Real-world assets (RWAs) represent a paradigm shift in decentralized finance, bridging traditional finance (TradFi) with blockchain infrastructure by tokenizing offchain assets such as government bonds, private credit, public equities, real estate, and even physical goods. This transformation offers new levels of liquidity, programmability, and global accessibility, particularly for financial instruments that have historically been illiquid, restricted, or inefficiently distributed. Over the past year, Solana has emerged as a serious contender in this space, establishing itself as a viable platform for institutions and retail users alike to access and interact with RWAs onchain.

Solana’s appeal stems from its high throughput, near-zero transaction costs, and robust developer ecosystem. Technical innovations like the Token-2022 standard and fast block finality enable seamless compliance tooling, yield distribution, and composable DeFi integrations. These traits make Solana uniquely suited for hosting a broad spectrum of RWAs, from tokenized Treasury tokens to onchain equities and tokenized commodities. Its infrastructure is increasingly tailored to the needs of asset issuers, regulators, and users, paving the way for RWA adoption at both institutional scale and community levels.

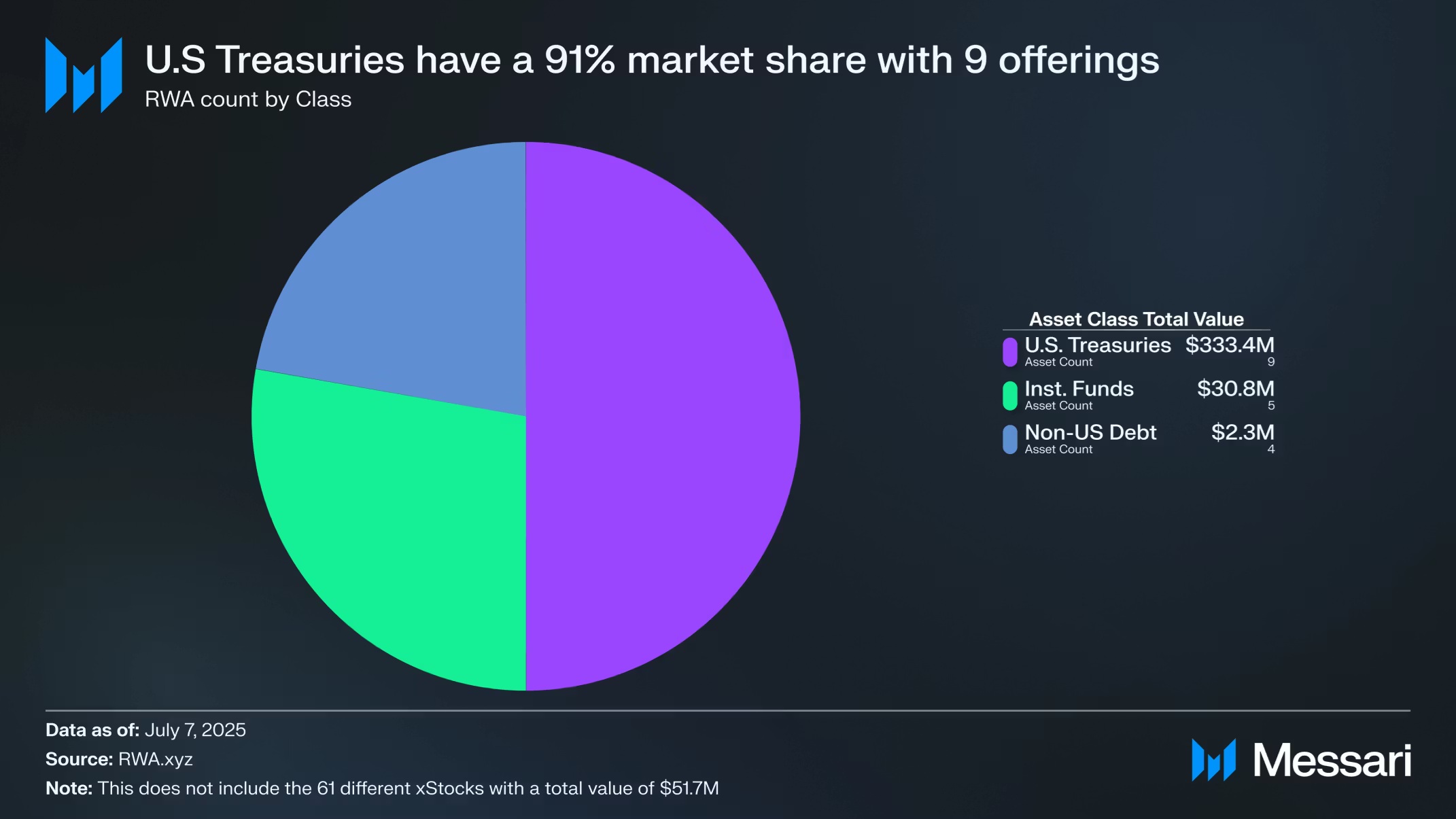

RWAs on Solana exist across four core categories: (1) yield-bearing assets, including tokenized U.S. Treasuries, institutional funds, and private credit protocols like Ondo Finance, Franklin Templeton, and Maple; (2) tokenized public equities, with upcoming launches from Superstate, Kraken, and Ondo Global Markets; (3) non-yielding assets such as tokenized real estate and collectibles from platforms like Parcl and BAXUS; and (4) emerging infrastructure providers like R3 and Securitize that underpin compliance and interoperability. Through this lens, we assess Solana’s trajectory as a rising hub for onchain RWAs and what it means for the future of global capital markets.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Yield-Bearing Assets

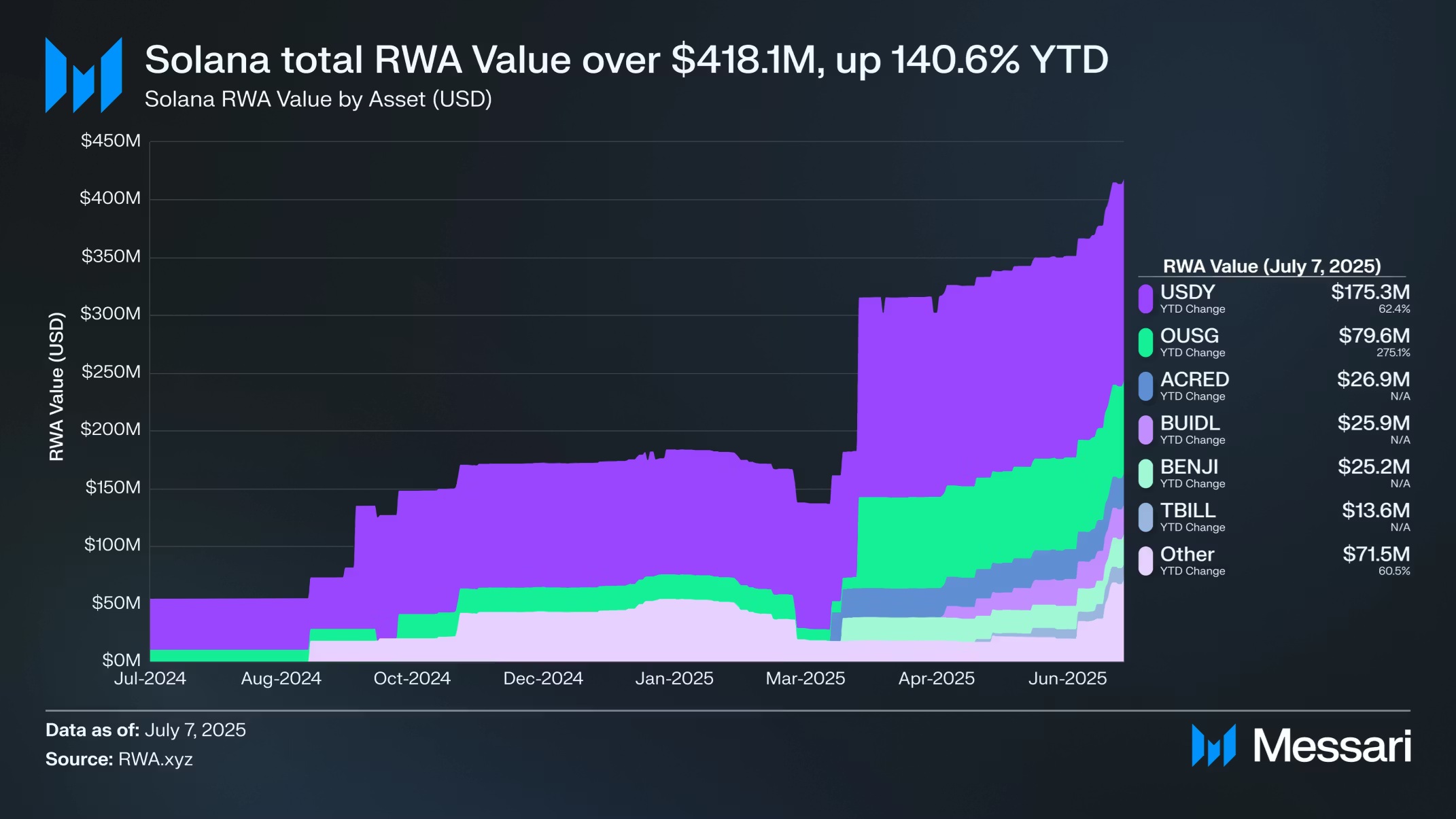

Yield-bearing RWAs are the most significant and fastest-growing segment in Solana’s RWA landscape, capturing the vast majority of non-stablecoin RWA value (USD). These assets, ranging from tokenized U.S. Treasuries to institutional funds and private credit, provide onchain investors with direct exposure to offchain yield streams, often with enhanced composability and 24/7 accessibility compared to their TradFi counterparts.

Tokenized U.S. Treasuries

Tokenized Treasuries offer a digital wrapper for the world’s most liquid and trusted yield instruments and have become a foundational pillar for onchain asset management, stablecoin collateralization, and DAO treasury operations. Solana’s tokenized Treasury market has grown from a small base to encompass a range of products from both native and cross-chain asset issuers.

Ondo Finance – OUSG & USDY (Treasury and Yield Tokens)

OUSG and USDY represent Ondo Finance’s dual approach to tokenized U.S. Treasuries.

- OUSG, introduced in January 2023, is a tokenized fund initially structured around BlackRock’s BUIDL Fund. It is primarily intended for accredited investors. In July 2025, OUSG was the second-largest yield-bearing asset by market cap on Solana, with seven holders and a market cap of $79.6 million.

- USDY, launched in August 2023, is a token backed by Treasuries and bank deposits, designed to function as a yield-bearing stablecoin with broad accessibility. USDY appreciates in price as interest accrues. The token is transferable across chains using LayerZero, making it highly composable in DeFi applications. As of July 2025, USDY was the largest yield-bearing RWA by market cap on Solana, with 6,978 holders and a market cap of $175.3 million.

Kamino Lend’s Integration of Tokenized Equities Is A Game-Changer For DeFi

Kamino Finance, a Solana-based decentralized lending protocol, has integrated tokenized equities (xStocks) into its Kamino Lend platform, enabling users to borrow against assets like SPYx (S&P 500), NVDAx (NVIDIA), MSTRx (MicroStrategy), and others directly on-chain. This integration, powered by Chainlink’s xStocks oracle and Backed Finance, marks a significant step in blending traditional finance (TradFi) with DeFi, allowing 24/7 trading and lending without intermediaries.

Users can deploy these tokenized stocks as collateral to borrow assets like USDC, potentially leveraging their positions. However, this feature is not available to users in restricted jurisdictions like the U.S., U.K., and EU due to regulatory constraints. The initiative has been highlighted as a pioneering move in DeFi, with trading volumes for assets like MSTRx showing significant activity, such as $3.4M in 24-hour trading volume recently reported.

Tokenized equities enable traditional financial assets to be used in DeFi protocols, allowing users to borrow against stocks without selling them. This creates new liquidity options, potentially increasing capital efficiency for investors who can leverage their holdings for loans (e.g., borrowing USDC against NVDAx) while retaining exposure to price appreciation.

Unlike traditional markets with set trading hours, tokenized equities on Kamino Lend operate on-chain, enabling round-the-clock trading and lending. This could attract users seeking flexibility, especially in volatile markets where assets like MSTRx have shown high trading volumes (e.g., $3.4M in 24 hours).

By integrating familiar assets like SPYx (S&P 500), Kamino Lend lowers the entry barrier for TradFi investors, potentially driving mainstream adoption of DeFi. This could expand the total value locked (TVL) in Solana-based protocols, which already saw Kamino Lend’s TVL grow significantly after its launch. Borrowing against tokenized equities introduces leverage, amplifying potential returns but also risks. Users could face liquidations if collateral values drop, a risk heightened by the volatility of assets like NVDAx or MSTRx.

This requires robust risk management and reliable oracles (e.g., Chainlink’s xStocks oracle) to ensure accurate pricing. Tokenized equities can be used in complex DeFi strategies, such as yield farming or collateralized lending, creating new financial products. This could reshape how investors interact with equities, moving beyond traditional “buy and hold” strategies.

Kamino Lend’s tokenized equities are unavailable in jurisdictions like the U.S., U.K., and EU due to strict securities regulations. This creates a divide where users in permitted regions (e.g., parts of Asia or LATAM) gain access to innovative financial tools, while others are excluded, reinforcing a fragmented global financial system.

DeFi platforms like Kamino require technical knowledge and crypto wallets, which may exclude less tech-savvy or underbanked populations. Even within permitted regions, only those with access to Solana-based assets and stablecoins can participate, widening the gap between crypto-native users and traditional investors.

The ability to borrow against high-value tokenized equities benefits users with significant holdings, potentially concentrating wealth among those already invested in assets like NVDAx or SPYx. Smaller retail investors may struggle to participate at scale, exacerbating financial inequality. Sophisticated users with DeFi expertise can navigate the risks of leverage and volatility, while less experienced users may face losses due to liquidations or market swings.

While Kamino Lend operates on decentralized principles, reliance on oracles (Chainlink) and tokenized asset issuers (Backed Finance) introduces points of centralization. Users in regions with less trust in centralized entities may hesitate to engage, creating a trust divide. Kamino Lend’s integration of tokenized equities is a game-changer for DeFi, offering new ways to unlock liquidity and merge traditional and decentralized finance.

However, it also underscores a divide—regulatory, economic, and technical—that limits access and benefits to certain users and regions. As DeFi evolves, addressing these disparities through clearer regulations, user education, and broader accessibility will be crucial to ensuring equitable participation.