How do you price to thrive in Nigeria? Answering that question is the most important job of any effective Board/Executive Management. In a nation under severe economic dislocation, finding a way to get people to choose you, within the expanding competitive supply base, is a serious matter.

They taught us price elasticity in the secondary school, on the assumption that the “economic string” can expand and contract; in Nigeria today, there is no string! Yes, we have about 30 million people with decent income supporting more than 200 million, using tax numbers and informal sector upper estimates.

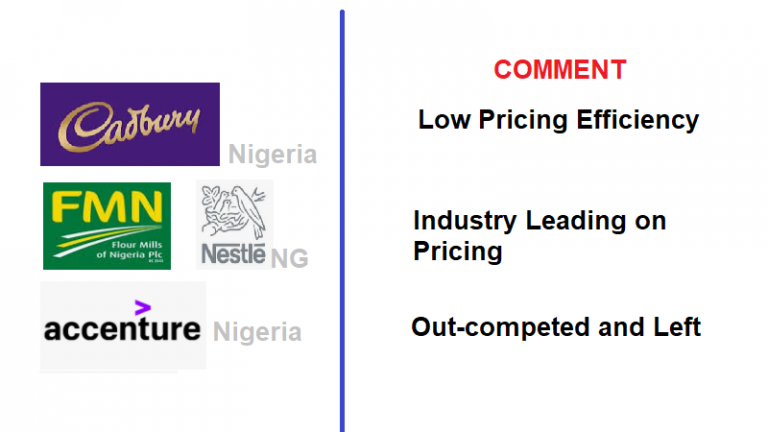

Flour Mills Nigeria Plc has improved its pricing and the market rewarded it. Nestle is now the queen of sachetization and it is doing amazingly fine. Cadbury is struggling because its products are not that well optimized on pricing. Unilever is also under siege but it has to clean its books first. In these entities, having well priced products, in segments that customers can afford, at their levels, is very important.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (begins Nov 15th).

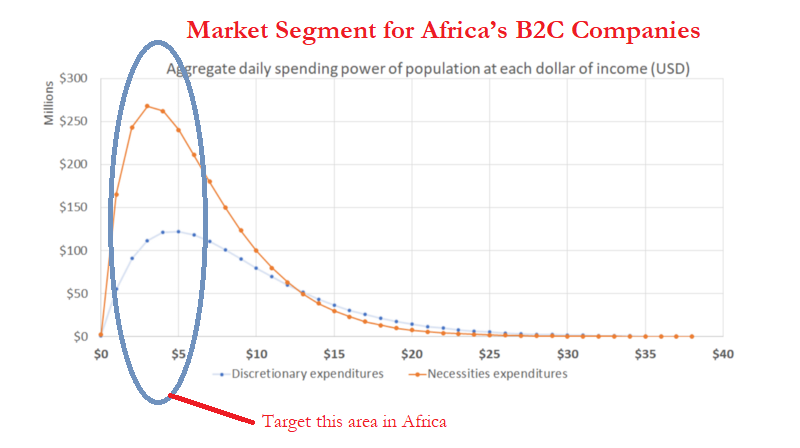

Now, you want to do business in the B2C space in Nigeria, the question is “where do you position the company”? You need to go back to this plot (above). It is called the Fortune at the middle of the pyramid: “the most significant opportunity for African B2C startups lies with consumers who earn between $4 — $8 per day … This is largely because that income band holds the highest concentration of discretionary spending power on the continent, as the graph below shows.”

Companies like Bigi Cola and La Casera understand this redesign. You can also make a case that the sachetization in places like Nigeria where everything is now bundled in sachets has a root therein. Simply, there are not many consumers outside that $4-$8 per day segment for any big B2C business (if you focus outside this segment, your business must have a dose of B2B).

Nigeria is a tough market: Accenture ran away from Nigeria because it was out-competed. The local peers were more optimized on pricing and with no free cash anywhere, not having pricing efficiency is a burden for companies.

This is the age of sachetization in Nigeria irrespective of whatever you are selling. We are doing it in Tekedia Mini-MBA with bands for core courses, review of labs, projects supervision, etc. Having broken all into “sachets”, our members have the freedom to pick as they need. If we had lumped all together, resistance to conversion would mount. Pay attention to your pricing playbook – it is a key factor now to success in Nigeria.

It does not really mean making things cheaper, it simply means finding a way to follow people’s purse sizes!

Robinhood Fractional Shares

Fractional shares are pieces, or fractions, of whole shares of a company. With fractional shares, you can trade stocks in pieces of shares, in addition to trading in whole share increments. Imagine a scenario where one can buy 1/1000 of a share, and doing that fractional share trading is real-time. Robinhood offers Fractional Shares feature in America, and that is sachetization in Nigeria (packaging products in sachets…Cowbell Milk). Yes, America now sells company shares in sachets! And that innovation has made Robinhood a really great company. What is your product pricing innovation?

Our mission is to democratize finance for all, and our Fractional Shares feature provides unique investing opportunities to people who might not otherwise be able to participate in the stock market.

With fractional shares, you can invest in stocks and ETFs that cost hundreds or thousands of dollars for a single share with as little as $1. This gives you the flexibility to invest as much as you want in the companies or ETFs you believe in, or get your toes wet without committing to an entire share.

Fractional shares can also help investors manage risk more conveniently. Since you’re not locked into purchasing full shares, you can diversify your portfolio with smaller amounts of money.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

When you operate in the mass market segment, innovation on pricing becomes the most important, for survival and sustainability.

It is not easy to get plenty people to pay for something here, but with seductive and charming pricing mechanism, you give them some bragging rights, and they congregate.

This is the land of brave and socially adapting beings, if you do anyhow, you will see anyhow.