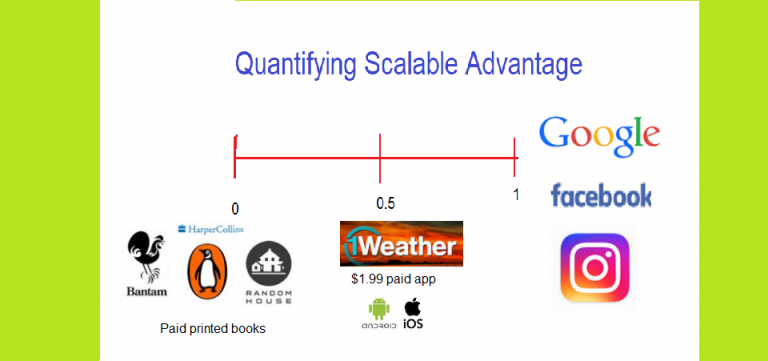

Any startup needs to model its scalable advantage (SA) to ascertain its capacity to scale and win in the market place. There are many factors which determine a company’s scalable advantage. Some are external like regulation, industry of operation and size of the market. Others are internal and they include marginal cost, supply pipeline, among others. In this video, I explain how to model that advantage by looking at the core transaction frictions between selling and buying. The more the business eliminates the friction, the more scalable it becomes.

But yet, scaling is not the whole story. You can scale traffic and make lesser money. I have called that diminishing abundance of internet where user growth does not correlate with more revenue. Wall Street Journal is largely subscription-based while many publishers have the freemium model. While the latter may have more readers (i.e. more traffic), WSJ may be making more money. So, scale must be put in context to make sense. And that is why you need to ascertain what matters for your business.

But no matter what it is, you have to test if you are closer to SA “0” or to SA “1”.

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

---

Register for Tekedia Mini-MBA (Sep 15 – Dec 6, 2025), and join Prof Ndubuisi Ekekwe and our global faculty; click here.

Great stuff