The United States has collected nearly $100 billion in tariff revenue so far in 2025, and that figure could triple to $300 billion by the end of the year, according to Treasury Secretary Scott Bessent.

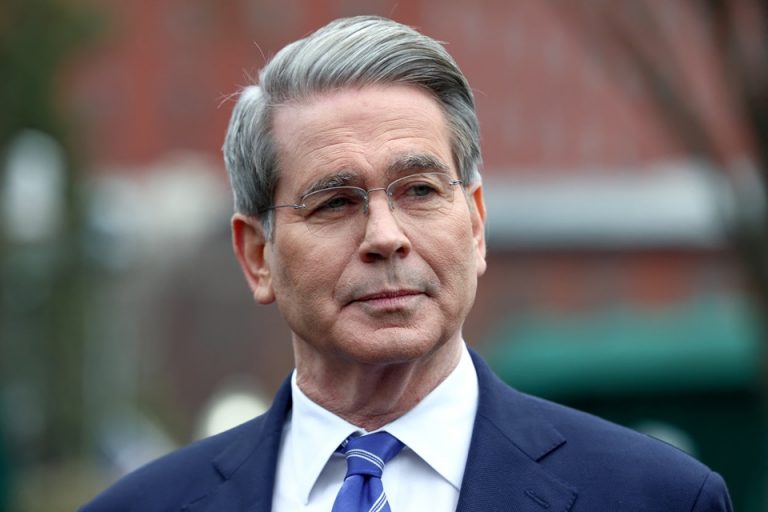

Speaking during a White House cabinet meeting on Tuesday, Bessent said the steep uptick in revenue began in the second quarter following President Donald Trump’s implementation of a near-universal 10% duty on all U.S. imports, alongside increased tariffs on steel, aluminum, autos, and other key goods.

“So we could expect that that could be well over $300 billion by the end of the year,” Bessent said, referring to the calendar year ending December 31, 2025. He added that the Congressional Budget Office’s long-term forecast of $2.8 trillion in tariff income over the next decade was likely an underestimation, as collections continue to accelerate.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The Treasury’s internal figures show that the administration collected a record $22.8 billion in gross customs duties in May alone — nearly four times the $6.2 billion collected in the same month last year. This brought total collections to $86.1 billion for the first eight months of fiscal 2025 and $63.4 billion for the first five months of the calendar year. By June 30, combined customs and excise tax collections had already topped $122 billion, with more increases expected in the Treasury’s next budget report due Friday.

Trump’s sweeping tariff plan — which includes a 50% tariff on copper imports and expected duties on semiconductors and pharmaceuticals — is the most aggressive trade policy seen in recent U.S. history. He said the “big money” will begin flowing from August 1, when higher reciprocal tariffs will take effect across nearly all trading partners. Trump hinted that countries could still negotiate for lower tariffs, but said letters had already gone out to key nations, signaling the start of a new phase in his protectionist trade campaign.

But while the Trump administration hails the ballooning tariff revenues as a success, economists and business leaders remain skeptical of its long-term benefits. Many argue the tariffs are already beginning to backfire — stoking inflation, disrupting supply chains, and burdening American businesses and consumers with higher prices.

“Copper prices soared by 10% today, hitting an all-time record high, following Trump’s statement that he will impose a 50% tariff on imports,” said Peter Schiff, Chief Economist and Global Strategist at Euro Pacific. “If this is the case, American businesses will pay a lot more than 10% extra to buy copper, raising prices for all products that use copper.”

Copper is a critical industrial metal, used in housing, electronics, electric vehicles, renewable energy grids, and defense equipment. Analysts warn that the cost increase will ripple through the economy, pushing up prices on consumer goods, industrial inputs, and key infrastructure projects.

Schiff, a long-time critic of protectionist policies, also warned that the latest round of tariffs — including the additional 25% duties on imports from South Korea and Japan — will significantly raise the cost of living for ordinary Americans.

“As I warned, Trump just imposed an additional 25% tariff on imports from South Korea and Japan,” Schiff said. “As I also guessed early on, all the talk of nations begging Trump for trade deals was BS. Consumers need to brace for much higher prices and get used to higher interest rates.”

The criticism highlights a growing divide between the White House’s portrayal of tariff policy as a fiscal win and the concerns of market economists who say the short-term revenue boost masks deeper structural problems. Several industries, particularly in manufacturing and construction, have voiced concern over rising input costs, delayed imports, and unstable pricing.

Business lobby groups are also beginning to push back, warning that the August 1 tariff escalation could trigger retaliatory measures from trading partners, harm export prospects, and chill investor confidence.

Still, the Trump administration remains defiant, reiterating that the U.S. will no longer let other countries take advantage of American workers and producers. This reinforces Trump’s belief that the tariffs will ultimately restore balance to U.S. trade and fuel domestic production.

However, with U.S. inflation still uncomfortably high and interest rates lingering at elevated levels, analysts worry that the added costs from the tariff wave could complicate monetary policy and deepen voter unease heading into an election year.