One of the more overlooked and underappreciated trends in crypto is the omni-bank supertrend. This trend is at the intersection of fintech and crypto and is often dubbed the “omni-banking” revolution.

Omni-banking refers to the convergence of traditional banking services with cryptocurrency. Consider it a super app where users can send, receive, hold, transfer, save, invest, and spend value in any form on one platform. In an omni-bank ecosystem, dollars, euros, yen, cryptos, and stablecoins are all interchangeable money in a single account.

The omni-bank investment thesis has taken a back seat among the investment community, who are focused on DeFi, NFTs, RWAs, and other hot topics. However, consumer demand for a product that offers the speed and freedom of crypto with the familiarity of traditional finance is rapidly growing and could show a snowball effect over the coming years.

1. Inside Digitap’s Omni-Bank: Wallets, FX, and Visa Access

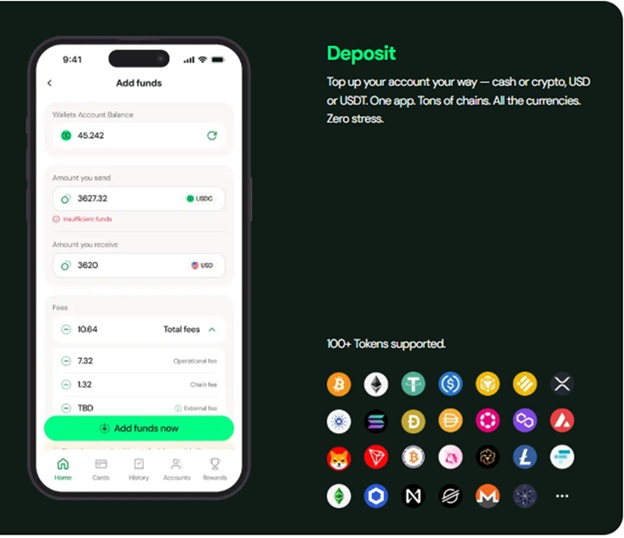

Digitap ($TAP) is one of the projects that best represents the omni-bank supertrend. Marketed as the world’s first crypto omni-bank, Digitap created a platform where all forms of money coexist and interact with each other.

Users can store fiat currency and crypto in a single account, exchange between them instantly, and spend their balance via a Visa-branded Digitap card. This means that users can get paid in a crypto stablecoin, invest part of the proceeds in a crypto like Bitcoin (BTC) or Ethereum (ETH), and use the remaining balance to pay for everyday items via the Visa card.

Digitap’s goal is to make crypto-enabled banking as easy as traditional online banking, which is key to attracting mainstream users. Digitap is early in its journey and is currently undergoing the second round of its presale event.

Currently priced at $0.0159 per token, early investors who bought in the first round have already made a 27% paper profit, and those buying today will make a 22% profit when the price jumps to $0.0194 in the next round.

Still, the current price offers investors a ground-floor opportunity to invest in one of the few crypto presales with real utility. Digitap needs to capture just a fraction of a percent of the trillions of dollars in global payments to succeed.

2. Stellar’s Rails Power Remittances, but Fees Remain Sticky

Stellar (XLM) is a crypto veteran project built for financial integration. It is an open-source blockchain designed for fast, low-cost payments and cross-border transactions. Stellar’s network has been selected by traditional financial institutions like MoneyGram to assist in global on- and off-ramps. Stellar is testing upgrades to handle up to 5,000 transactions per second to support enterprise-scale workloads.

Stellar’s proven technology and the 12,000% lifetime gain in its token validate the omni-banking investment thesis. Users can turn cash into digital dollars (Circle’s USDC stablecoin) and vice versa through the MoneyGram mobile app, essentially blending traditional remittances with crypto.

The problem with Stellar’s business model is that it has no say in how a firm like MoneyGram sets fees. Traditional remittance fees cost on average 6.2% of the transfer’s total value. Coupled with high foreign exchange fees for global transfers, consumers can certainly move their money quicker but at too high a cost.

To be clear, this is no fault of Stellar. However, platforms like Digitap, for example, can slash the remittance fee by up to sixfold to a potentially industry-leading sub-1% rate.

3. Tron’s Speed Matters, But Still Falls Short

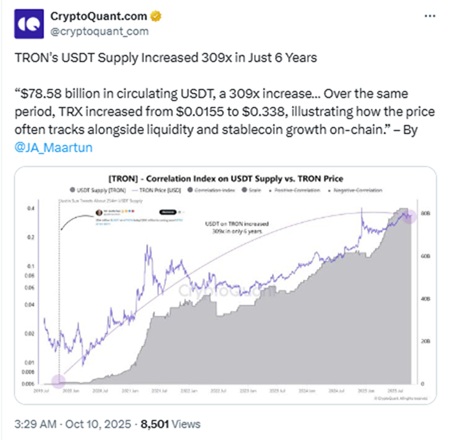

Tron (TRX) isn’t a pure play “bank” or provider of banking services. However, it has become an industry leader for something very relevant: stablecoin transactions. In the context of omni-banking, stablecoins are vital, as they are digital dollars that people actually use for day-to-day value transfer.

Tron has evolved to become the preferred rail for moving stablecoins worldwide. Over half of Tether’s USDT supply (the largest dollar stablecoin) is used on Tron. Tron also handles more than $23 billion in USDT transactions on a daily basis.

Tron’s network is built for speed and low cost. Transaction fees on Tron come in at a fraction of a cent, while throughput is high at more than 1,000 TPS. This means sending USDT on Tron is near-instant and almost free.

Tron has positioned itself as a major player in the backbone of crypto transactions. But one thing it lacks is the advanced features of a new DeFi app that can handle fiat transactions or be used to pay for everyday items.

Omni-Banking Needs an All-in-One: Where $TAP Fits Today

The concept of omni-banking in crypto refers to breaking down the wall between crypto assets and everyday money. While Stellar and Tron deserve praise for their contribution to making it easier for people to send and receive money, they fall short of an all-in-one crypto and fiat app.

Digitap checks all the right boxes and remains mostly undiscovered among investors. Digitap is certainly making the case to be included in the list of best crypto presales for 2025.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app