Trading fees don’t look like a big deal at first, but they quietly shape your overall returns in the crypto derivatives market. If you’re a regular trader or adjust positions in fast-moving markets, you’ve probably felt how charges stack up over time.

Many traders lose a chunk of their gains without realising that frequent order placements, multi-leg setups, and hedges all trigger extra costs. This is where a cost-friendly platform like Delta Exchange makes a real difference.

In this post, we’ll discuss how this leading Indian crypto exchange helps you trade with confidence, whether you’re just starting out or already active in crypto F&O trading.

Market Insights and Delta Exchange’s Ecosystem

India already leads the global crypto population, and the growth ahead is set to be even stronger. The AltIndex report projects that the country’s crypto user base will grow by 21% to reach almost 330 million by 2028. The report also states that by 2028, every third crypto user worldwide will likely be from India.

With such a huge audience stepping into trading, access and affordability matter a lot. Many traders here want a smooth entry into crypto derivatives, and what better way than to rely on an Indian crypto exchange that keeps things simple.

Delta Exchange – One of the leading Indian crypto exchange

Delta Exchange fits well into this shift by offering crypto F&O and trackers with low trading fees, clean tools, and an app experience that suits all levels of users. It brings a practical setup that helps you trade without feeling weighed down by costs or complexity.

Why Worry So Much About Crypto F&O Trading Fees

High trading fees quietly eat into your profits. You notice it the most when you’re an active trader and rely on quick entries and exits. Even small cuts on every order add up over time.

Here’s where it matters:

- Scalping multiple times a day, where each trade can cut your gains.

- Multi-leg options setups that need several orders to build and adjust.

- Regular hedging on platforms without low trading fees.

- Active users on the Delta Exchange app who want flexibility without expensive trades.

When your fee outflow grows faster than your profit inflow, your crypto trading strategy stops feeling worth the effort. Delta Exchange solves this issue with a structure that supports frequent crypto F&O trading without draining your pockets.

Delta Exchange’s Transparent and Low Trading Fee Structure

Delta Exchange’s transparent fee structure helps you make apt trading decisions. Here are all the details you need to know about the crypto derivatives trading fees:

1. Maker and taker fees

- Futures:05% taker and 0.02% maker fees.

- Options:015% maker and taker fees – capped at 5% of option premium.

- Trackers:05% maker and taker fees.

2. Liquidation fees

- For futures: BTC 0.05%, ETH 0.10%.

Other altcoin liquidation fees range from 0.10% (100x leverage) to 1% (10x leverage).

- For options:

When an options position on Delta Exchange gets liquidated, the platform charges a fee proportional to the notional size:

- BTC: 20% of the premium and 0.05% of the notional size

- ETH: 20% of the premium and 0.10% of the notional size.

A GST of 18% is also applicable to these liquidation fees on the platform.

3. Small lot sizes

- BTC contracts start at ~?5000.

- ETH contracts are available from ~?2500.

4. No hidden charges

You benefit from low trading fees if you scalp, adjust options often, or test strategies on the Delta Exchange app. The structure makes active trading on an Indian crypto exchange feel smoother and more cost-efficient without surprise deductions.

5. Deposit and withdrawal fees

Another benefit of Delta Exchange is that you don’t have to pay any deposit or withdrawal fees on the platform.

Extra Features That Support Efficient Crypto Derivatives Trading

Apart from the low trading fees on an Indian crypto exchange, you want tools that help you avoid errors, place cleaner trades, and test ideas without stress.

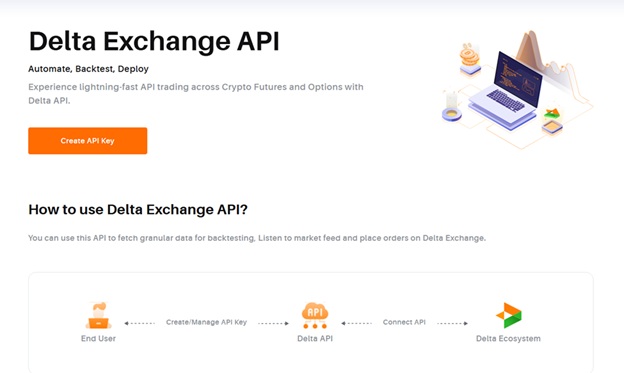

Delta Exchange’s API integration

The Delta Exchange app keeps your entire process smooth with features like:

- INR deposits and withdrawals: You can move funds in and out in INR without currency conversions and keep your crypto F&O flow stable.

- Demo account: If you want to try a new setup or learn crypto derivatives trading with zero pressure, the demo account gives you space to test freely.

- Strategy builder and payoff charts: These tools show you how a multi-leg setup may behave. With payoff charts, you can readjust trades and enter the market more confidently.

- Automated and API-based trading: You get tools to automate trades through the Delta API, run backtests, and deploy algo trading bots – reducing manual effort.

- Mobile trading through the Delta Exchange app: You can download the mobile app for quick order placement and position checks to trade from anywhere, any time.

Final Thoughts: Should You Trade on Delta Exchange?

If you’ve ever felt your profits shrinking because of charges applied across trades, you’re not alone. To stand out, Delta Exchange has kept its fee structure transparent and lower than most competitors.

The low trading fees give you more breathing space, especially if you adjust positions often or run multi-leg ideas in crypto derivatives. With small lot sizes, INR access, and the Delta Exchange app, your bitcoin trading experience becomes smoother without extra effort.

Disclaimer: Cryptocurrency markets are subject to high risks and volatility. Kindly do your own research before investing.

This is a really helpful overview of how fees impact crypto derivatives trading. Delta Exchange’s focus on low costs is exactly what active traders need, especially in volatile markets where every small charge adds up. It’s great to see platforms that prioritize keeping more profits in traders’ pockets.