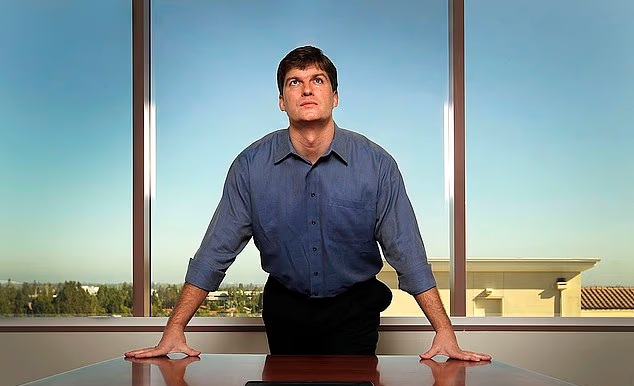

Michael Burry says financial markets are badly underestimating the consequences of the United States’ dramatic intervention in Venezuela, arguing that the muted reaction in oil and equity prices masks a profound shift in global power dynamics, energy markets and geopolitical risk.

In a post published early Monday on his Substack, the investor made famous by “The Big Short” said the US seizure of Venezuelan President Nicolas Maduro marked a decisive break with recent precedent.

“The game just changed,” Burry wrote, adding that markets “are not pricing in all that may come of this weekend’s events,” particularly over the medium to long term.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

He later reinforced the point on X, calling the development a “paradigm shift” that investors appeared to be shrugging off.

That complacency was visible in early trading. Benchmark oil prices rose by less than 1%, while US stock futures opened higher, even after President Donald Trump said Washington would effectively take control of the oil-rich nation for the time being. For Burry, that reaction reflects a failure to grapple with the strategic implications rather than a sign that the move lacks significance.

Central to Burry’s argument is China. He described the US action as a “shot across China’s bow,” pointing to Beijing’s deep financial exposure to Venezuela through billions of dollars in loans extended under its Belt and Road Initiative. Many of those loans were backed by future Venezuelan oil production. With that output now under US control, Burry suggested China’s collateral has effectively been neutralized, altering Beijing’s risk calculus well beyond Latin America.

Burry argued the episode may also serve as a case study for how China thinks about Taiwan. While he wrote that Beijing may now have a clearer “blueprint” for asserting control over contested territories, he added that Chinese leaders “must be in awe of Trumpian America’s infuriating gall and decisive power.” In his view, the speed and scale of the US move introduce a new variable into China’s strategic planning.

That shift, he said, has direct market implications. Burry warned that Chinese equities now look “somewhat riskier,” particularly companies vulnerable to sanctions if geopolitical tensions escalate. He flagged Alibaba, Baidu and other major firms as potential sources of volatility should China increase pressure in the South China Sea or move against Taiwan, raising the risk of Western retaliation.

Russia also features prominently in Burry’s analysis. He suggested the Venezuela operation underscores a stark contrast with Moscow’s stalled campaign in Ukraine.

“Putin’s jaw has to be on the floor,” Burry wrote, arguing that the US accomplished in seconds what Russia has been struggling to achieve for years. Strategically, he said, Russian oil has “just become less important” over the longer term, as Venezuelan supply could strengthen the US energy position while reducing Russia’s leverage, revenues and geopolitical influence.

The knock-on effects could extend closer to home. Burry said Canada and Mexico may lose bargaining power in trade talks with Washington if US refiners pivot away from Canadian crude toward Venezuelan oil. Such a shift would reorder North American energy flows and potentially reshape long-standing commercial relationships.

At the same time, Burry sees clear corporate winners. He said US oil-services giants such as Halliburton, Schlumberger and Baker Hughes stand to benefit significantly, as American contractors are likely to be called in to repair, upgrade and modernize Venezuela’s neglected pipelines, fields and refineries after years of underinvestment.

For the broader US economy, Burry forecast a longer-term tailwind. Increased access to Venezuelan oil, he argued, could push down prices for gasoline, diesel and jet fuel. That, in turn, would ease supply-chain costs, reduce inflationary pressure and provide tangible relief to consumers, particularly lower-income households. Lower energy costs could also reduce uncertainty for business owners and support investment decisions.

Burry’s core message is that markets are reacting to the headline but not the implications. In his view, the Venezuela intervention is not a one-off geopolitical shock but a signal of a more assertive US posture with cascading consequences for China, Russia, global energy markets and corporate valuations. Investors reaction, especially in reassessing the risks are expected to determine how abruptly those consequences are eventually reflected in prices.