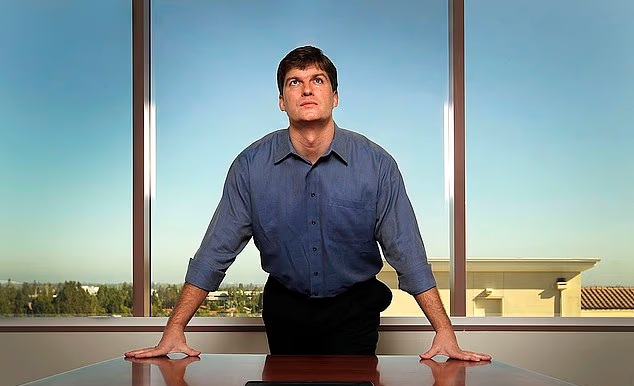

Michael Burry has found a new target in his widening clash with the world’s most powerful tech names — and this time, he’s aiming straight at Elon Musk.

The investor known for the subprime mortgage call that inspired The Big Short said on Sunday night that Tesla’s valuation “is ridiculously overvalued today and has been for a good long time.” The remark appeared in a fresh post on his Substack, published days after he revealed bets against Nvidia and Palantir.

Burry argued that Musk’s newly approved $1 trillion compensation plan will further dilute Tesla’s shares over time. He also delivered one of his sharpest jabs yet at Musk’s shifting product pitches.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

“The Elon cult was all-in on electric cars until competition showed up, then all-in on autonomous driving until competition showed up, and now is all-in on robots — until competition shows up,” he wrote.

A Long-Running Grudge Match

This is not Burry’s first swing at the company. In 2021, he wagered against about $530 million worth of Tesla stock before exiting the trade months later, explaining to CNBC that it had been “just a trade.”

His latest salvo arrives as Tesla’s stock trades at more than 250 times earnings — far above traditional automakers — a valuation that even long-time short seller Jim Chanos said in 2023 was inflated.

Burry has spent the past year calling the surge in AI-linked stocks a bubble. After disclosing short positions against Nvidia and Palantir last month, he traded barbs with both companies online. In November, he deregistered his hedge fund and moved his commentary to Substack, where he has been more vocal.

Musk’s Response as Tesla Shares Climb

Tesla’s stock is up 11% in 2025, buoyed by the company’s robotaxi push. Musk, who often spars with short sellers, has insisted that Tesla will become the world’s most valuable company.

His $1 trillion pay package, approved by Tesla shareholders last month, hinges on the carmaker’s valuation rising to $8.5 trillion within ten years. That target is nearly twice Nvidia’s current valuation.

Tesla still leads the US EV market with about 41% market share as of August, though that number has slid as rivals push their own models into the market.

Musk argues that the company’s future rests on two pillars: its robotaxi program and its humanoid robot, Optimus. Both lines face growing rivalry from firms like Google-backed Waymo and China’s Unitree, which has gained attention with its lower-cost robotics platform.

A Wider Tech Showdown

Burry’s campaign puts him at odds with nearly every major force in the tech rally. He has attacked AI exuberance, questioned the basis of trillion-dollar pay packages, and now taken aim at the flagship company of the EV and automation race.

For investors, the fight between the man who foresaw the housing collapse and the man steering the most polarizing automaker on the planet adds a fresh layer of drama to a market already running hot on expectations of AI-fueled transformation.

Investors, now driving one of the most heated valuations in global markets, are expected to determine whether Burry’s warnings gain traction this time — or whether Tesla’s momentum continues to defy skepticism.