As Bitcoin prices continue to reach new highs, global investors are enthusiastically following the crypto market with unprecedented enthusiasm. In particular, in the fourth quarter of 2025, with BTC prices stabilizing above $110,000, market confidence is high, and traditional and institutional investors are flocking in. Riding this wave of wealth, BlackchainMining, leveraging its leading cloud computing technology and flexible contract mechanisms, has officially launched new BTC mining contracts, offering investors potential daily returns of up to $4,777, making it one of the most sought-after cloud mining platforms in the crypto world.

BTC prices soar, driving a surge in demand for cloud mining.

Since its inception, every surge in Bitcoin’s price has been accompanied by an increase in mining difficulty and a shift in its profit structure. With Bitcoin’s hash rate currently reaching record highs, individual mining machines have long struggled to achieve stable profits. The emergence of cloud mining allows ordinary investors to easily earn BTC by renting computing power through a platform, participating in mining dividends, and earning profits without having to purchase mining machines, maintain equipment, or bear electricity costs.

As Bitcoin reaches new all-time highs, BlackchainMining is launching BTC mining contracts, enabling global investors to share in Bitcoin’s growth with a low barrier to entry and high efficiency.

Why Choose BlackchainMining?

Signup Bonus: Once you create an account, you’ll receive an $18 bonus.

Secure Funds: BlackchainMining utilizes a bank-grade fund supervision and security system to ensure the safety of all user funds.

Various Options: The platform supports income settlement in nine popular currencies: [USDT-TRC20, BTC, ETH, LTC, XRP, USDC, USDT-ERC20, BCH, DOGE, SOL].

Easy Management: Users don’t need to worry about maintaining and managing mining rigs, and can earn income through contract purchases.

Flexible and Transparent: The platform offers contracts with various terms and amounts for users to consider.

Affiliate Program: Users can join and earn up to 5% referral rewards (3% + 2%).

Professional Support: BlackchainMining provides 24/7 online customer service to help you resolve any issues.

Sustainable Contracts: BlackchainMining offers a wide variety of contracts that are not only easy to use but also provide a variety of options to meet your investment needs and generate stable and efficient returns.

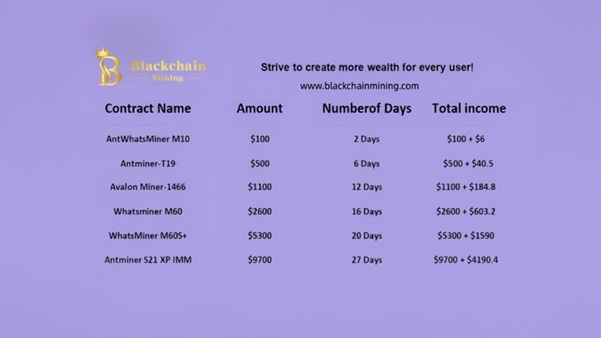

BTC Mining Contract Highlights: Daily Profits Up to $4,777

This means that even if users do not own physical mining machines, they can easily participate in the Bitcoin ecosystem by signing contracts and obtain long-term returns in a stable income system.

Conclusion: Seize the Wealth Opportunities of BTC’s New Cycle

Bitcoin is currently in a new bull market cycle, with multiple positive factors driving BTC’s long-term upward trend, including institutional entry, global inflation, and the anticipated halving. For ordinary investors, participating in mining is one of the best ways to share in Bitcoin’s dividends. BlackchainMining’s BTC mining contracts undoubtedly provide a safer, more efficient, and more transparent channel for market participation.

While others are still waiting for the next Bitcoin surge, BlackchainMining users are already steadily earning profits daily.

Official website: blackchainmining.com

App download: https://blackchainmining.com/xml/index.html#/app