Intel is in the early stages of discussions with longtime rival AMD about becoming a customer of its foundry business, according to a report from Semafor.

The talks underscore not just an unlikely potential partnership but also the extent of pressure facing the American chipmaker, which has seen its market position eroded in recent years by competitors and manufacturing missteps.

Citing “people familiar with the matter,” the report said it remains unclear how much of AMD’s chip production could migrate from Taiwan Semiconductor Manufacturing Company (TSMC), AMD’s primary foundry partner. Intel also outsources some of its own chips to TSMC, highlighting how far the company has fallen behind in advanced manufacturing capacity.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The talks come at a time when Intel is experiencing a rush of activity that analysts say resembles a collective rally to keep the U.S. semiconductor giant alive. In recent weeks, the U.S. government announced it would take a 9.9% ownership stake in Intel — an unprecedented move that converts $11.1 billion in Chips Act funding into equity and makes Washington Intel’s largest shareholder. The intervention, officials argue, is aimed at giving Intel the financial stability to catch up with Asian rivals and safeguard America’s technological backbone.

Private investors have also piled in. Japan’s SoftBank purchased $2 billion worth of Intel shares, while Nvidia agreed to buy $5 billion in stock as part of a partnership that will see the two companies jointly develop x86 processors powered by Nvidia graphics technology. Reports have further suggested that Apple and Intel are exploring new ways to collaborate.

Analysts say the swirl of alliances looks less like business as usual and more like a coordinated effort to prop up Intel after years of decline. Once the undisputed leader in chipmaking, Intel has been plagued by repeated delays in rolling out its advanced process nodes, losing ground to TSMC and Samsung in cutting-edge manufacturing. Its market share in CPUs has also been steadily chipped away by AMD, while Nvidia has dominated the lucrative AI accelerator market. Intel’s costly push into foundry services has yet to deliver a breakthrough client, raising concerns about its long-term strategy.

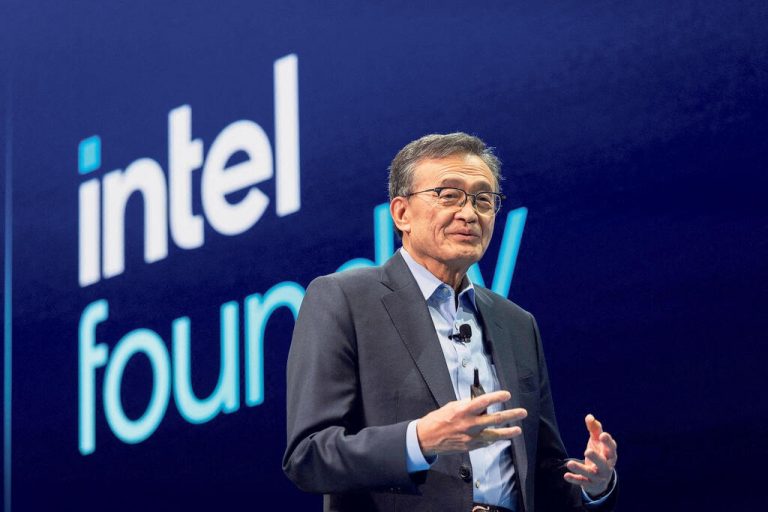

A partnership with AMD would be especially significant. Former Intel CEO Pat Gelsinger once vowed to build chips for all of the world’s major tech companies — even competitors like AMD. Securing AMD as a customer could give Intel’s foundry ambitions the validation it has been seeking. Current CEO Lip-Bu Tan has openly admitted that if there is not enough demand, Intel may have to scrap its advanced 18A process node altogether, a prospect that underscores the high stakes.

Thus, AMD moving even part of its production to Intel would mark a dramatic twist in an industry rivalry that has spanned decades. But the pressures are real as Washington has set a target for 50% of chips consumed in America to be made domestically, tariffs on foreign chips remain possible, and AMD has already felt the sting of U.S. export restrictions after its GPUs were swept up in curbs designed to throttle China’s AI ambitions. Working with Intel could reduce regulatory risks — and please the U.S. government, which now has a vested interest in Intel’s survival.

Still, the challenges remain daunting. Intel’s foundry technology is widely considered less advanced than TSMC’s, meaning AMD would likely see Intel as a backup option rather than a primary manufacturing partner. But analysts say even a secondary role could help Intel restore credibility and reassure investors that its foundry pivot has a viable future.

With geopolitical tensions rising, the semiconductor industry is increasingly seen as a theater of national strategy. What once seemed unthinkable — AMD turning to Intel for chipmaking — is now on the table, as rivals, investors, and governments converge in a bid to save America’s most important but embattled chip company.