El?Salvador’s officials believe a future quantum hack could put the country’s crypto assets at risk. In late August?2025, the country that held roughly 6,274?BTC – about?$686?million considering the current price of Bitcoin – decided to split it up. Fourteen fresh addresses were made, each never to hold more than 500?BTC.

Officials think that spreading the coins should make a single hack less effective. The Salvadoran government promised a public dashboard where anyone could monitor the balances and any transfers in real time.

Why are quantum computers a worry for Bitcoin?

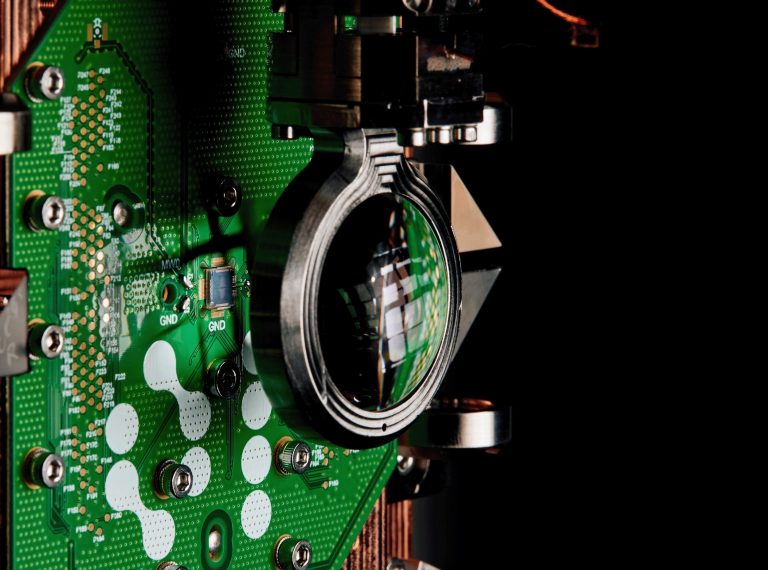

Bitcoin uses a signature scheme based on ECDSA or Schnorr (secp256k1 curve). Quantum machines can run Shor’s algorithm and break the signatures that keep the coins safe.

When a holder initiates a transaction, their public key is exposed on-chain. If a quantum computer is powerful enough — which can happen sooner than we think — it could use that public key to “extract” the private key.

From there, the coins could be hijacked before the network confirms the transaction — known as a “race theft”. But at the moment, only the UTXOs that already have their public key exposed could be at risk.

Some studies say 25?% of all Bitcoins could be vulnerable, while others say as much as 50?%. A safe guess is probably around 30?%. A crypto heatmap performance overlay would make it easier to visualize which coins or UTXOs appear most exposed in practice. That means not every coin is in danger, even though this is already a huge amount of money. That justifies the Salvadoran government’s decision to fragment its Bitcoin portfolio.

Such a decision has its pluses and its downsides. The main advantage of this strategy is that no single address holds a huge sum, so an isolated hack would have a minimal impact.

Still, this trick does not seem to solve the anticipated quantum issue. When the coins finally move, the public key will appear on the chain, opening the door for quantum hacks to powerful machines.

The split?up approach then looks like a sensible short-term fix, but cannot, on its own, constitute a real defense against quantum cryptanalysis. That point leads to the need for a definitive solution, like quantum?resistant encryption.

What might El?Salvador or other nations do?

Bitcoin’s community seems to push a move toward post?quantum signatures — solutions like Dilithium, Falcon, SPHINCS+ — via a planned soft-fork in the future.

Therefore, the country could:

- Continue to apply good address hygiene (no reuse, careful fragmentation).

- Implement a proactive migration to post-quantum signature schemes before UTXOs (Unspent Transaction Output) become active.

- Reduce exposure windows via strategies like batching and payment channels, to limit the time a public key remains visible.

El?Salvador’s plan to split its Bitcoin assets into many small addresses seems judicious from an operational point of view. But this remains a temporary measure, considering how fast the computing industries move. Projections indicate significant advances in quantum computers in the next 5 to 10 years.

Once El Salvador and other crypto holders manage to safeguard their assets by spreading them across several wallets, the real challenge will be to migrate to a quantum-resistant Bitcoin, via post-quantum signatures and a controlled soft-fork.

Like many others drawn into the world of cryptocurrency, I was excited by the promise of decentralization and financial freedom. But that excitement quickly turned into panic when I realized I had fallen victim to a phishing scam and lost access to my crypto wallet. I had invested a significant amount in Bitcoin and Ethereum, and watching it disappear was devastating.

After exhausting every possible self-help route — from contacting the wallet provider to seeking help on crypto forums — I came across Swift Recovery Services. At first, I was skeptical. I had heard about crypto recovery scams and didn’t want to get burned twice. But their professional approach, transparency, and positive reviews encouraged me to take a cautious step forward.