Venture capitalist David Sacks, who serves as President Donald Trump’s artificial intelligence and cryptocurrency czar, said Thursday that the administration has no plans to provide a federal bailout for AI companies, even as OpenAI continues to push for policy incentives to support its massive infrastructure expansion.

“The U.S. has at least 5 major frontier model companies. If one fails, others will take its place,” Sacks wrote on X, emphasizing that the government will not intervene to rescue any private AI firms that run into financial trouble.

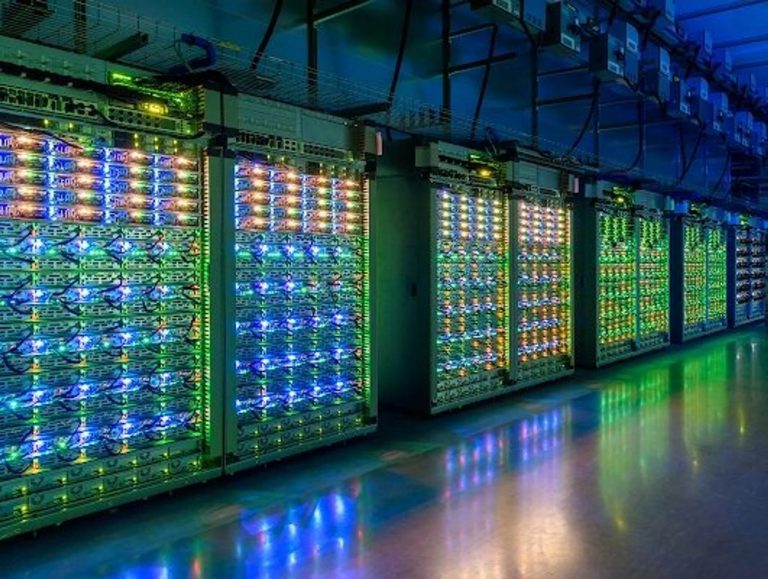

His comments came amid growing debate over whether Washington should offer broader financial support for AI infrastructure development—especially as AI giants such as OpenAI, Google, Anthropic, and Meta face escalating hardware costs tied to data centers and advanced chips.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Sacks’ statement followed remarks by OpenAI Chief Financial Officer Sarah Friar, who on Wednesday suggested that the company hoped to build an “ecosystem” of private equity, banks, and potentially a federal “backstop” or “guarantee” to help fund its planned $1.4 trillion investment in AI infrastructure over the next eight years. The proposal drew immediate scrutiny, with some critics interpreting it as a call for government underwriting of OpenAI’s operations.

Friar later clarified her comments in a LinkedIn post, saying that OpenAI was not seeking a government backstop for its investments. She explained that her use of the term “backstop” was misunderstood.

“As the full clip of my answer shows, I was making the point that American strength in technology will come from building real industrial capacity, which requires the private sector and government playing their part,” Friar wrote.

OpenAI also directed reporters to Friar’s clarification post when asked for comment.

Sacks’ rejection of a bailout aligns with the Trump administration’s broader stance on reducing government intervention in private enterprise, though he acknowledged that the government intends to play a facilitative role in easing regulatory bottlenecks.

The Trump administration is understood to only want to make permitting and power generation easier, with the goal of facilitating rapid infrastructure buildouts without raising residential electricity rates.

Sacks also struck a conciliatory tone toward OpenAI, suggesting that the misunderstanding may have stemmed from semantics rather than intent.

“To give benefit of the doubt, I don’t think anyone was actually asking for a bailout. (That would be ridiculous.),” he said.

The exchange underscores a growing tension between Silicon Valley’s ambitions to expand AI capacity and Washington’s cautious approach to financial risk and industrial subsidies. OpenAI’s push for an expanded Advanced Manufacturing Investment Credit (AMIC) under the Chips Act—which would include AI data centers, server production, and grid components—reflects its strategy to incentivize private-sector investment without direct federal bailouts.

The company’s infrastructure plans, including major investments in U.S.-based data centers and chip development, have become part of a wider national conversation about technological competitiveness. President Trump’s administration has signaled interest in bolstering domestic energy and manufacturing capacity to support AI growth, but remains resistant to direct corporate rescues or cash infusions.

Now, policymakers face the challenge of balancing the need for innovation with fiscal restraint as the debate over AI financing intensifies. The U.S. now leads the world in the number of large-scale AI model developers, and the administration’s stance suggests that competition—not government guarantees—will determine which firms ultimately endure.