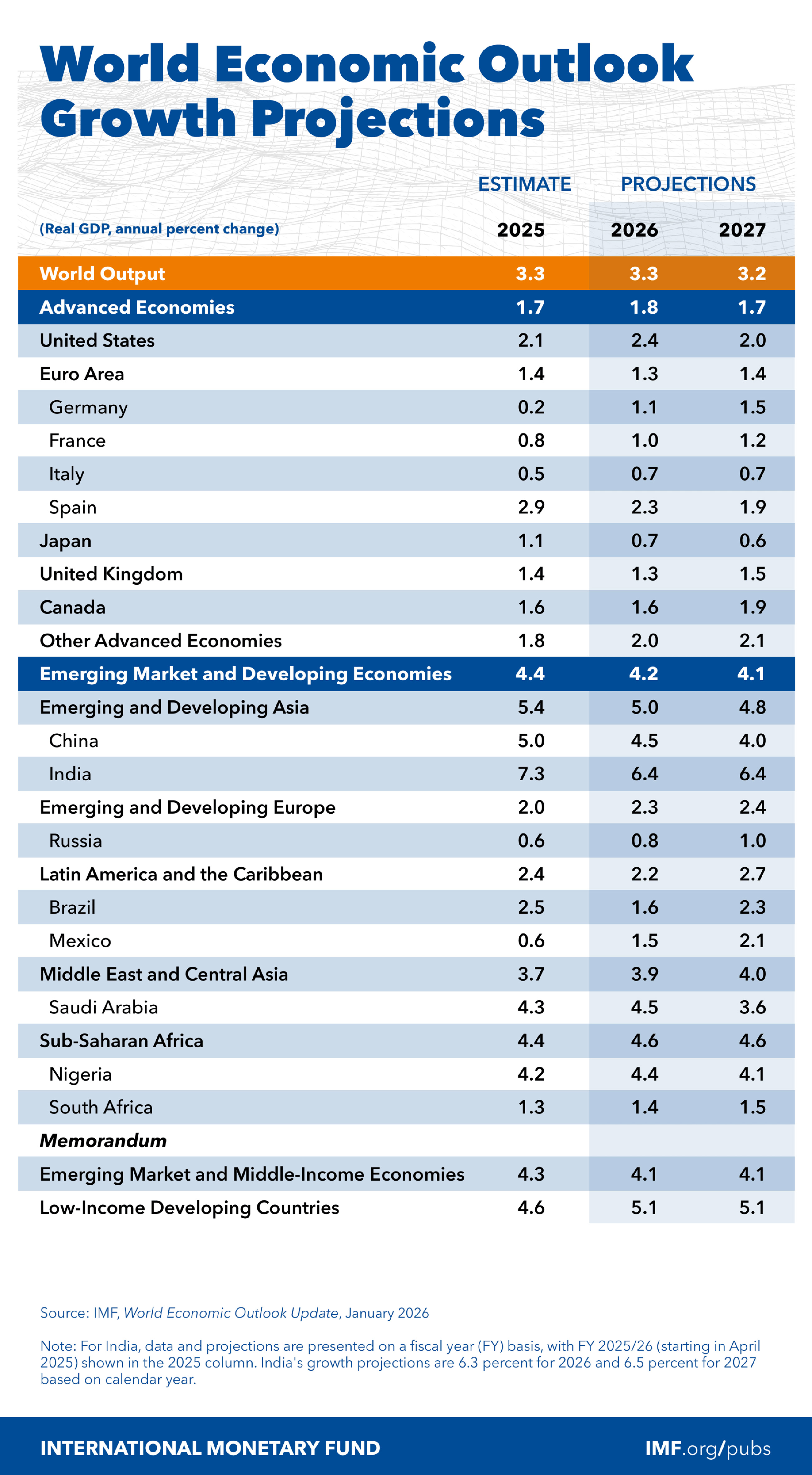

The International Monetary Fund has raised its forecast for Nigeria’s economic growth in 2026 to 4.4%, up from an earlier estimate of 4.2%, signaling growing confidence that Africa’s 4th-largest economy is beginning to stabilize after a prolonged period of strain.

The Fund’s decision to raise Nigeria’s 2026 growth forecast may appear incremental, but analysts believe it carries a heavier signal about how global lenders now read the country’s economic direction after years of volatility.

Published in the IMF’s January 2026 World Economic Outlook update and unveiled at the report’s official launch on Monday, the revision places Nigeria on a slightly stronger medium-term footing within a cautiously improving regional and global landscape. More importantly, it suggests that the Fund sees a clearer payoff from reforms that, until recently, were associated more with pain than progress.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

However, the IMF stopped short of upgrading Nigeria’s near-term outlook, a choice that underscores the central tension in the economy. Growth momentum is expected to build gradually, not suddenly. Inflation remains elevated, purchasing power is strained, and financing conditions are still tight. Yet the Fund now appears more convinced that policy adjustments underway are beginning to anchor expectations beyond the immediate horizon.

In its October 2025 outlook, the IMF flagged Nigeria’s economy as one weighed down by inflationary pressure, fiscal stress, and structural rigidities. Since then, authorities have continued with reforms aimed at restoring macroeconomic balance, improving fiscal coordination between different layers of government, and reducing long-standing distortions in key markets. The January 2026 revision signals that the IMF believes these measures are starting to change the medium-term narrative, even if everyday economic realities remain harsh for many Nigerians.

Nigeria’s upgrade also fits into a broader regional story. The IMF lifted its growth projections for Sub-Saharan Africa to 4.1% in 2025 and 4.4% in 2026, pointing to a shared recovery rather than a Nigeria-specific turnaround. South Africa’s outlook improved marginally as well, reinforcing the sense that Africa’s largest economies are stabilizing after years of shocks ranging from pandemic disruptions to global tightening cycles.

The regional context is important for Nigeria. Investors often assess the country not in isolation but as part of an emerging-market basket. A stronger regional growth profile can help improve capital flows, deepen risk appetite, and support financial market stability. That dynamic partly explains why the IMF’s modest upward revision could punch above its numerical weight.

Still, the Fund’s optimism comes with caveats that are implicit rather than loudly stated. Growth at 4.4% remains below what many economists consider necessary to meaningfully lift incomes in a country with rapid population growth. Inflation has eased in headline terms, but Nigerians continue to complain that food, transport, and housing costs remain painfully high. Government statistics showing slower price growth have been met with skepticism in some quarters, with accusations that technical adjustments such as rebasing are being used to soften the inflation picture without easing real pressures on households.

From a fiscal standpoint, a stronger growth outlook offers some breathing room but not a solution. Higher growth can improve revenue collection and help manage debt ratios, but only if it is broad-based and accompanied by tighter spending discipline. The IMF has consistently stressed that productivity gains, private-sector expansion, and structural reforms are essential if Nigeria is to avoid repeating cycles of boom and strain.

The global backdrop adds another layer. The IMF expects world growth to hold at around 3.3% in 2026 before easing slightly in 2027, supported by technology-driven investment and relatively accommodative financial conditions. Global inflation is forecast to continue slowing, a trend that could ease external pressures on countries like Nigeria by lowering import costs and stabilizing capital flows.

In that sense, Nigeria is entering a potentially more forgiving external environment. Steadier global growth and easing inflation could give domestic policymakers more room to consolidate reforms without the constant shock of external crises. The IMF’s latest forecast suggests it is cautiously betting that Nigeria will use that space wisely.

The 4.4% projection is less a declaration of success than a signal of guarded confidence, at least for now. It indicates that the Fund believes Nigeria is edging toward a firmer recovery path, even as the lived experience for many citizens remains one of high costs and slow relief.

The coming years will test whether the medium-term optimism embedded in the IMF’s numbers can translate into tangible improvements on the ground.

IMF Concerns on Workforce In AI-Driven Future

Meanwhile, as artificial Intelligence (AI) grows at an unprecedented pace over the last decade, transforming from a futuristic concept into a practical tool embedded in everyday life and business, growing concerns about job displacement and disruption are more present than ever.

The International Monetary Fund (IMF), in a recent blogpost, highlighted the transformative impact of artificial intelligence (AI) and digital technologies on global labor markets, noting that even workers at the forefront of innovation are not immune to disruption.

Recent layoffs at major technology companies underscore the reality. While AI creates new opportunities, it also displaces existing roles, reshaping job markets across industries. According to a World Economic Forum survey, more than half of business executives globally expect the technology to displace existing jobs, while 24% said AI will create new jobs.

IMF’s analysis of millions of online job vacancies notes than one in ten postings in advanced economies and one in twenty in emerging markets now require at least one new skill. Professional, technical, and managerial roles, particularly in IT, account for more than half of this demand.

Sector-specific skills are also rising, with healthcare requiring telecare and digital health expertise, and marketing increasingly emphasizing social media proficiency.

The IMF notes that employers are willing to pay more for workers with emerging skills. In the United Kingdom and the United States, jobs requiring at least one new skill pay roughly 3 percent more, while roles demanding four or more new skills offer up to 15 percent higher wages in the UK and 8.5 percent more in the US. Such wage premiums can stimulate local economies, as higher earnings translate into increased spending and job creation.

However, the benefits are uneven. High-skill and low-skill workers gain the most, while middle-skill roles, such as routine office jobs, face pressures from automation. AI-related skills, although commanding higher wages, have not yet driven employment growth.

In fact, regions with high demand for AI skills have seen employment in vulnerable occupations decline by 3.6 percent over five years, highlighting challenges for entry-level workers entering a labor market increasingly exposed to automation.

Global Readiness And Policy Imperatives

The IMF emphasizes that these trends are not inevitable and can be shaped through proactive policy.

High demand, low supply: Nations like Brazil, Mexico, and Sweden must invest in STEM education, training, and potentially attract foreign talent.

High supply, modest demand: Countries such as Australia, Ireland, and Poland should stimulate innovation, support new firm creation, and improve access to finance.

Emerging and low-income economies: Need both investments in skills and policies that enable workers to adapt, access new opportunities, and maintain mobility.

The IMF also stresses the importance of social protection, competition policy, and flexible work arrangements to help workers navigate transitions and connect with emerging opportunities. Education systems must be redesigned to equip students with cognitive, creative, and technical skills that complement AI, ensuring they work alongside technology rather than in competition with it.

Countries that are already well-positioned include Finland, Ireland, and Denmark, which invest heavily in tertiary education and lifelong learning programs. These initiatives allow workers to adapt as technology evolves, increasing both workforce resilience and economic productivity.

The IMF concludes that the success of AI adoption depends not only on technology but also on preparing workers and firms for transition. Beyond economics, work provides dignity and purpose, making the AI transformation a profound social as well as economic challenge.

Notably, the fund adds that bold investments in skills, support for job transitions, and policies that keep markets competitive will determine whether the benefits of AI are broadly shared.