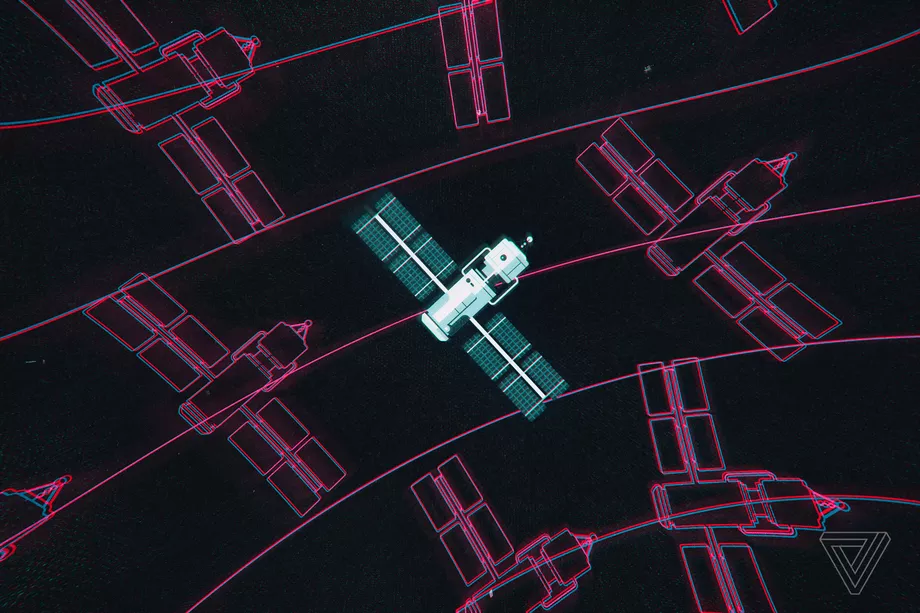

Amazon is moving its satellite internet project into a more advanced phase, giving select companies early access to its newly renamed Amazon Leo network — a quiet but notable escalation in its long-planned bid to compete with SpaceX’s Starlink, the world’s largest satellite internet provider.

In a blog post on Monday, the company said that an “enterprise preview” has begun, allowing businesses to test Amazon Leo production hardware and software ahead of a broader rollout. Amazon said the test program will help it collect feedback from users in different sectors, refine its engineering decisions, and “tailor solutions for specific industries” before the service becomes widely available.

The expanded testing comes shortly after Amazon officially rebranded its satellite initiative from “Project Kuiper” to “Amazon Leo,” accompanied by a redesigned website and a more direct commercial pitch. The name points to low Earth orbit — the region up to about 1,200 miles above the planet where the entire satellite network will operate.

Amazon first revealed its satellite ambitions six years ago with a plan to deploy a constellation of 3,236 low Earth orbit satellites to deliver high-speed, low-latency internet to consumers, companies, and government clients — especially those in areas underserved by traditional broadband. The system is designed around flat, square terminals that connect to satellites overhead.

So far, the company has launched more than 150 satellites since April, using rockets from partners including United Launch Alliance and SpaceX. The latter is a notable choice, given that Amazon’s main competitor in the space now has nearly 9,000 satellites in orbit and has a commanding lead in global market share.

Still, Amazon is pressing on with its own roadmap. It has already secured commercial agreements with JetBlue, L3Harris, and Australia’s NBN network, and the company says units of its “Pro” terminals and “Ultra” antennas are now being shipped to participants in the enterprise preview program.

On Monday, Amazon also revealed the final production design of its Ultra model — the highest-end terminal in its lineup. According to the company, the Ultra antenna will offer download speeds up to 1 gigabit per second and upload speeds up to 400 megabits per second. Amazon says the terminal is powered by a custom in-house silicon chip, which it describes as the fastest commercial phased-array antenna currently in production.

The enterprise preview is expected to expand steadily over the coming months as the company adds more satellites and increases network capacity. Amazon has not yet announced pricing or a timeline for consumer availability.

The broader context behind Amazon’s push is the escalating race to build global satellite broadband infrastructure — a contest that involves enormous capital, unprecedented scale, and long-term bets on connectivity trends. For Amazon, Leo is both a strategic project and a competitive hedge: the company’s cloud business, AWS, sees satellite broadband as a critical layer for global enterprise customers, while Amazon’s retail and logistics divisions rely increasingly on connectivity in remote areas.

However, Starlink’s head start means any challenger faces steep odds, but Amazon’s scale, partnerships, and hardware development suggest it is preparing for a long contest. With more satellites set for launch and enterprise testing now underway, Amazon’s low Earth orbit network is gradually taking shape — even as pricing, rollout timelines, and final performance remain open questions for the consumer market.

Amazon Commits $50bn to AI and Supercomputing for U.S. Government Cloud Services

Meanwhile, Amazon.com also announced Monday a landmark investment of up to $50 billion to expand artificial intelligence and high-performance computing capabilities for its Amazon Web Services (AWS) customers within the U.S. government.

The initiative, expected to commence in 2026, will establish one of the largest public-sector cloud infrastructure commitments in U.S. history, reflecting the strategic role of AI and cloud computing in national security and technological leadership.

The expansion will add nearly 1.3 gigawatts of AI and supercomputing capacity across AWS’s Top Secret, Secret, and GovCloud regions. These specialized cloud environments handle sensitive and classified government data, and the planned infrastructure will feature cutting-edge computing hardware, high-bandwidth networking, and energy-efficient design to meet federal security and operational standards. One gigawatt of computing power is roughly equivalent to the electricity used by 750,000 U.S. households, highlighting the scale of the initiative.

AWS currently serves over 11,000 U.S. government agencies, ranging from defense and intelligence organizations to federal civilian departments. The company’s cloud services include foundational AI tools like Amazon SageMaker for model training and fine-tuning, Amazon Bedrock for rapid deployment of AI models, and proprietary foundation models, including Amazon Nova and Anthropic Claude. These platforms allow agencies to develop tailored AI solutions for mission-critical tasks, from intelligence analysis to cybersecurity, predictive maintenance, and administrative automation.

“This investment removes the technology barriers that have held government back,” AWS CEO Matt Garman said, emphasizing the importance of dedicated infrastructure to meet the increasing computational demands of AI-driven initiatives.

Garman noted that while Amazon continues to lead the broader cloud market, competitors such as Google Cloud and Oracle are accelerating AI-specific growth, making large-scale investments essential for maintaining leadership in the federal sector.

Analysts say the move underscores the intensifying AI infrastructure race, both in the commercial and public sectors. Tech companies, including Microsoft, Alphabet, and OpenAI, have committed billions of dollars to scale AI compute resources, sparking a surge in demand for GPUs, networking hardware, and specialized AI chips.

“Large-scale infrastructure is no longer optional,” said Emarketer analyst Jacob Bourne. “Organizations and governments that fail to secure sufficient AI compute capacity risk falling behind competitors in innovation and operational efficiency.”

The U.S. government has increasingly prioritized AI adoption to maintain strategic advantages over international rivals, particularly China, which has rapidly scaled its AI capabilities. According to D.A. Davidson analyst Gil Luria, the federal government’s reliance on AWS for expanded compute capacity is part of a broader effort to bolster AI readiness in national security, energy, healthcare, and economic forecasting.

Amazon did not provide a detailed timeline for the full $50 billion expenditure but emphasized that investments would be phased to ensure uninterrupted service to current AWS government clients while supporting new AI workloads. In addition to compute and networking upgrades, the expansion will also enhance power resilience, cooling infrastructure, and cybersecurity protections, ensuring that government data remains secure even as AI workloads scale dramatically.

The investment is expected to generate thousands of high-skilled jobs across engineering, operations, and security functions. It may also stimulate demand for U.S.-manufactured semiconductors and data center components, supporting broader supply chain and industrial policy objectives.

Beyond government applications, the project boosts AWS’ chance to maintain dominance in the AI ecosystem, providing tools for private sector innovation in sectors such as autonomous systems, healthcare, financial modeling, and logistics optimization. The initiative reflects a growing trend of public-private collaboration in AI infrastructure, bridging technological innovation with national priorities.

However, analysts note that while investments of this magnitude can drive breakthroughs, they also risk creating overcapacity and infrastructure bubbles if growth expectations do not materialize.

Like this:

Like Loading...