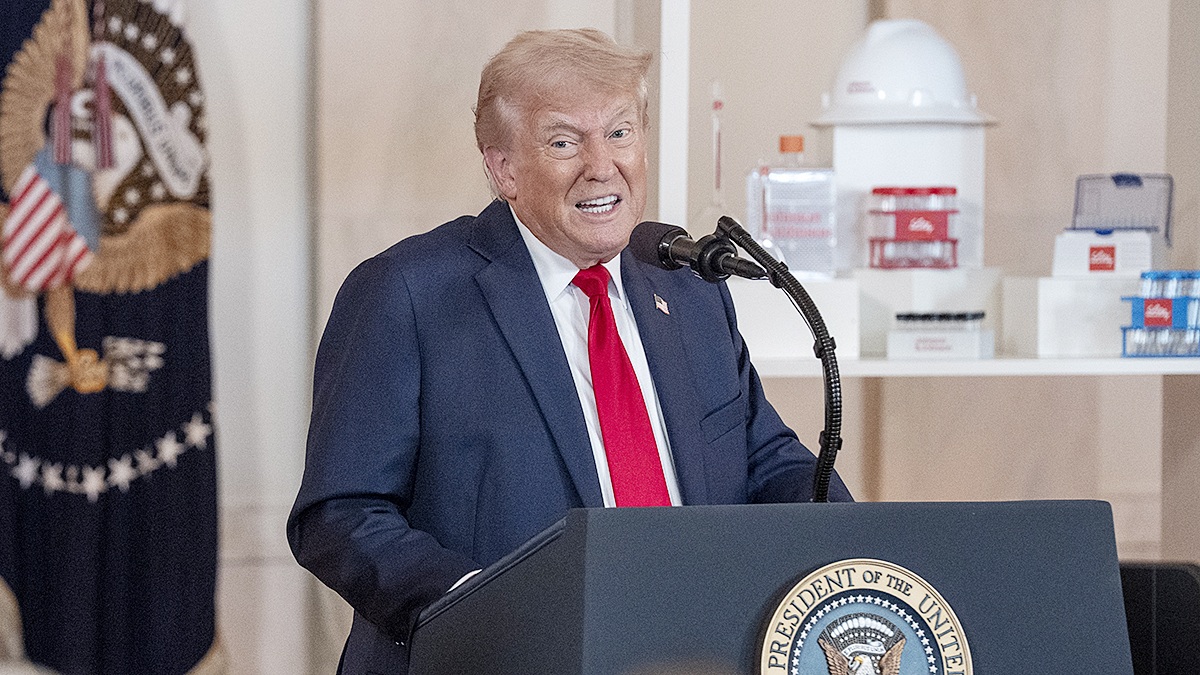

In mid-2025, when the U.S. president Donald Trump presented his sweeping tax package dubbed “One Big Beautiful Bill, it swiftly became a subject of controversy – even from his close allies.

Now, Reuters reports that economists are increasingly pointing to the tax package as a central force shaping the trajectory of the U.S. economy in 2026, with wide-ranging implications for households, businesses, and federal finances.

The legislation locks in and expands major elements of Trump’s 2017 Tax Cuts and Jobs Act, removing the looming expiry of several provisions and injecting fresh incentives aimed at boosting consumption, investment, and hiring. Analysts say the combined effect is likely to show up quickly, particularly in early 2026, when taxpayers begin to feel the impact through larger paychecks and refunds.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

For individuals, the changes amount to a broad reset of the personal tax landscape. The law makes permanent the lower individual income tax rates introduced in 2017, which were previously scheduled to expire at the end of 2025. It also extends the higher standard deduction and expands relief from the alternative minimum tax, while lifting the estate tax exemption from $14 million to $15 million.

Beyond extending existing cuts, the bill introduces a series of targeted breaks that directly affect take-home pay. Workers who earn tips will be exempt from federal taxes on up to $25,000 of tipped income through 2029, a provision that phases out for earners above $150,000. The exemption excludes certain categories, such as automatic service charges and tips linked to pornographic activity.

Overtime pay receives similar treatment, with up to $12,500 exempt from taxation until 2029, again subject to income phase-outs. Older Americans also stand to benefit, with a new deduction of up to $6,000 for people aged 65 and above over the same period.

The law also targets specific spending decisions. Interest payments on auto loans of up to $10,000 will qualify for a tax break until 2029, but only for personal vehicles assembled in the United States, reinforcing the administration’s domestic manufacturing agenda.

One of the most politically sensitive provisions involves state and local taxes. The cap on SALT deductions is raised sharply from $10,000 to $40,000 through 2029, a change that disproportionately benefits higher-income households in high-tax states such as New York, New Jersey, and California. Economists say this could provide a meaningful boost to disposable income in those regions, though critics argue it tilts relief toward wealthier taxpayers.

On the business side, the bill is heavily weighted toward encouraging investment. The lower corporate tax rate from the 2017 law is made permanent, eliminating uncertainty that had been hanging over boardroom planning decisions. More significantly, companies regain the ability to fully expense certain equipment purchases, allowing them to deduct the entire cost immediately rather than spreading it over several years. This provision had begun phasing out in 2023 and was set to disappear entirely by 2027.

Research and development also receive a major boost. Firms can once again fully expense U.S.-based R&D costs, a change independent tax experts widely regard as one of the most effective ways to stimulate productivity and long-term growth. Small businesses are given additional relief, with the option to retroactively deduct R&D expenses incurred since 2022, potentially unlocking cash flow for expansion.

The law also relaxes limits on interest deductions. Restrictions introduced in 2022 tightened the calculation to earnings before interest and taxes, excluding depreciation and amortization. The new legislation broadens the definition again, making it easier for capital-intensive firms to deduct financing costs.

Owners of pass-through businesses — a vast category that includes freelancers, family-owned restaurants, law firms, medical practices, hedge funds, and private equity firms — see their tax break extended and expanded. Eligible owners can continue deducting up to 20% of their income, lowering effective tax rates. Views on the economic impact of this provision remain split. While supporters say it supports entrepreneurship, the nonpartisan Tax Policy Center has said there is little evidence the deduction meaningfully boosts growth.

Taken together, economists expect the package to act as a short- to medium-term stimulus, with households likely to increase spending as withholding levels adjust and refunds rise. Businesses, meanwhile, may accelerate investment and hiring decisions, particularly in sectors that rely heavily on equipment and R&D.

At the same time, the scale of the tax cuts has renewed debate over fiscal sustainability. With deficits already elevated, critics warn the bill could add to long-term debt pressures unless offset by stronger growth or future spending restraint.