The TON-based NFT marketplace Fragment, integrated with Telegram, generated $2.83 million in fees over the prior 24 hours, edging out Hyperliquid’s $2.25 million or approximately $2.08 million as reported in some trackers.

This milestone propelled Fragment to the #3 spot among all DeFi protocols by daily revenue, trailing only stablecoin giants Tether and Circle. Launched by the Telegram team on the TON blockchain, Fragment is a specialized NFT marketplace focused on Telegram-native assets like usernames, anonymous numbers, premium subscriptions, and collectible gifts.

It supports anonymous peer-to-peer trades, fixed-price sales, and public auctions—all settled in TON coins. Its seamless Telegram mini-app integration has made it a gateway for over 900 million users to dip into Web3 without leaving the chat app.

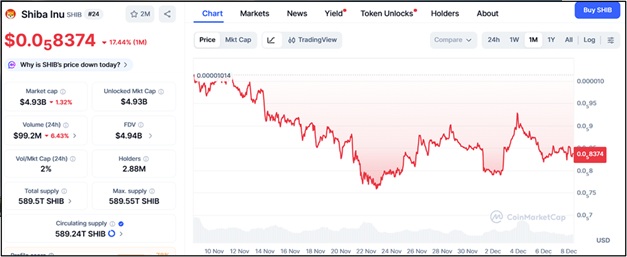

This surge aligns with a broader NFT market rebound, where global NFT sales jumped ~50% in the last 24 hours and market cap rose 33%. Fragment’s weekly revenue hit $7.08M, with $36.97M over 30 days, driven by high-demand auctions for rare Telegram identities.

In contrast, Hyperliquid—a high-performance Layer 1 for perpetuals trading—saw $6.3B in 24h perp volume but lower fee capture due to its model 99% of fees funneled to an Assistance Fund for buybacks and ecosystem support.

TON’s on-chain activity is booming, with Fragment as a key catalyst for consumer-facing NFTs. Amid a choppy crypto market, this shows “social” NFTs tied to apps like Telegram can outpace DeFi trading volumes during hype cycles.

For Hyperliquid its no cause for alarm—its $237B 30-day perp volume dwarfs Fragment’s scale, and the “flip” is temporary, underscoring how niche consumer apps can spike ahead of infrastructure plays.

Charles Hoskinson’s Take on Quantum Threats to Crypto

Cardano founder Charles Hoskinson recently addressed the growing buzz around quantum computing as an existential risk to cryptocurrencies, calling it a “big red herring” and largely overhyped for the near term.

In a podcast discussion around December 8, 2025, he emphasized that while quantum-resistant cryptography is technically feasible today, the practical hurdles make widespread adoption unnecessary and inefficient right now.

This aligns with broader expert consensus that meaningful quantum threats to blockchain signatures like those in Bitcoin or Ethereum won’t materialize until the 2030s or later, giving the industry ample time to prepare without panic.

Hoskinson’s core argument boils down to three key points, rooted in real-world trade-offs for blockchain networks. Quantum-safe protocols, such as those based on lattice cryptography, are currently about 10x slower and 10x more expensive to run than standard elliptic curve cryptography (ECC).

For high-throughput chains like Cardano which aims for thousands of transactions per second, this could slash efficiency dramatically. As Hoskinson put it: “I have a thousand transactions a second. Now I’m going to do a hundred transactions a second, but I’m quantum proof. Nobody wants to be that guy.”

Rushing into non-standard algorithms risks obsolescence. Hoskinson urges waiting for the National Institute of Standards and Technology (NIST) to finalize its post-quantum cryptography standards (FIPS 203–206), expected soon.

These will enable hardware-accelerated support from chipmakers like Intel and ARM, making quantum-safe tech 100x faster than unoptimized alternatives. Adopting prematurely could lock networks into “inefficient cryptography for a decade.”

Current quantum computers lack the scale to break real-world ECC keys which require millions of stable qubits. Experts, including Hoskinson, peg a “strong possibility” of viable threats in the 2030s, not tomorrow.

This echoes sentiments from Ethereum’s Vitalik Buterin, who in 2020 dismissed immediate quantum risks as overblown, noting that upgrades like BLS signatures already mitigate many concerns.

Quantum computers could theoretically crack ECC via Shor’s algorithm, exposing private keys from public ones. But this needs fault-tolerant systems with 1–10 million qubits—far beyond today’s ~1,000-qubit noisy prototypes.

Cardano has been proactive: Its Ouroboros consensus is modular for post-quantum upgrades, and sidechains like Midnight incorporate zero-knowledge proofs with quantum resistance in mind. Bitcoin, however, faces steeper challenges due to its rigid design—upgrading would require a contentious hard fork.

Not everyone agrees it’s “overhyped.” BlackRock’s 2025 warnings flagged quantum risks to Bitcoin as a “precipice,” and some researchers like MIT’s Elena Vertsova argue chains are “woefully unprepared.”

Ripple’s CTO David Schwartz has claimed XRP is inherently more quantum-proof, but that’s debated. This stance is bullish for Cardano ($ADA), as it positions the network to focus on scalability like the upcoming Leios upgrade for parallel processing without diverting resources prematurely.

Hoskinson ties it to ecosystem growth, like the Midnight token launch on December 9, 2025, which enhances privacy without quantum FUD. Overall, his message: Match urgency to actual threats—build efficiently now, upgrade smartly later.

If you’re holding crypto, this reduces short-term doom-scrolling but underscores the need for chains to monitor NIST progress. If you’re trading or collecting, Fragment’s low-friction entry via Telegram wallet makes it worth exploring—bullish on TON if this momentum holds.