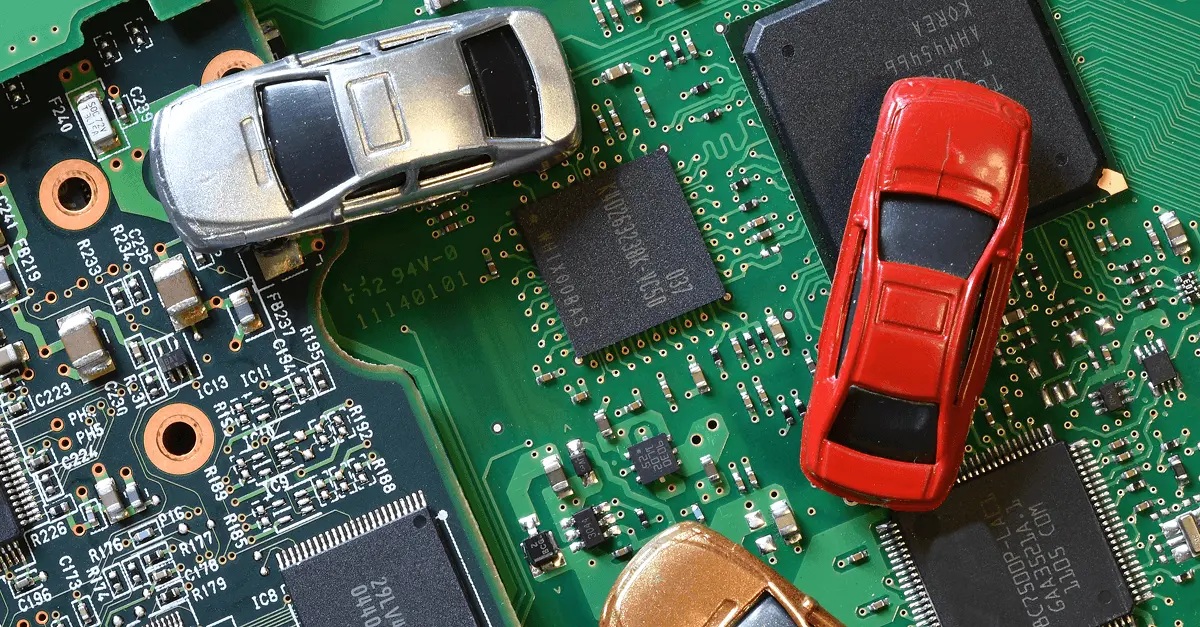

The Dutch semiconductor manufacturer Nexperia, a key supplier of basic but high-volume chips like diodes, transistors, and MOSFETs essential for automotive electronics (e.g., power management, steering controls, and electronic control units), is at the center of a geopolitical standoff.

These components are not highly advanced but are produced in massive quantities—over 50 billion annually across Nexperia’s facilities in Hamburg (Germany), Nijmegen (Netherlands), and Manchester (UK)—and are difficult to source quickly from alternatives due to customization and scale.

On September 30, 2025, the Dutch government invoked its Goods Availability Act to seize control of Nexperia from its Chinese parent company, Wingtech Technology, citing national security risks. Dutch officials feared Beijing could pressure the firm to divert technology or prioritize Chinese exports, potentially disrupting European supply chains in a crisis.

This move followed months of U.S. pressure, as Wingtech was added to the U.S. Entity List in December 2024 for alleged ties to military end-uses, extending export controls to subsidiaries like Nexperia.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

In retaliation, on October 4, 2025, China’s Ministry of Commerce imposed export controls, blocking shipments of Nexperia’s finished products mostly packaged in China to global customers.

Nexperia notified automotive suppliers on October 10 that it could no longer guarantee deliveries. Existing inventories are estimated to last only 2–4 weeks for most carmakers, raising fears of assembly line halts similar to the 2021–2022 chip shortage that cost the industry billions.

Nexperia produces about 40% of the global market for these automotive-grade discrete semiconductors, affecting not just Europe but U.S. and Asian production as well. The crisis exacerbates ongoing challenges for the auto sector, including U.S. tariffs, weak demand, and foreign competition.

Impact on German Carmakers

Germany’s automotive industry, which employs over 700,000 people and relies heavily on just-in-time manufacturing, is particularly vulnerable. The German Association of the Automotive Industry (VDA) warned on October 21, 2025, that unresolved issues could lead to “considerable production restrictions… and possibly even to production stoppages” within weeks.

Suppliers like Bosch and ZF, which integrate Nexperia chips into modules, are scrambling for alternatives, but experts note the process could take months due to qualification and ramp-up times.

Production unaffected as of October 22, but not ruling out short-term outages. Wolfsburg plant world’s largest, building Golf/Tiguan at highest risk; considering “kurzarbeit” government-subsidized short-time work if halts occur. Nexperia parts enter via Tier 1 suppliers.

Temporary shutdowns within 2–3 weeks; broader supply chain ripple to U.S./global plants. Assessing impacts with suppliers; exploring alternatives. Mercedes-Benz; No short-term disruptions expected; monitoring closely. Minimal immediate risk, but prolonged halt could affect luxury EV models. Stockpiling and supplier diversification.

BMW; Supplier network impacted, but European production intact so far. Potential delays in components like power electronics; U.S. plants also vulnerable. Evaluating risks; collaborating with Nexperia for solutions. Part of VW Group; similar exposure. VDA-wide risks apply. Assembly line stoppages if inventories deplete. Industry-wide contingency planning.

The VDA’s Hildegard Müller emphasized the urgency, noting the halt “seriously affects the stability of global industrial and supply chains.” ZF Group reported working with customers to stabilize chains and qualify new suppliers, while Bosch described the situation as a “major challenge” and called for a swift resolution.

The European Automobile Manufacturers’ Association (ACEA) expressed “deep concern” on October 16, warning that without chips, suppliers can’t build parts, threatening “significant disruption” across members like Stellantis and Toyota Europe. U.S. production could also grind to a halt soon after, per ACEA.

Affects consumer electronics too, but autos are hit hardest. Analysts predict higher car prices if plants idle, echoing pandemic-era shortages that slashed output by millions of vehicles. Germany’s export-driven auto industry could see severe strain, with potential job impacts under kurzarbeit schemes.

Economy Minister Vincent Karremans spoke with his Chinese counterpart on October 21 but failed to resolve the impasse. The government aims to protect Nexperia’s viability and ensure emergency supplies. Berlin’s Economy Ministry convened a crisis meeting on October 22 with auto/electronics stakeholders to accelerate solutions. Officials are pushing for pragmatic fixes to avoid broader trade escalation.

China: The Commerce Ministry labeled Dutch actions “selective and discriminatory,” urging a focus on “global industry stability.” Nexperia’s Chinese unit has asserted independence, allowing employees to ignore “external instructions,” and resumed limited local supplies.

U.S./EU: Indirect involvement via export controls; no formal intervention yet, but pressure on allies to secure chips. A quick fix seems unlikely, with Nexperia negotiating with governments and customers. Short-term: Rationing stockpiles and partial restarts from non-Chinese facilities.

Diversifying suppliers, though costly and time-intensive. Industry watchers like Capgemini’s Peter Fintl stress that while chips are “mass-produced,” their customization makes swaps “complicated.” If resolved by early November, disruptions might be limited; otherwise, expect plant idles and price hikes by mid-2026.

This crisis underscores deepening U.S.-China tech decoupling’s risks to interdependent supply chains, hitting Europe’s auto heartland hardest.