Market sentiment appears fragile as the Cosmos (ATOM) price forecast signals deep uncertainty, with indicators pointing strongly toward bearish movement. Similarly, the Binance Coin (BNB) price drop, though moderate, highlights the ongoing short-term volatility gripping digital assets. With these top names showing instability, many are wondering where to turn for the best crypto to buy in 2025.

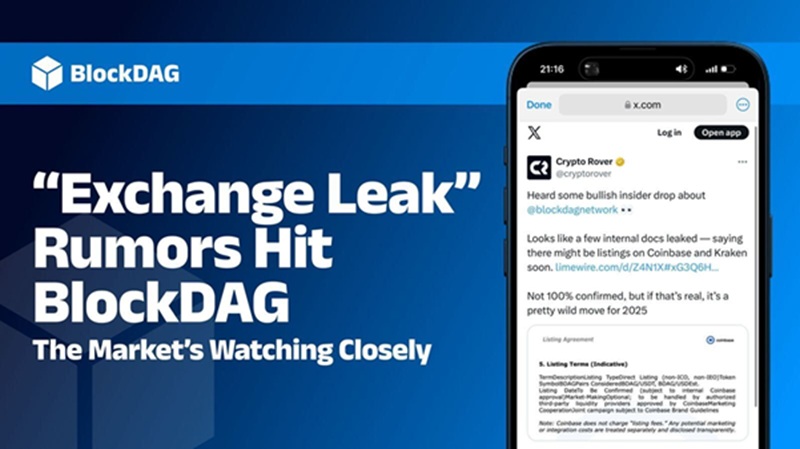

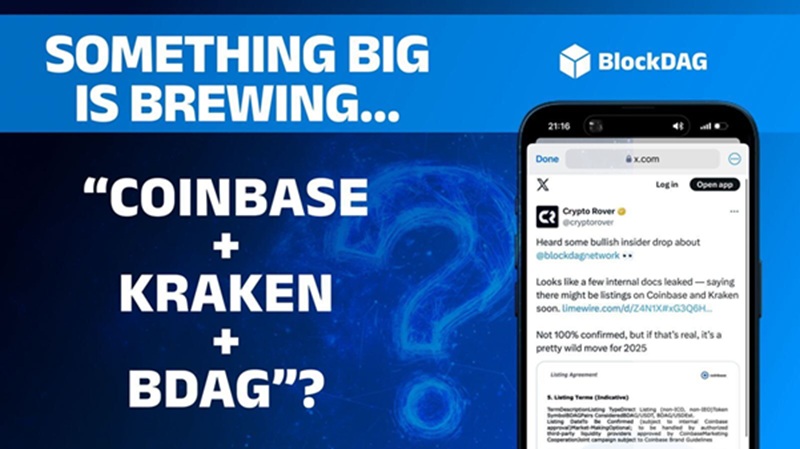

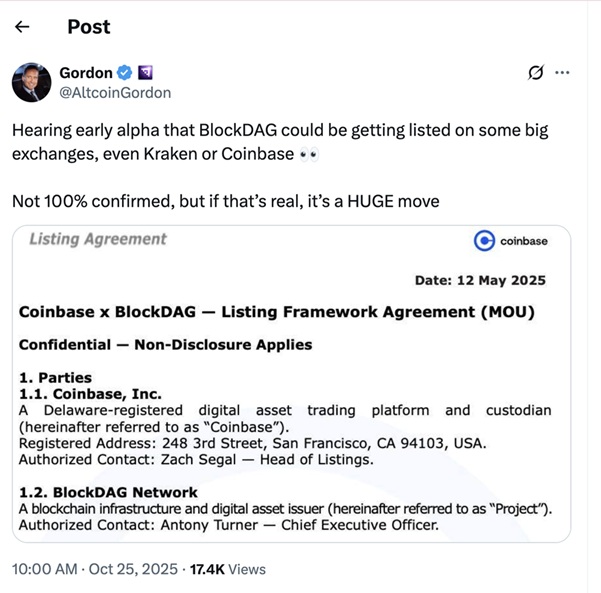

Forget the noise, a major leak has taken center stage. Sources, including AltcoinGordon, revealed that BlockDAG (BDAG) is preparing for high-profile listings on Coinbase and Kraken. Reportedly, internal documents mention BDAG/USDT trading pairs for Coinbase and a signed agreement with Kraken involving $300,000 for marketing and another $200,000 in USDT for liquidity support.

BlockDAG Exchange Leaks Fuel Massive Presale Growth

New reports from AltcoinGordon indicate that BlockDAG is moving closer to Tier-1 exchange listings. Leaked materials circulating online show specific details about Coinbase and Kraken partnerships. This revelation comes as BlockDAG’s presale continues to impress, raising over $435 million in funding. BlockDAG is now in Batch 32, priced at $0.005, with its official listing set for February 10, 2026.

With only 4.5 billion coins left in the presale, this marks the final stretch before BlockDAG’s highly anticipated market debut. Many notable crypto influencers, including Crypto Rover, have hinted that major developments are unfolding behind the scenes.

According to the alleged documents, Coinbase’s memorandum outlines BDAG/USDT and BDAG/USD pairs labeled as “Pairs Considered,” along with marketing collaboration and compliance checks.

Meanwhile, the Kraken agreement reportedly solidifies the deal, detailing $300,000 for technical integration, $300,000 for promotions, and a $300,000 liquidity deposit. These developments strengthen claims that BlockDAG is among the best cryptos to buy in 2025. For traders searching for the best crypto to buy in 2025, this leak points to BlockDAG’s presale window as a potential game-changer while it remains open.

Cosmos (ATOM) Price Forecast: Struggling to Recover

Cosmos has recently faced mounting pressure. The coin took a heavy hit in the recent $20B market pullback, with prices ranging between $3.18 and $3.29. Current data reflects roughly 91% bearish sentiment, coupled with a fear index score of 30, showing a lack of confidence among market participants. Technical charts continue to display strong resistance levels across major moving averages, leaving ATOM nearly 93% below its all-time high.

However, the Cosmos network remains active despite price weakness. Developers have introduced a new real-world assets (RWA) protocol, and USDC transfers now operate natively across platforms such as dYdX and Injective. These integrations improve interoperability and add utility to the ecosystem. Still, the Cosmos (ATOM) price forecast for late 2025 remains divided, with analysts suggesting possible lows near $3.09 or rebounds reaching $5.87, making ATOM’s future uncertain in the near term.

Binance Coin (BNB) Price Drop: Temporary Setback or Trend Reversal?

BNB continues to exhibit a pattern of sharp surges and quick pullbacks, recently peaking around 100,074 INR before dipping to 96,850 INR. Though the Binance Coin (BNB) price drop might alarm some, the medium-term analysis indicates the asset is still trading within an ascending channel. Analysts see the dip as normal volatility rather than a lasting decline.

The October 25 correction, where BNB dropped slightly before rebounding, reinforced the idea of resilience. Technical support remains strong near $690, while resistance lies around $1,300. Market experts view this as a healthy consolidation period that may precede another upward breakout. For now, the movement seems to represent typical market adjustments rather than sustained weakness.

In a Nutshell

While Cosmos faces heavy selling pressure and Binance Coin displays minor corrections, the true momentum could be shifting toward BlockDAG. The leaked details regarding Coinbase and Kraken collaborations hint at significant progress behind closed doors.

Reportedly, Kraken’s parent company, Payward Inc., has allocated $300,000 for marketing and another $300,000 for liquidity, a clear signal of intent. If accurate, these moves position BlockDAG as the best crypto to buy in 2025, particularly as its presale approaches completion with prices expected to rise in upcoming batches.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu