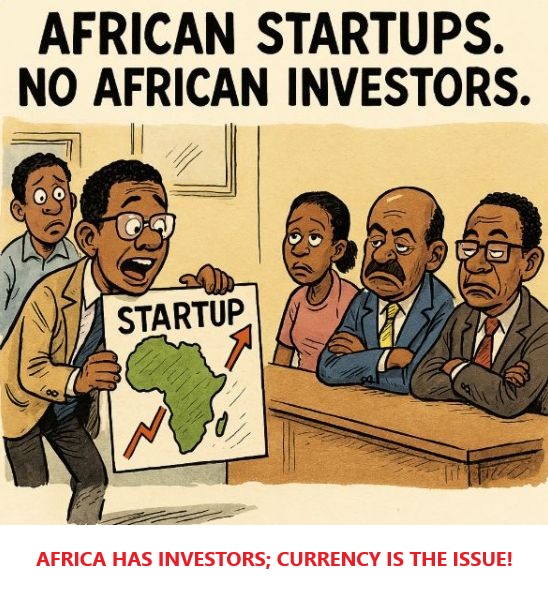

Let me expand the conversation by noting that Africa does have investors. My original comment: “I think there are African investors. The real challenge is not the startups but the currency. If you invested in Nigeria, for example, before 2015, when Naira was about N200/$, there is no way you would be fine now that the currency is N1600/$. We should understand that investors do not run charities. I wrote here how I put 15% of my gross wages as an entry banker and how worthless everything has become because of currency. Let us push for African leaders to find solutions to the currency mess and inflation. Africa has INVESTORS; the issue is that we do not have stable currencies for long term investments.”

I will add that even if you want to remove the impact of exchange rate, as an investor, you MUST still model the time value of money. Yes, you do not do investments to pack digits in your bank accounts. You do investments to create value on your assets so that you can have more spending power after you have grown your asset value. So, the real issue is not the absolute amount but the purchasing power, post the investment.

Looking at that, if you invested N2 million in 2015 in Nigeria and that money has “grown” to N2.2 million in 2025, even though you have “grown” the absolute value of that asset, you have lost on the purchasing or spending power associated with that asset. In other words, that investment is not a good one. Inflation and currency loss have destroyed value there!

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

So, the loss of spending power as a result of currency deterioration does not shield local investors. Simply, even if you are investing and getting returns in Naira, you are going to lose value when it comes to using that fund due to inflation and the loss of the value of the money in an import-dependent economy. And that takes me to the summary: until we can stabilize our currencies in Africa, few investors will do long-term deals.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

Whether you invest with dollars or naira in Nigeria, once there’s devaluation and then runaway inflation, every investor suffers. It is not about nominal value, but what the money can buy. It is also why dollar-denominated debt repayment can sink an economy if the local currency is weaker. How do you pick up a debt of $1 billion at N220/$ and try to repay same at N1600/$? The old N220 billion will magically become N1.6 trillion. This is only on the account of currency devaluation, and then add inflation. When your N1 million in 2020 can now buy goods worth of N200k then, and you are paying N1 million? To keep up, that N1 million should be showing N5 million. But at N5 million, there’s still no growth. Can you beat that?

The more you understand mathematics, the more annoyed you get when anyone tells you that Nigeria is making progress economically. You cannot be smart and make such statement. Once you think everything as numbers, you will avoid meaningless and unproductive conversations, because it’s obvious you are dealing with clueless people. Which investment does %700 returns in 5 years in Nigeria? That’s the sort of growth you need to feel a bit like you are crawling forward, and not even sprinting.