The Changing Face of The Changing of the Guard

The passage from the old year to the new, is a period when some people tend to reflect on the year just past, and think about how they can ‘do’ the next year a bit better. More expand it further, reflecting all that has passed, and thinking about how that can inform what is yet to come.

Normally I offer an End of Year, and New Year message focusing on the places that make me. That’s generally Trinidad, where I spent some childhood and as a youth, Ireland, where I was born, and Nigeria, which shaped close to the last 30 years.

There are common threads with all places pursuing an emergence from Colonial control and dealing with the normal ills and challenges of a young independent nation.

Ireland had been in ‘servitude’ the longest, though ‘The Republic’, had full autonomy about 20 years earlier, and later benefited from one of the earliest admission support models of the EU.

Neither ECOWAS nor CARICOM had the same ‘uplift’ capacity.

But I remember a ‘challenging’ Ireland which shared ‘emergence’ features with both Nigeria and Trinidad.

Where is home? Well less than being about a place, for me, it’s more about being in a type of sunrise, or perhaps moon rise. A place where there is this 360 ° ecosystem in flux which is far beyond the insular thing you are mandated to do, or, the business you are in.

Anticipating that flux, and acting from that informed position is where the holy grail is. That decides what succeeds and what fails.

Ireland has lost most of it, Trinidad has lost a lot of it, Nigeria has probably accumulated a bit more of it than is ideal. There is the concept of ‘too much of a good thing’.

With nation emergence comes a certain degree of savagery. But remembering from early years, with it comes a sense of unified moral conduct. There are lines that would not be crossed, and places people would not go in their heads. Brutality and Amorality aren’t the same thing. In some ways these chaotic, mal-regulated environments with patchy and counter-intuitive policing, exhale some sense of societal innocence and an almost unified will to preserve certain values.

Single Acts of mass violence that began with Barnett Davenport in 1790, through Anders Behring Breivik in 2011 and on to Stephen Paddock in 2017, didn’t happen in any part of the ‘Global South’.

This raises questions about the development of amorality in countries considered to be ‘developed’ and asks real questions about where exactly is ‘safe’. Feeling ‘safe’ is a significant ingredient in where people call ‘home’.

From reflecting on me to focusing on 9ja Cosmos

And so, we move on from the established style of a New Year message to where we are with the work of 9ja Cosmos.

We were established as an ‘Extra-Sovereign’ DNO (Decentralized Non Profit Organisation) in 2022.

Our mission works to level the playing field for youth of the ‘Global South’ through generating Web 3 products which are approachable, affordable, and can make solutions, such as highly programmable Web 3 ‘tokens’ available to be leveraged as doorways for completely new things.

Doorways were always there since the original emergence of Bitcoin, but historically it was only the geo-privileged could walk through them. 9ja Cosmos doesn’t try to stop anybody or provide a pipe where some people have been deselected. We simply widen the door!

The pivot gives a nod to legacy announcements at this time though the name ‘9ja Cosmos’ which says everything.

Our Project List Since 2022:

- 9jacom

- 9javerse

- Qatar 2002

- Dinos

- Sino Amazons/Sinosignia

- .det0x names

- Incorporating 9jaCosmos as ‘extra-sovereign’ using Programmable Handshake Tokens as Shares (Internal Project)

- Det0xant Portfolio

>8.1 Original Det0xants Series

>8.2 Det0xant (overflow merch)

>8.3 Det0xants 3

>8.4 Det0xants – Fiendyard Fruit & Veg

>8.5 Det0xants – Banshee Baby Beauterin

- Opaque Emotion Pathways

- MiddelWorld GhostDancers

- Sino Amazon Active

Det0xant Extensions

Recall while we were promoting the Web 3 names ‘.det0x’, we began giving away tokenized artwork which we named ‘Det0xants’. Det0x names have their backend and ‘root’ on Handshake. Handshake is a fork/copy of Bitcoin, the most secure blockchain in the world. The pioneering of Handshake was led by Joseph Poon, an original core-dev in pre-2008 Bitcoin development, also led on the ‘Lightning’ network, and later, co-developed Plasma with Vitalik Buterin.

We created the ‘front-end’ on the Optimism Network, which is EVM (Ethereum Virtual Machine) compatible. The EVM environment is known for being fairly ubiquitous but not the most secure environment out there. As a sense of identity and the ‘Web3’ successor to internet domains, Det0x names are safety and security in an unsafe ‘place’.

We got a lot of approaches, especially on X, making ‘proposals’ on the Det0xants, though they were not for sale, and had been given free to Det0x name owners and supporters of 9ja Cosmos.

We made several extensions to the Det0xant promotional work, keeping art fundamentals consistent, though deviating somewhat on theme. As always, all tokenized works have a supply of 1 (unique) and were manually laboured upon rather than being an ‘algo’ product.

They were also minted to Optimism in order to maintain interoperability with Det0x names and any future developments.

They were also released ultra-affordable in keeping with the raison d’être of 9ja Cosmos.

MiddleWorld Ghost Dancers

MiddleWord Ghost Dancers is a series of tokenized art (stills).. They are our second excursion into the surreal and abstract following the ‘Opaque Emotion Pathways’ series, but involve a loose interpretation of human form.

The series was first given public viewing in online platforms and the title ‘MiddleWorld Ghost Dancers’ was arrived at on LinkedIn.

Using the Optimism Chain continues with the technical theme of interoperability with the Det0x names.

Internal Project – 9ja Cosmos ‘Extra Sovereign’ Share System

The Share System of 9ja Cosmos allows full privacy and decentralized exchange of shares using ZKP (Zero Knowledge Proof) rather than KYC (Know Your Customer) methodology for shares to exchange, and to execute on shareholder decisions and entitlements.

It leverages the powerful programmability of Handshake Tokens (Handshake Names). They are embedded in the Handshake Blockchain in a manner similar to Bitcoin. Smart Contracts are not needed to create them.

Bitcoin Blockchain and Handshake Blockchain are so similar that BIPs (Bitcoin Improvement Protocols) can, and have been made to work on Handshake.

Right now, most of the ownership is with founding elements of 9ja Cosmos. Over time, that is expected to change.

As this fragments and devolves we expect to see ownership change more frequently, and shareholder activity to rise dramatically.

Aspects of the technical architecture which makes many things possible will have to change as activities scale.

This is an ongoing activity that needs to grow as the shareholding devolves.

Sino Amazon Active.

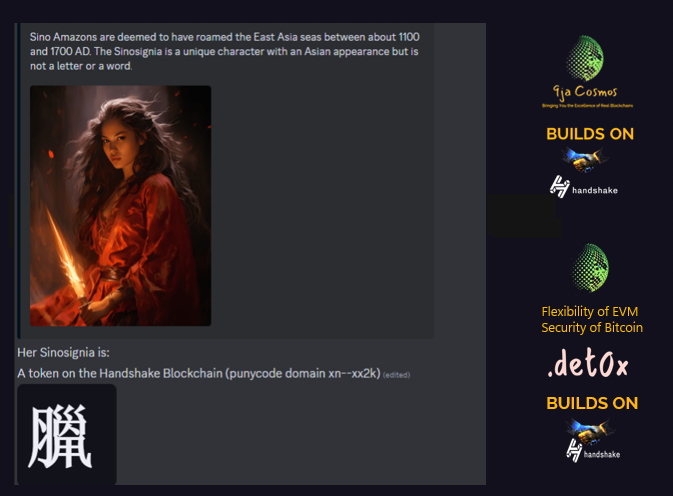

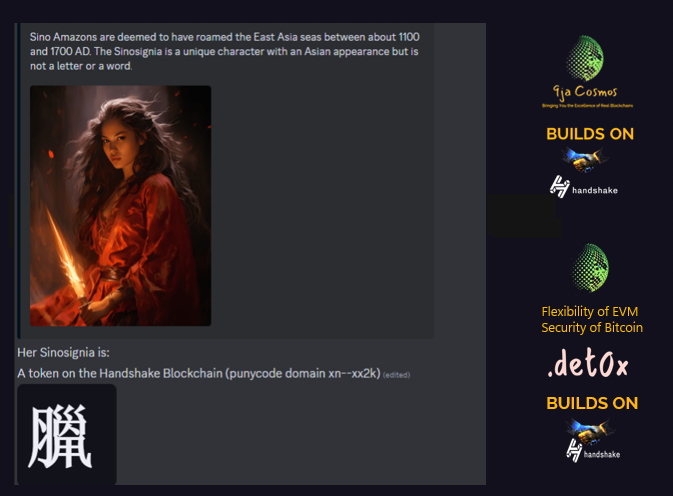

Beginning towards the end of 2022 and going right on to early 2024, we developed the Sino Amazon/Sinosignia series.

Based around ‘notional’ female sea pirates named ‘Sino Amazons’ . Sino Amazons are deemed to have roamed the East Asia seas between about 1100 and 1700 AD.

They are represented as a high-quality layered artwork which is then blockchain tokenized.

These were high quality ‘stills’ paired with a ‘Sinosignia’.

The Sinosignia is a unique character with an Asian appearance. Each Sino Amazon has one unique to them, which they use as an identity in bonds and oaths.

The Sinosignia is a fully working Web3 Top Level Domain (TLD) off the Handshake Blockchain. It’s on a completely different chain to the Sino Amazon related to it.

The original Sino Amazon/Sinosignia dual product is minted to order. Creator cost is very high so displaying them on a retail platform is a financial risk. Instead, customers buy privately and choose the blockchain home for the Sino Amazon component themselves.

Moving on, we’ve developed ‘Sino Amazon Active’

These are animated versions of Sino Amazon originals – around 5 seconds long (in MP4 format) and then ‘tokenized’.

Again, we mint to the Optimism Chain. Sino Amazon Active are compatible with the Ethereum Ecosystem and with .det0x names.

No ‘Sinosignia’ accompanies a ‘Sino Amazon Active’ however they are fully traceable to the Sino Amazon ‘stills’ from which they originate, and their Sinosignia companion.

They can be checked against Explorers for the Handshake Blockchain and the Optimism Chain.

Development Challenges

9ja Cosmos experimented with different retail video output platforms.

Examples: Runway (Gen 3 Alpha Turbo), Google Veo, Image Studio, Sora 2, Luma, Pixverse, (non exhaustive list).

It made sense for us to keep with many of the strategies that worked fine with Web 3 domains, leveraging existing third party architectures rather than getting bogged down in creating our own. In this field it didn’t work.

Free plans pointless, only produced one or two results a day

Paid plans prohibitive. When tokenized, the cost the market would bear for the completed series wouldn’t pay a fraction of the cost of making them.

Almost impossible to get the cut down to a size exactly right for tokenizing/minting purposes > created lots of extra work.

Provider often insisted upon embedding their own logo

Video generating content providers generally work better from text prompts rather than by ‘animating’ existing stills.

The original Sino Amazons are a multi-layered work in themselves, and represent a sunk cost. Pricing is modelled on all input data being worth zero.

Overall, these programs only make sense for individual fun, illustrating social media posts, or for single use in advertising campaigns for something else. They retail GPU service, and trying to ‘retail’ retail won’t work. Margin can’t be realized

We finally found an upstream GPU services provider where we could scale usage fairly flexibly without breaking the bank.

Societal and Moral Value Challenges

Sino Amazon Active product is highly visual. From a moral standpoint we found difficulty in arriving at some kind of ‘universal right’, which encompassed valuing diversity, NSFW (Not Suitable for Work), violation threshold and various other socio-political notions.

On the one hand some lobbying comments suggesting the product was weighted towards false physique ideals and we would do better to include more subject variations. What should a ‘REAL’ female warrior of the ages ‘LOOK LIKE’? The phrases ‘fuller figure’ and ‘plus model’ were used. However, frequently, the censoring software bundled with the GPU service false flagged attempts to animate subjects more in keeping with the lobbyists requests.

Unlike stills, animations generate many frames, and frame analysis by censoring software may flag an instance the eye can’t see. Though generally, the stills of a ‘lobbyist friendly’ image appeared a more ‘compliant’ animation starting point, than some of the more athletic physique specimens.

The use of ‘traits’

Sino Amazon Active sees our first excursion into the use of ‘traits’ although they don’t resemble the model used by ‘pfp’ series with prescribed components (typically called NFTs). The hierarchy includes Trainees, Probies, (Asscendant) Battle Mages or Sea Mages, and then Grand Mage. Trainees and Probies have no traits yet. Rank and File carry organically grown traits. (Asscendant) Battle Mages or Sea Mages absorb traits of those they lead and mentor. A Grand Mage has all traits.

Trait List : Blade Doctor; Blur; Brutal; Chameleon; Cybernetical; Demonic; Dream Maker; Earth Quake; Firestorm; Force Field; Ice Storm; Junglist; Law Code; Light Path; Mechanic; Mind Warp; Necromancer; Sea Rage; Shape Shifter; Sorcerer; Sultre; Tempest; Time Nomad; Vanish; Vixen and Vortex.

Human impression shapes traits and not an algorithm. We don’t define trait influence on the subject, preferring to leave interpretation up to buyers.

2026 and Beyond

The direction of 9ja Cosmos 26 is intended to consolidate on existing product and see where we can bring improved workability, alignment, interoperability, value and quality. But more important, we want to touch people with what we do, and bring smiles to people.

With the devolution of activists they are just intentions. But the smiles are bankable.

9ja Cosmos is here…

.det0x Domains

Detoxant 3 Tokenized Artworks

Detoxants – FiendYard Fruit & Veg

Opaque Emotion Pathways Tokenized Artworks

Preview our Sino Amazon/Sinosignia releases (Ente)

Visit 9ja Cosmos LinkedIn Page

Visit 9ja Cosmos Website

Like this:

Like Loading...