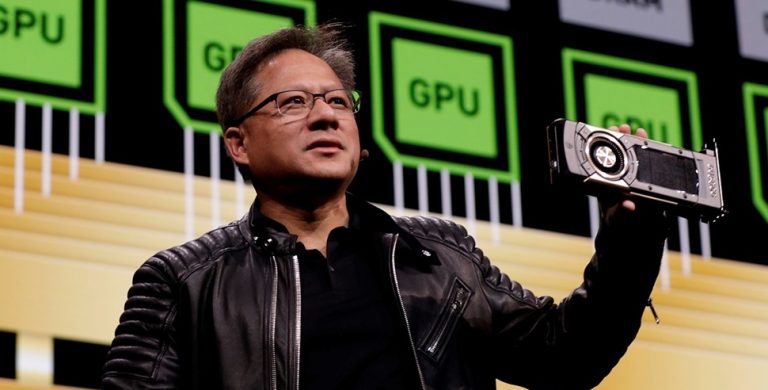

Nvidia CEO Jensen Huang said on Saturday that the chipmaker is experiencing “very strong demand” for its state-of-the-art Blackwell processors, even as the company remains locked out of China’s lucrative market under U.S. export restrictions.

The remarks came during Huang’s visit to Taiwan for an event organized by Nvidia’s long-time partner, Taiwan Semiconductor Manufacturing Co (TSMC), where he reaffirmed the strength of the global AI chip boom and Nvidia’s growing reliance on TSMC’s production capacity.

“Nvidia builds the GPU, but we also build the CPU, the networking, the switches, and so there are a lot of chips associated with Blackwell,” Huang told reporters in Hsinchu.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

He noted that demand for the firm’s AI hardware has surged across the U.S., Europe, and the Middle East, where cloud providers and AI startups are racing to secure high-performance computing capacity.

TSMC’s CEO C.C. Wei confirmed that Huang had requested additional wafer supplies but said the quantity was confidential.

“TSMC is doing a very good job supporting us on wafers,” Huang said, crediting the Taiwanese foundry’s efficiency and innovation for Nvidia’s record growth.

In October, Nvidia became the first company to reach a $5 trillion market capitalization — a milestone Wei described as “historic,” calling Huang a “five-trillion-dollar man.”

The demand for Nvidia’s new Blackwell platform — which integrates advanced graphics, networking, and compute technologies — highlights the company’s near-total dominance in AI hardware. The chip is the engine behind major generative AI systems such as OpenAI’s GPT models and underpins data center operations at firms like Amazon, Microsoft, and Google.

However, Nvidia’s growth is unfolding under the weight of geopolitical constraints that have effectively cut off access to one of its largest potential markets. Since 2023, Washington has banned the sale of Nvidia’s most advanced AI chips — including the A100, H100, and now the Blackwell series — to China, citing concerns that the hardware could accelerate Beijing’s military and artificial intelligence capabilities.

The restrictions have been steadily tightened under the Trump administration, with the U.S. government now blocking Nvidia from shipping even downgraded versions of its chips, such as the A800 and H800, which were specifically designed to comply with earlier export limits.

Huang confirmed on Friday that “there are no active discussions” about selling Blackwell chips to China and had said the company’s share of the advanced AI chip market in China is now “zero.”

Before the restrictions, China accounted for roughly 20% of Nvidia’s total revenue, with tech giants like Alibaba, Tencent, and Baidu among its biggest customers. Their heavy investments in AI training clusters had made China one of the world’s fastest-growing buyers of data center GPUs. The ban has since forced these companies to seek alternative suppliers or accelerate domestic chip development. Beijing has responded by fast-tracking local semiconductor firms such as Huawei, which has developed its Ascend AI chips as a partial substitute for Nvidia’s products.

Despite losing this vast market, Nvidia’s global demand has more than compensated for the shortfall. The company has seen explosive growth in data center sales, driven by the worldwide race to build AI supercomputing infrastructure. With supply shortages still limiting production, even major U.S. tech firms are competing for allocation slots.

Huang acknowledged that Nvidia continues to face occasional supply constraints — not just in wafer capacity but also in high-bandwidth memory (HBM), which is crucial for AI workloads.

“We have three very, very good memory makers — SK Hynix, Samsung, Micron — all incredibly good memory makers, and they have scaled up tremendous capacity to support us,” he said.

The global chip supply chain has entered what analysts describe as an “AI super cycle,” with suppliers expanding production to meet demand that shows no sign of slowing. SK Hynix said last week it had already sold out its entire 2025 output of advanced memory chips, while Samsung Electronics confirmed it was in “close discussion” to supply its next-generation HBM4 chips to Nvidia.

Even without China, Nvidia’s trajectory remains unmatched. Its Blackwell chips, expected to surpass the performance and efficiency of the current Hopper generation, are central to nearly every major AI deployment worldwide. The company’s success has also bolstered Taiwan’s TSMC, which manufactures nearly all of Nvidia’s GPUs using its most advanced process nodes.

Huang’s fourth trip to Taiwan this year underscored the growing strategic importance of that partnership.