this effort by offering responsive customer service dedicated to compliance-related challenges.

Step 5: Monitor, Report, and Adjust

Compliance is not a one-time exercise but a continuous process. Aggregators should build dashboards that monitor terminal activity in real time, flagging irregularities such as relocation attempts. CBN and the National Central Switch can strengthen oversight by requiring monthly reports and sharing data insights across the ecosystem.

Merchants should also report persistent device failures or connectivity issues promptly. This collaborative monitoring ensures that the policy remains effective while reducing unintended service disruptions.

Step 6: Turn Compliance into Opportunity

Stakeholders must look beyond the rule as a burden and see it as an opportunity. CBN can promote compliant merchants and aggregators as trusted partners, setting higher benchmarks for credibility. Fintech providers can position “compliance-ready” POS devices as premium solutions for secure and reliable payments. Merchants can use certification as a way to attract customers who value safety and transparency in financial transactions. When compliance becomes a competitive advantage, the industry moves from resistance to innovation.