French satellite operator Eutelsat endured another bruising day on the markets on Wednesday after a Reuters report revealed that Japanese investor SoftBank had offloaded a large block of subscription rights tied to the company.

The sale triggered a steep drop in the share price, reinforcing the uncertainty surrounding Europe’s efforts to build a credible challenge to Elon Musk’s Starlink.

Eutelsat’s stock fell by more than 7 percent earlier in the session before closing 5.7 percent lower. According to the Reuters account, SoftBank sold 36 million subscription rights—equivalent to about 26 million shares and roughly half of its stake in the French operator. The move marks the latest in a series of strategic disposals by the Japanese group, which has been under pressure to free up capital for its next wave of artificial intelligence investments.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

SoftBank founder Masayoshi Son told an audience on Monday that the company would not be selling assets unless it needed to bankroll its AI ambitions, making the disposal particularly telling.

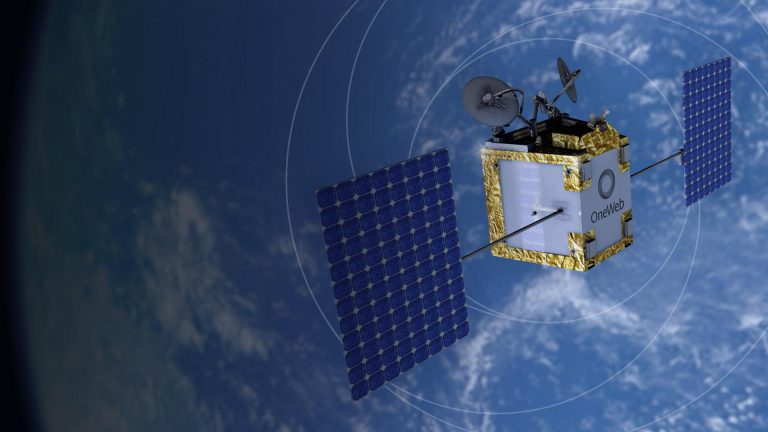

Eutelsat sits at the center of Europe’s push for technological autonomy. The company completed a merger with satellite internet provider OneWeb in 2023, positioning the newly combined group as Europe’s sharpest answer to Starlink. But the competitive gulf remains vast. Eutelsat and OneWeb collectively field more than 600 satellites in orbit; Starlink has deployed over 6,750, according to the companies’ websites. That sheer numerical difference underscores the scale advantage that SpaceX continues to enjoy in low-Earth orbit broadband.

The French operator has had a turbulent year in the markets. Shares had surged more than 600 percent in early March as European governments scrambled to shore up their technology independence following the United States’ decision to scale back military support for Ukraine. But the momentum evaporated quickly, and Eutelsat’s stock has since collapsed by more than 70 percent. The volatility highlights the fragile confidence surrounding Europe’s satellite internet strategy, even as governments continue to treat the company as a central pillar of continental tech infrastructure.

In June, the French state led a €1.35 billion investment in Eutelsat, emerging as its largest shareholder with roughly 30 percent. That recapitalization underscored the strategic weight now placed on Eutelsat’s constellation and ground network as Europe attempts to steer its own course in space-based communications. The state-backed support also signaled a shift in the company’s trajectory.

Luke Kehoe, an analyst at Ookla, told CNBC that Eutelsat is no longer being positioned as a pure growth story but rather as a foundational component of Europe’s digital sovereignty architecture. Kehoe described SoftBank’s withdrawal as consistent with the group’s “aggressive monetization” strategy across other holdings, including its earlier exit from Nvidia as it redirected funds toward OpenAI and related ventures.

Even so, Eutelsat’s strategic plan hinges on carving out markets where Starlink’s dominance is less entrenched. While Starlink continues to hold overwhelming scale and remains the most visible player in retail satellite broadband, Eutelsat has emphasized government contracts, aviation connectivity, mobile backhaul, and emergency-response links as its core growth lanes.

Kehoe noted that these B2B segments carry higher value relative to consumer broadband, potentially giving the French group a defensible position even without matching Starlink on satellite numbers.

The challenge now is whether that strategy can produce sustainable returns. The merged Eutelsat-OneWeb business remains deep in a cycle of heavy capital expenditure, and governments have repeatedly stepped in to keep operators like Eutelsat funded at levels necessary to participate in the global race for satellite dominance.

Kehoe framed the unresolved issue with a blunt question: Will Europe continue to write cheques at the scale needed to close—even partially—the capability gap with Starlink, and will Eutelsat’s more focused, enterprise-driven model be enough to justify the investment once the current recapitalization wave recedes?

Currently, the market reaction to SoftBank’s move suggests investors are not convinced. The heavy rights sale, paired with the broader backdrop of near-limitless capital flowing into AI, reinforces a hierarchy where space infrastructure competes directly with artificial intelligence for investor attention. SoftBank’s recent comments about prioritizing AI underscore that reality even more sharply.

Eutelsat’s role in Europe’s long-term technology sovereignty remains unquestioned in political circles. But in the financial markets, pressure continues to build. The selloff shows how quickly confidence can erode when major shareholders reposition their portfolios. And with Starlink’s lead showing no sign of narrowing, Eutelsat faces an uphill battle to convince investors that its strategic reorientation and government-backed support can eventually translate into commercial resilience.