In 2018, I wrote a simple post and a Kenyan member of parliament asked to speak with me. I had written that the ordinance which Kenya was trying to approve WeChat Pay in the nation could pose challenges to its banking system:

“The Kenyan banking regulator has run a regulatory regime where market forces are allowed to play. Allowing WeChat and Alipay in Kenya would certainly have real challenges to the Kenyan banking system. Even in China, WeChat has become so popular that local banks are having liquidity problems as what users do is to move their monies from their bank accounts into WeChat, and from there spend as they want. The banks have become pipelines into and out of WeChat and nothing more.

“For the banks, this is a very huge test because if WeChat warehouses lots of cash in its platform, some banks may fold. Interestingly, that is what Alipay and WeChat plan to do”. Kenya changed the structure!

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

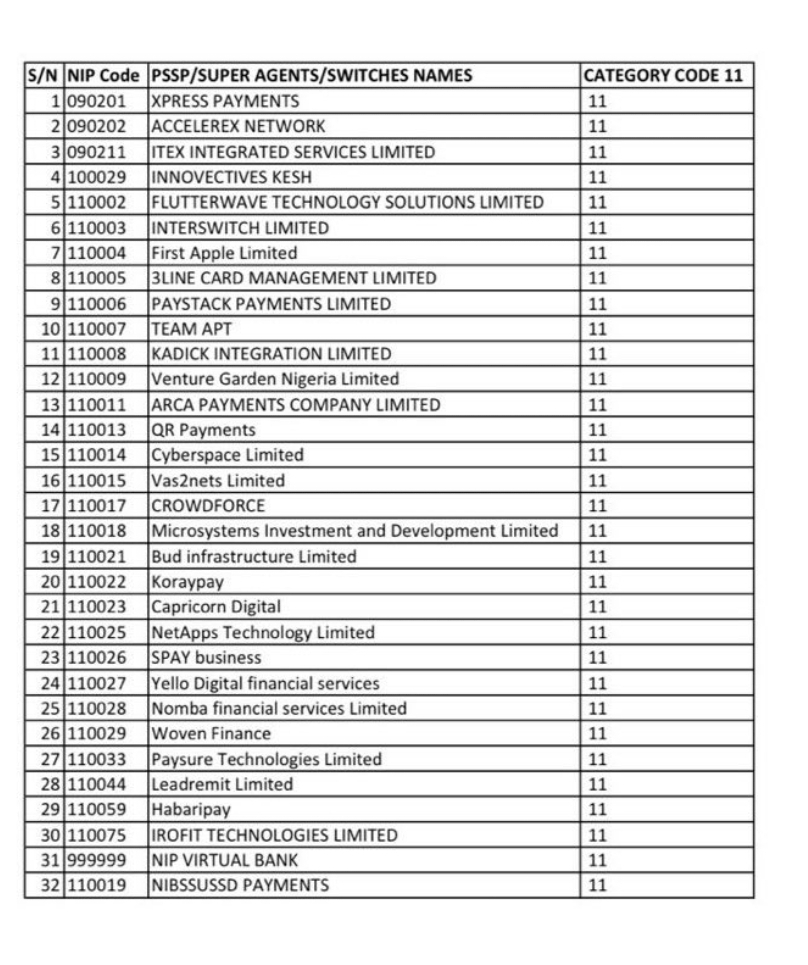

On Dec 5, 2023, the Nigeria Inter-bank Settlement System (NIBBS) sent a circular, and asked for switches, superagents, and payment solution service providers, to be disconnected from the NIBSS instant outward payment system. NIBBS noted that these companies are “non-deposit taking financial institutions”, and by implication should not “hold customers’ funds.”

The next day we received a list of companies which are alleged to have contravened this policy. Simply, most of the major fintech companies in the payment space are affected.

Good People, while these fintechs are not the real culprits, but if you are paying attention you will notice that Nigerian banking is under stress despite the “huge profits” they declare yearly. Those profits are vapour-profits, powered by mindless fees on customers and FX-anchored arbitrages. When it comes to real banking, which is interest-anchored banking, Nigerian banking has disappointed.

And that disappointment is evident as there is no catalytic project in Nigeria which any bank can come and claim that it funded. In America, banks tell you dams, bridges, etc they financed and challenged Americans to support them so that they can finance the future for shared prosperity and progress.

Why are banks under stress? It has to do with the aggregation business model. These fintechs which have figured out how to aggregate users are capturing value, making it challenging for banks. In other words, one fintech handles $14 billion monthly in Nigeria and if a huge part of that stays in its wallet, that is money not for the banks to lend. It is key to note that Nigeria’s largest financial institution does not have a bank license; it is a fintech aggregator which delivers APIs which millions of users use to collect payments.

And the big one, when these startups operate, they stay at the edges of the smiling curve where they capture value. What that means is clear: they can quickly improve gross margins at a pace banks which fund the foundational stacks cannot.

So, in the end, the government wants to help the banks, to ensure the deposit funds stay with them so that they can fund businesses via loans. This is not a new policy across nations; in small regions in China, fintechs are mandated not to allow funds to stay more than 3 days in wallets without moving them to banks. China did that to save many small banks which were running into liquidity problems due to WeChat and AliPay.

It does seem like Nigeria just woke up. Yet, this should not affect these fintechs as their business models are not built on lending. So, not holding the customers’ funds will not derail them at scale.

---

Register for Tekedia Mini-MBA (Sep 15 – Dec 6, 2025), and join Prof Ndubuisi Ekekwe and our global faculty; click here.

The banks with the help of NIBBS are working hard to secure the bag, quite understandable. The fintechs holding funds did not apply to become banks, so the ones with banking licenses who are starved of funds obviously need to fight back, else they are taken down.

The thing is that, our banks are more or less fintechs that hold customers funds, not like we do much banking in the land anyway. The economy is not structured to help people rise and prosper, rather it’s extractive and extortionate, and every institution here, whether public or private is doing its best to extract and extort, nothing much else.

What the banks are experiencing today, the public power companies will experience same in the near future. What exactly do you think would happen if majority of electricity consumers with significant purchasing power end up having their respective independent power supplier? If we dream of well funded public power supply, and on the other hand we are encouraging the disconnection and disintermediation of capable consumers from the same public supply system, you end up having double whammy of some sort. The law of unintended consequences will visit our electricity market soon.

When you fail to view things correctly, you suffer.

“Dec 5, 2023 and not 2024″……….note the typo Prof. Thanks for your perspective and contributions always.

The fintechs don’t hold the actual funds, they only hold the financial position (wallets) of the users/customers.

The actual funds is received by the accounts of these fintechs(in most cases) which is domiciled in a bank.

The bank still holds most of the funds

If this is the case, what the policy above aim to achieve?

or am I missing a logic here?

I honestly wish this could be answered because I share the same perspective.

Your position is what should be the correct state. But that is not the case. Most of these startups HOLD the funds and that is why most offer lending services, basically becoming mini-banks by lending on the deposits!

The word “hold” seems to have been loosely used here. This is not physical cash that is held in a vault here. Their positions are still within the banking system. So, how doesn’t it starve the system?

The word “hold” seems to have been loosely used here. This is not physical cash that is held in a vault somewhere. Their positions are still within the banking system. So, how does it starve the system

Thanks so much. Fixed.

What is the position of Fintech company that have operational license micro finance banks?

They issue NUBAN.

It should be fine because a microfinance license does allow you to hold funds. Nonetheless, there is a limit you can play on that license. When an MFB license enables you to process and hold $billions in a month, it may not be what the government has in mind

Dear writer,

Thanks for your understanding of some of the biggest issues on our streets today.

In fact, Nigerians were initially reluctant to patronise the so called “non-deposit companies because, the deposit holding companies were just milking as if, that is their statutory obligation.

Same thing goes to power supply system in Nigeria.

One day, we will help them to disconnect our meter and wires from poles.

???? is that last paragraph for me?

Thank you Prof.for this educating write up. The Nigerian government and banks have taken us(customers)for granted for too long.

They(banks)lend at exorbitant rates,& to their preferred people only,directors executives etc. May it rain more problems and if positive downfall for the banks that way they also feel what the customers feel always

Honestly, the speculation that our public power supply system will be next to nothing soon is becoming more real than imagined.

Today, the Fintechs in Nigeria have practically stolen the show.

The deposit money banks formerly known as commercial bank is now a second option when it comes to banking and financial services as close to 65% of the banking population in Nigeia have accounts (both business and personal banking) and digital financial transaction tools (POS Terminals, Debit Cards ?) all provided by the Fintechs. And I think this is an innovation that Nigerians have long yearned for. What the banks can do, the Fintechs can even do better.

We need more of this in other sectors especially in power and energy and petroleum sectors.

I wish all the traditional banks could all go down. Like everyone has said, their major aim is to extort the citizens, providing a malnourished service.

I have two accounts with GT, one with UBA, Zenith, Access, and Sterling. That’s a total of six accounts and why is that, I was searching for a bank that will not consistently steal from me.

They hardly give small businesses loans and if they eventually want to, the interest rate is out of the roof with a short period of six months.

Right now, I use a fintech company and for the past 2years, I have not lost a cent.

Everything about them is a night mere unfortunately the Government is not considering the plight of the citizens but wants to save the chief in the block.

“Right now, I use a fintech company and for the past 2years, I have not lost a cent.” – amazing. Fintechs offer better services and governments should allow them to breathe

Nigeria is a country that may never experience real development, economically and otherwise. The country has expertise like yours but the government always listens to political cronies. Kenya may listen to you but will Nigerian politicians?

While this is a fantastic perspective to the issue, as an insider I will like to correct some impression. This rule has been foundational rule of NIP. NIP was built as a instant P2p product and the guideline clearly states one bank account / wallet to another. Fintechs were allowed on board the service for strictly outward transactions. The letter from NIBSS was as a result of 2 things, 1: a recent fraud of almost N30b on one of the Fintech platform and 2: an industry error were FSP list all the institutions on the NIP financial institution list.

While most of the proceeds of the fraud was recovered, it was noted that 90% of the proceeds went to Fintechs. NIBSS pushing at protecting depositor funds.

NIBSS publishes the list of institutions on NIP and broadcast to the banking industry on a daily basis, on this list we have Institution that are supposed to do both outward and inward and institutions that do only inward. They recently noticed that FSP are listing everybody on the FI list on their transfer channels which is not supposed to be the case.

Transferring to any of the listed institutions will invariably give an error as they are not configured to receive inward transactions. This is the reason we have not heard any out cry from the Fintech market segment.

Thank you for this enlightenment