Bitcoin’s momentum has weakened sharply, plunging the world’s largest cryptocurrency into one of its most bearish phases of 2025.

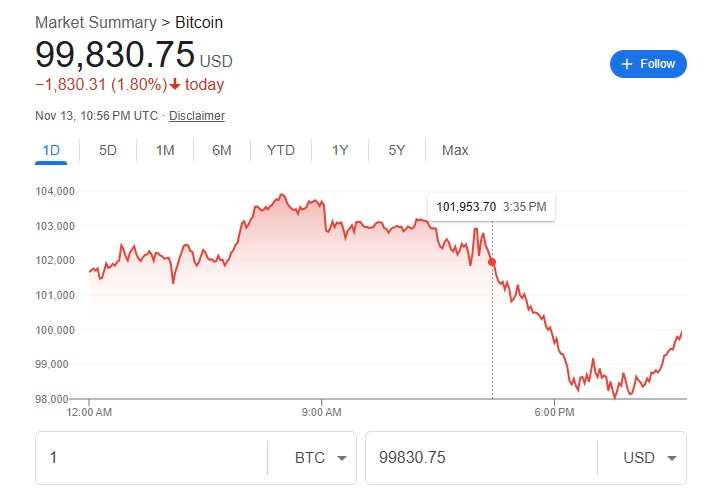

The digital asset has once again fallen below the $100,000 threshold, the third time this month, as investors continue to offload risk assets such as cryptocurrencies and tech stocks amid mounting economic concerns.

As of the time of writing, Bitcoin was trading at $99,103, marking a steep decline from its October peak of $126,080. Data indicates that long-term holders have sold approximately 815,000 BTC in the past 30 days, the highest level of selling activity since January 2024. With demand contracting, this surge in sell-side pressure has intensified downward momentum.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

A Market Losing Its Grip on Momentum

Earlier in October, Bitcoin’s record high of $126,000 was accompanied by a strongly optimistic market sentiment, with the Fear and Greed Index registering 80 a signal of aggressive buying. However, that optimism has since evaporated. As Bitcoin slipped below $100,000 for the first time since June, the index plummeted to 20, reflecting extreme bearish sentiment.

The decline underscores a swift shift from enthusiasm to hesitation, as weakening spot demand and a slowdown in stablecoin liquidity, typically a key driver of market inflows created a fragile market environment.

Long-Term Holders Unload at Rare Levels

One of the most notable developments has been the aggressive selling by long-term Bitcoin holders. Over the past month, approximately 815,000 BTC were distributed, representing the heaviest selling since early 2024. This occurred as Bitcoin traded between $118,000 and $121,000, even as spot demand began to fade.

Despite the bearish sentiment, JPMorgan analysts believe Bitcoin’s downside risk is now “very limited.” In a Wednesday note, Managing Director Nikolaos Panigirtzoglou and his team estimated Bitcoin’s production cost historically a reliable price floor at around $94,000, up from a previous estimate of $92,000.

The sharp increase stems from a rise in network difficulty, which reflects the growing computational power required to mine Bitcoin. The ratio of Bitcoin’s price to production cost now sits just above 1.0, at the lower end of its historical range.

“The bitcoin production cost has empirically acted as a floor for bitcoin, so a $94,000 production cost implies very limited downside to the current bitcoin price,” the analysts wrote.

JPMorgan reiterated its 6–12 month upside projection of $170,000, based on Bitcoin’s volatility-adjusted comparison to gold. The firm noted that Bitcoin currently absorbs about 1.8 times more risk capital than gold. To reach parity with private-sector gold investment — roughly $6.2 trillion — Bitcoin’s market capitalization would need to rise by about 67%, implying a theoretical price near $170,000.

Bitcoin Stuck in “Consolidation Limbo”

Blockchain analytics firm Glassnode described Bitcoin’s current phase as a “state of consolidation.” Analysts at the firm noted that both on-chain and off-chain indicators reflect a stabilizing market that is “not yet ready to confirm a bullish reversal.”

Until new inflows or a strong macroeconomic catalyst emerge, Glassnode expects Bitcoin to oscillate within a $97,000–$111,900 range, with $100,000 remaining a crucial psychological support level.

Macro Pressures Add to Market Strain

Notably, Bitcoin’s recent plunge coincides with the reopening of the U.S. government following its longest shutdown in history, as President Donald Trump signed a funding bill late Wednesday. The broader downturn also mirrors the Federal Reserve’s recent monetary stance. Chairman Jerome Powell maintained a hawkish tone, stating that further rate cuts were “not a foregone conclusion,” even after the central bank lowered rates by a quarter point in October.

Together, these factors have created a challenging environment for risk assets leaving Bitcoin, once again, in a fragile balance between consolidation and renewed decline.

Outlook

While near-term sentiment remains cautious, analysts believe the worst of Bitcoin’s correction may be nearing its end. The confluence of limited downside, steady network activity, and rising production costs suggest that Bitcoin could find firm support around the $94,000–$97,000 range before attempting a gradual recovery.

Market participants are also watching for potential macroeconomic triggers — including a shift in Federal Reserve policy, improved liquidity conditions, and renewed institutional inflows that could spark a fresh uptrend in 2026