President Donald Trump has recently advocated for significant Federal Reserve interest rate cuts, specifically calling for a reduction of at least 300 basis points (bps), which would lower the federal funds rate from its current range of 4.25%–4.5% to around 1%–1.25%. This push, expressed through public statements and a handwritten letter to Federal Reserve Chair Jerome Powell, is part of Trump’s broader economic strategy to ease borrowing costs and stimulate growth amid his aggressive trade policies.

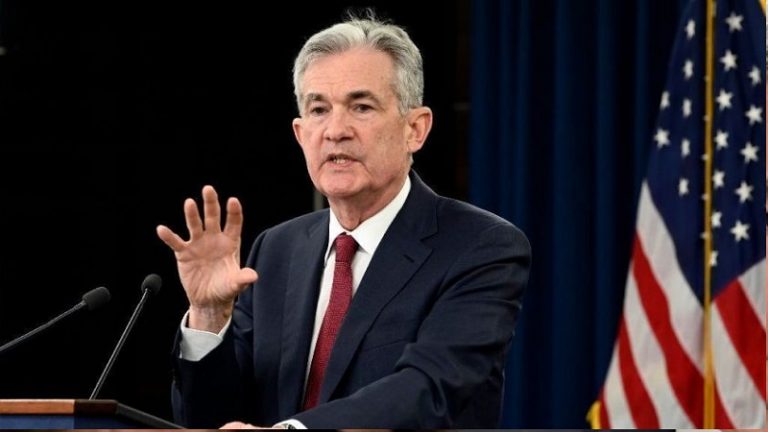

Posts on X reflect this sentiment, with some users speculating that such cuts could reduce mortgage rates to approximately 3%, potentially fueling a housing market surge. However, Fed Chair Jerome Powell has resisted immediate cuts, citing the inflationary risks posed by Trump’s tariff policies, which he noted have already driven up inflation forecasts and prompted the Fed to maintain its current rate stance.

Concurrently, Trump has escalated his trade agenda by sending tariff letters to multiple countries, announcing new “reciprocal” tariff rates effective August 1, 2025, unless trade deals are reached. On July 7 and 9, 2025, letters were sent to 21 countries, including Japan, South Korea, Brazil, and others, with tariff rates ranging from 20% to 50%. For instance, Brazil faces a 50% tariff, partly due to political tensions, while Japan and South Korea face 25%.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

These letters, often shared via Truth Social, warn against retaliatory tariffs and aim to address U.S. trade deficits, which Trump views as evidence of unfair trade practices. The administration argues these tariffs will boost domestic manufacturing and national security, though economists warn of inflationary pressures and global trade disruptions. Powell has indicated that the Fed’s cautious approach stems from the need to assess the economic impact of these tariffs, which could lead to higher inflation and slower growth.

Despite Trump’s pressure, the Fed has held rates steady, with bond markets pricing in a higher likelihood of cuts later in 2025, potentially in May or June, if economic growth falters. The interplay between Trump’s tariff policies and his push for rate cuts continues to create uncertainty in global markets, with critics warning of potential trade wars and recession risks.

Lowering the federal funds rate to ~1%–1.25% would reduce borrowing costs, potentially boosting consumer spending, business investment, and housing demand (e.g., mortgage rates could drop to ~3%, spurring real estate activity). Significant rate cuts could overheat the economy, especially if combined with tariff-induced price increases, leading to higher inflation. The Fed’s reluctance to act immediately reflects this concern, as Powell has noted tariffs’ inflationary impact.

Lower rates could weaken the U.S. dollar, making exports more competitive but increasing the cost of imports, amplifying tariff effects. Bond markets may face uncertainty, as investors adjust expectations for Fed policy. X posts suggest markets are pricing in cuts by mid-2025, but premature cuts could disrupt yield curves and equity valuations. Tariffs on imports from countries like Japan, South Korea, and Brazil will likely raise prices for goods (e.g., electronics, vehicles, agricultural products), contributing to inflation.

Affected countries may face supply chain challenges, particularly for industries reliant on global trade (e.g., auto manufacturing, tech). This could lead to shortages or higher production costs. Trump’s tariffs aim to narrow the U.S. trade deficit by incentivizing domestic production, but success depends on whether U.S. industries can scale up to replace imports.

Targeted nations may impose counter-tariffs, as warned against in Trump’s letters, potentially harming U.S. exporters (e.g., agriculture, aerospace) and escalating into broader trade wars. Rate cuts could boost stock prices by lowering borrowing costs for companies, but tariff-induced inflation and trade tensions may weigh on sectors like tech and consumer goods. X posts highlight mixed investor sentiment, with some expecting a short-term rally if rates drop, others fearing long-term trade disruptions.

Treasury yields could decline with rate cuts, but persistent inflation fears may keep yields elevated, as seen in recent bond market reactions to tariff announcements. Tariffs on countries like Brazil (a major commodity exporter) could drive up prices for raw materials (e.g., soy, steel), impacting global commodity markets.

Tariff letters to allies like Japan and South Korea (25% tariffs) could strain diplomatic ties, especially if perceived as punitive. Brazil’s 50% tariff, tied to political differences, may further sour U.S.-Latin America relations. The threat of reciprocal tariffs risks fracturing global trade frameworks, potentially weakening institutions like the WTO. Countries may seek alternative trade blocs, reducing U.S. influence.

While not directly mentioned in recent letters, China could exploit divisions among U.S. allies, strengthening its position in global trade networks. Trump’s base may view tariffs and rate cut advocacy as bold moves to protect U.S. interests, but consumers facing higher prices and businesses dealing with trade disruptions could fuel opposition. Trump’s direct pressure on Powell, including handwritten letters, raises concerns about Federal Reserve independence, potentially undermining confidence in monetary policy.

If tariffs significantly disrupt trade and inflation spikes, the Fed may be forced to maintain or raise rates, countering Trump’s push for cuts and risking economic slowdown. Retaliatory tariffs and supply chain issues could dampen global growth, affecting U.S. exports and multinational corporations. The combination of aggressive rate cut demands and tariff policies creates uncertainty, potentially delaying business investment and consumer spending.

Trump’s push for 300 bps rate cuts aims to stimulate growth but risks inflation and market instability, while his tariff letters could protect domestic industries but threaten global trade relations and economic stability. The Fed’s cautious stance and global responses will be critical in shaping these outcomes.