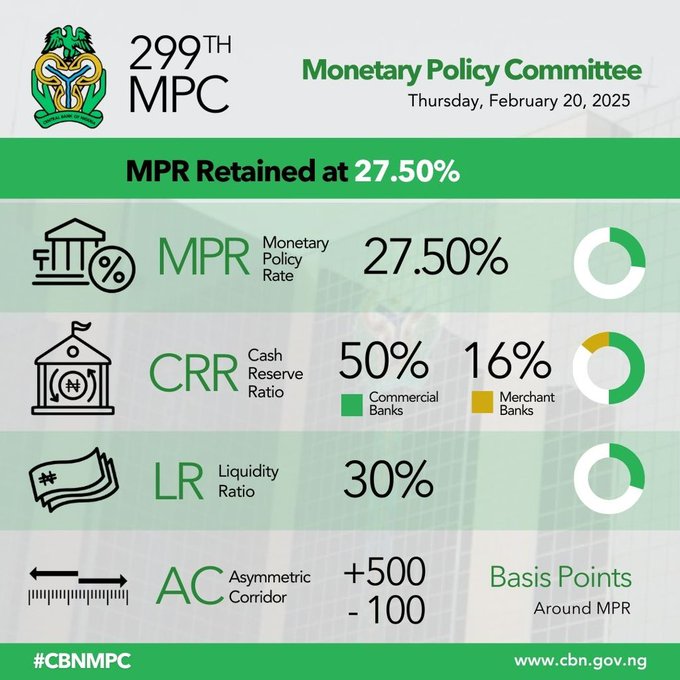

The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) has opted to retain the Monetary Policy Rate (MPR) at 27.5%, despite widespread expectations that it would cut interest rates following a significant drop in Nigeria’s inflation rate.

CBN Governor Olayemi Cardoso announced the decision on Thursday at a press conference in Abuja, following the committee’s 299th meeting. The decision to maintain the current rate comes after months of aggressive monetary tightening by the CBN, which has raised the MPR 15 times since May 2022 in a bid to combat surging inflation.

However, with the National Bureau of Statistics (NBS) reporting a sharp drop in inflation from 34.8% to 24.48% in January due to a rebasing of the Consumer Price Index (CPI), many analysts expected the MPC to ease monetary policy. The committee’s decision to hold the rate has cast further doubt on the credibility of the NBS’ inflation recalibration, which many argued misrepresents Nigeria’s economic reality.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The NBS’ revision of Nigeria’s CPI methodology significantly altered inflation calculations. The new methodology adjusted the weight of various components in the consumer basket to better reflect current spending patterns, leading to a drastic decline in reported inflation.

Cardoso acknowledged the revised CPI calculations but noted that committee members were still concerned about persistent inflationary pressures, particularly in food prices.

“Members, however, were not oblivious to the risk of persisting inflationary pressures driven largely by food prices,” Cardoso stated.

The controversy surrounding the NBS figures has been fueled by widespread complaints from Nigerians, who lament that prices of essential goods and services remain alarmingly high despite the reported drop in inflation. Many economic observers believe that the CPI rebasing does not reflect actual market conditions, and the MPC’s refusal to lower interest rates is believed to have reinforced doubts over the accuracy of the NBS’ inflation report.

Foreign Exchange Stability and Fiscal-Monetary Coordination

Beyond inflation, the CBN also factored in foreign exchange market stability in its decision to hold rates. Cardoso highlighted that the appreciation of the naira and the gradual convergence of exchange rates between the official and parallel markets were key factors in the committee’s deliberations.

“The committee highlighted the benefits of the improvements in the external sector to exchange rate stability, including the convergence of rates between the Nigeria foreign exchange market and the bureau de change,” he said.

This comes as the CBN continues to implement measures aimed at boosting liquidity in the FX market, with policies designed to tighten control over currency speculation and improve dollar inflows.

Additionally, the MPC stressed the importance of fiscal-monetary coordination, calling for stronger collaboration between the CBN and the federal government to achieve price stability and sustained economic growth. With Nigeria facing external shocks, volatile oil revenues, and a decline in foreign investment, such coordination is seen as crucial for long-term economic stability.

Other Key Policy Decisions: CRR and Liquidity Ratio Maintained

In addition to holding the MPR at 27.5%, the committee also kept the Cash Reserve Ratio (CRR) at 50% and the liquidity ratio at 30%. These measures aim to ensure stability in the banking system while controlling inflationary pressures.

Furthermore, the CBN reiterated its commitment to deepening financial inclusion, managing inflation expectations, and improving the monetary policy transmission mechanism.

“The committee also urged the bank (CBN) not to relent in its efforts to boost market liquidity,” Cardoso stated.

Is the NBS’ Inflation Report Credible?

With the MPC deciding to hold rates despite the inflation decline, the question remains: Does the NBS’ rebasing truly reflect Nigeria’s economic reality?

Public perception suggests otherwise as rising food and energy costs remain high, contradicting the official inflation figures. Against this backdrop, the business community remains skeptical, with concerns that the revised CPI paints an overly optimistic picture of Nigeria’s inflationary environment.

Analysts believe that investors may take caution as conflicting signals from the CBN and NBS raise questions about policy transparency and data reliability.